The market rebounded smartly in afternoon trade on January 24, led by short covering and faced strong resistance at 21,500 mark (which coincides with 21-day EMA), which experts expect to be a key to watch on the monthly expiry day for January futures & options contracts on January 25.

If the index decisively closes above 21,500, then 21,700 can be the possibility, with immediate support at 21,300-21,200 area, experts said.

On January 24, the BSE Sensex jumped 690 points to 71,060, while the Nifty 50 was up 215 points at 21,454 and formed long bullish candlestick pattern on the daily charts.

Nagaraj Shetti, senior technical research analyst at HDFC Securities, feels the short-term trend of Nifty seems to have reversed up, but the uncertainty remains in the market at the highs.

"The market could encounter strong resistance around 21,500-21,600 levels in the coming session. Immediate support is at 21,220 levels," he said.

The negative chart pattern like lower tops and bottoms is intact and the Nifty is currently moving up towards the formation of new lower top of the sequence (which is yet to be formed at the highs).

Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas, too, expects Nifty to face resistance in zone 21,500 – 21,520 where the key hourly moving averages are placed.

"Traders should look for signs of weakness around the resistance zone before initiating shorts as there is a possibility of a deeper retracement till 21,780 – 21,800 where the hourly upper Bollinger band is placed. The hourly momentum indicator has triggered a positive crossover which is a buy signal. Thus, price and momentum indicator are providing divergent signals which can lead to high intraday volatility," he said.

The broader markets also bounced back after around three percent loss in previous session. The Nifty Midcap 100 and Smallcap 100 indices gained 1.8 percent and 1.7 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 21,226, followed by 21,144, and 21,013 levels, while on the higher side, it may see an immediate resistance at 21,486, followed by 21,571 and 21,703 levels.

Meanwhile, on January 24, the Bank Nifty has not only successfully defended 200-day EMA (exponential moving average 44,565 which is crucial to watch) but also the crucial support of 44,500. The index recovered 592 points from day's low and closed with 67 points gains at 45,082, forming long bullish candlestick pattern with long upper shadow on the daily timeframe, with healthy volumes.

"Despite the rebound, the index is still navigating a downtrend, but a potential pullback rally towards the 45,500 mark is anticipated," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

He feels a significant development would be the index closing above 45,500, triggering further short-covering moves towards the 46,000 level, characterized by the highest open interest on the Call side."

As per the pivot point calculator, the Bank Nifty is expected to take support at 44,639, followed by 44,403 and 44,023 levels, while on the higher side, the index may see resistance at 45,174, followed by 45,635 and 46,015 levels.

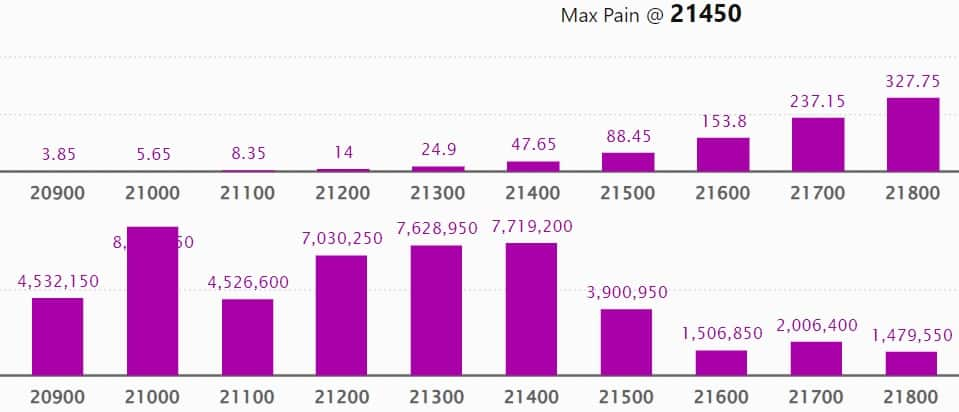

As per the monthly options data, the maximum Call open interest was visible in 22,000 strike, with 1.18 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 21,700 strike, which had 1.02 crore contracts, while the 21,800 strike had 86.05 lakh contracts.

