A power play seems to be building up quietly in the Indian markets as the country sees its demand for electricity shooting up by 8 percent in FY22 and 17 percent so far this fiscal. The heat wave during the summer caused an extraordinary spike this year, especially in peak demand.

While earlier demand used to shift towards commercial establishments during the day time and towards residential in the evenings and nights, the work-from-home and hybrid culture is creating day-time demand in residential areas as well. Further, as the GDP growth accelerates, the power demand is likely to grow in tandem.

Experts believe that the proliferation of electric vehicles (EV), a steady push towards renewables and a high capex cycle would continue to make the sector a huge investment opportunity.

“The Indian power sector would be a huge growth vector and would be instrumental in India’s growth story in the next two decades based on both consumption patterns and government initiatives to boost production and supply,” said Anand Varadarajan, Director of Asit C Mehta Financial Services.

Stocks like JSW Energy, Adani Transmission, Adani Power, NTPC, SJVN have been on a roll over the last few months, probably due to the cooling of the global coal prices and revival of industrial demand. “If the demand remains robust and the commodity prices do not flare up again the power sector will be extremely attractive,” Sonam Srivastava, Founder of Wright Research, said.

For a growing economy like India, power plays the role played by oxygen in humans. Having enough power to run the engines of the economy and to meet the requirements of the domestic households is of utmost importance. Power deficit cripples industrial activity as well as the household budgets.

“The power deficit has still not gone to the 8-10 percent range which was typical in 2009-2013,” pointed out Vikas V Gupta, CEO and Chief Investment Strategist at OmniScience Capital.

Under-investment in the past decade

The power sector has its set of structural challenges that it has struggled with for decades. There is a lot of inefficiency in the supply side due to distribution, and payables have accumulated due to non-payment of dues. On the other hand, the demand has continuously risen due to growing industry and household consumptions.

“India is re-entering an era of peak power deficit due to under-investment in power generation capacity in the past decade,” Mittul Kalawadia, Fund Manager, ICICI Prudential Mutual Fund, had said in a recent interview with Moneycontrol.

It is quite possible that the power demand grows at a much faster pace compared to new capacity coming online. This could create a huge deficit and thus higher power prices for a short period of time.

“However, one should keep in mind that there is significant capex work in progress by various power generation companies," Gupta said. This will augment power supply in the near future.

“We don’t think that India is entering in any kind of power shortage scenario because the cost per unit of renewable electricity (solar) has come down drastically over the last half a decade,” said Raj Vyas, Portfolio Manager, Teji Mandi.

Hence, any kind of surge in peak demand can easily be met with India’s current target of solar power generation capacity. Also, the gestation period for solar power plant is much less compared to traditional thermal energy which will help in meeting the required power deficit.

Vikram V, VP and Sector Head, ICRA, concurred and said that India has sufficient capacity to meet its peak demand and any shortage of thermal power can be met with additional capacity additions in renewable energy that are steadily coming online.

Large capex to fuel growth in coming future

Large capex is going on in the power generation space. “Except for the discoms, the rest of the power sector is growing at a fast pace,” Gupta said.

According to the NIP (National Infrastructure Pipeline), the target capital expenditure for the power sector is Rs 14 lakh crore, which shall provide a significantly large Total Addressable Market (TAM) for the power companies.

Distribution – the weakest link

The financial health of the distribution companies (discoms) generally is very poor which is being reflected in their outstanding dues of more than Rs. 1.5 lakh crore payable by them to generating companies. “T&D (transmission and distribution) losses and subsidised or free power are the key reasons for this,” said Deepak Jasani, Head of Retail Research, HDFC Securities.

Privatisation of Discoms and incentivizing private investment in the sector are steps in the right direction but have been met with resistance from various sections. “While reforms have been taken to address the challenges, implementation of these reforms will be a key monitorable,” Jasani said.

The reforms opened the sector to private participation and countered years of sluggish expansion of generation and transmission, which had not kept pace with growth in electricity demand. “The competitive framework supported a significant increase in the addition of thermal power plants and renewables while the transmission grid was unified into a national grid,” said Vikram Kasat- Head Advisory, Prabhudas Lilladher Pvt Ltd.

The newly introduced Electricity Bill allows multiple discoms to operate in a given area which might increase competition and bring efficiency in prices. But, “this is met with resistance from various state governments and state electricity boards”, said Srivastava.

With various schemes, penalties and incentives the government is trying to get the discoms into a healthier shape. The most notable revamp scheme for the distribution sector involves an outlay of over Rs 3 lakh crore for providing financial assistance to discoms for modernising and strengthening the distribution infrastructure.

The discoms are also getting penalized for not getting their act right. “The Power System Operation Corp (POSOCO) has barred 27 power distribution companies (discoms) from buying electricity from power exchanges to meet their short-term requirements,” said Vinit Bolinjkar, Head of Research at Ventura Securities.

In a letter to the exchanges on August 19, POSOCO invoked the Electricity (Late Payment Surcharge and Related Matters) Rules, 2022, after utilities in 13 states failed to clear Rs 5,085 crore in dues owed to electricity generating companies (gencos).

Another key aspect based on which the discoms can improve their performance is having power purchase agreements (PPAs) in place. "The discoms should plan their procurement and sign PPAs to manage the demand growth which would improve the visibility on revenues for Thermal GENCOs, which do not have PPAs currently", added Vikram V of ICRA.

Triggers for future

According to a report from global research firm Jefferies, there are five likely triggers that will play out for the power sector in the next 5-8 years. “Renewable energy (RE) capacity rising 82 percent by FY26-27 and 2.8x by FY30; thermal capex revival; transmission capex CAGR of 15 percent-plus against less than 5 percent in the last five years; Policy, especially distribution, being a game changer and green hydrogen ramp-up,” it said.

Renewable energy is one of the strongest growth vectors in power, with India planning to grow its renewable energy capacity from the current nearly 150 GW to 450 GW by 2030.

“India ranks third in the RE attractive index 2021 and the government has set an ambitious target to achieve a capacity of 175 GW by the end of 2022 and we believe that there is great opportunity for growth going ahead,” said Vyas of Teji Mandi.

The proliferation of Electric Vehicles (EV) in India also presents a huge opportunity in the power sector.

“The sector is expected to see robust growth with the government’s several policy reforms and the 'Make in India' initiative which is expected to result in increased per-capita consumption of power in India which is still significantly low compared to the global average,” said Varadarajan.

Stocks likely in focus