Meaningful Call writing was seen at the 22,000 strike, which added 15.55 lakh contracts followed by 21,600 and 21,900 strikes adding 14.91 lakh and 11.79 lakh contracts, respectively.

The maximum Call unwinding was at the 21,200 strike, that shed 19.73 lakh contracts followed by 21,300 and 22,500 strikes which shed 19.45 lakh and 18.28 lakh contracts.

On the Put front, the 21,000 strike owned the maximum open interest, which can act as a key support area for Nifty, with 87.01 lakh contracts. It was followed by 21,400 strike comprising 77.19 lakh contracts and then 21,300 strike with 76.28 lakh contracts.

Meaningful Put writing was at 21,400 strike, which added 52.3 lakh contracts followed by 21,300 strike and 20,700 strike adding 37.33 lakh contracts and 22.23 lakh contracts, respectively.

Put unwinding was seen at 20,400 strike, which shed 4.96 lakh contracts, followed by 21,700 strike which shed 3.98 lakh contracts, and 21,600 strike, which shed 3.08 lakh contracts.

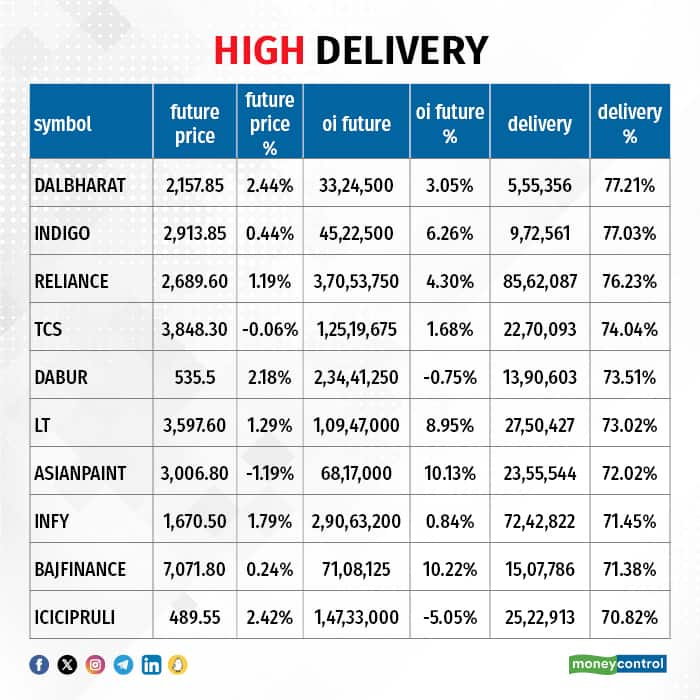

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Dalmia Bharat, InterGlobe Aviation, Reliance Industries, Tata Consultancy Services, and Dabur India saw the highest delivery among the F&O stocks.

A long build-up was seen in 77 stocks, which included Zee Entertainment Enterprises, Britannia Industries, Indraprastha Gas, Pidilite Industries, and Bank of Baroda. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 5 stocks saw long unwinding which were MRF, IDFC, Axis Bank, Delta Corp, and HDFC Life Insurance Company. A decline in OI and price indicates long unwinding.

13 stocks see a short build-up

A short build-up was seen in 13 stocks including IDFC First Bank, Asian Paints, Oberoi Realty, Canara Bank, and Adani Ports. An increase in OI along with a fall in price points to a build-up of short positions.

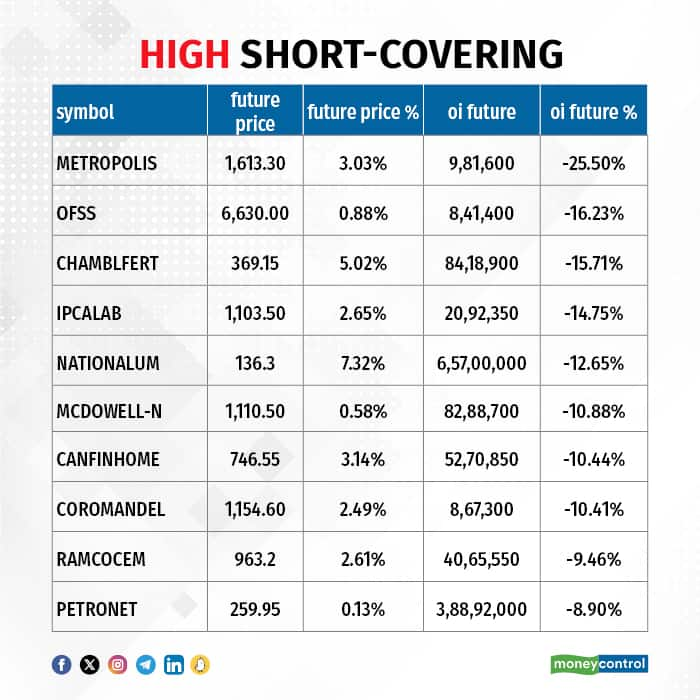

Based on the OI percentage, 91 stocks were on the short-covering list. This included Metropolis Healthcare, Oracle Financial Services Software, Chambal Fertilisers and Chemicals, Ipca Laboratories, and National Aluminium Company. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, climbed to 0.92 on January 24, from 0.74 levels in the previous session. The below 1 PCR indicates that the traders are buying more Calls options than Puts, which generally indicates an increase in bullish sentiment.

For more bulk deals, click here

Results on January 25 and January 27

Stocks in the news

Bajaj Auto: The two-and-three-wheeler major recorded a 37 percent on-year growth in standalone net profit at Rs 2,042 crore for quarter ended December FY24, with broad-based double-digit growth across all segments. Revenue from operations grew by 30 percent year-on-year to Rs 12,113.5 crore for the quarter, with 21.7 percent growth in sales volume.

Tech Mahindra: The digital transformation, consulting and business re-engineering services company registered a 3.3 percent sequential growth in net profit at Rs 510.4 crore for October-December period of FY24. Revenue from operations grew by 1.8 percent QoQ to Rs 13,101 crore.

Tata Steel: The Tata Group company recorded consolidated net profit at Rs 522.1 crore for quarter ended December FY24, against loss of Rs 2,502 crore in year-ago period, with healthy operating numbers with fall in input cost. Revenue from operations fell 3.1 percent year-on-year to Rs 55,312 crore for the quarter.

CEAT: The tyre maker registered more than five-fold increase in consolidated net profit at Rs 181.3 crore for October-December period of FY24, increasing from Rs 34.85 crore in same period last year, backed by strong operating numbers. Revenue from operations grew 8.6 percent YoY to Rs 2,963.1 crore for the quarter.

TVS Motor Company: The two-and-three-wheeler maker clocked a 68 percent year-on-year growth in net profit at Rs 593 crore for quarter ended December FY24, while revenue from operations increased 26 percent YoY to Rs 8,245 crore with total two-wheeler sales rising 27.1 percent to Rs 10.63 lakh units.

DLF: The real estate major recorded a 26.6 percent on-year growth in consolidated net profit at Rs 655.7 crore for quarter ended December FY24, with healthy operating margin performance and higher other income. Revenue from operations increased by 1.8 percent year-on-year to Rs 1,521.3 crore for the quarter.

Mazagon Dock Shipbuilders: The shipbuilding company signed a contract with acquisition wing of Ministry of Defence for construction and delivery of 14 Fast Patrol Vessels (FPVs) for Indian Coast Guard (ICG). The contract is worth Rs 1,070 crore.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) maintained selling pressure in the cash segment for six days in a row, offloading shares worth Rs 6,934.93 crore, while domestic institutional investors (DIIs) bought Rs 6,012.67 crore worth of stocks on January 24, provisional data from the NSE showed.

Stocks under F&O ban on NSE

The NSE has added Zee Entertainment Enterprises to the F&O ban list for January 25. Balrampur Chini Mills, IRCTC, National Aluminium Company, Oracle Financial Services Software, and RBL Bank were removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.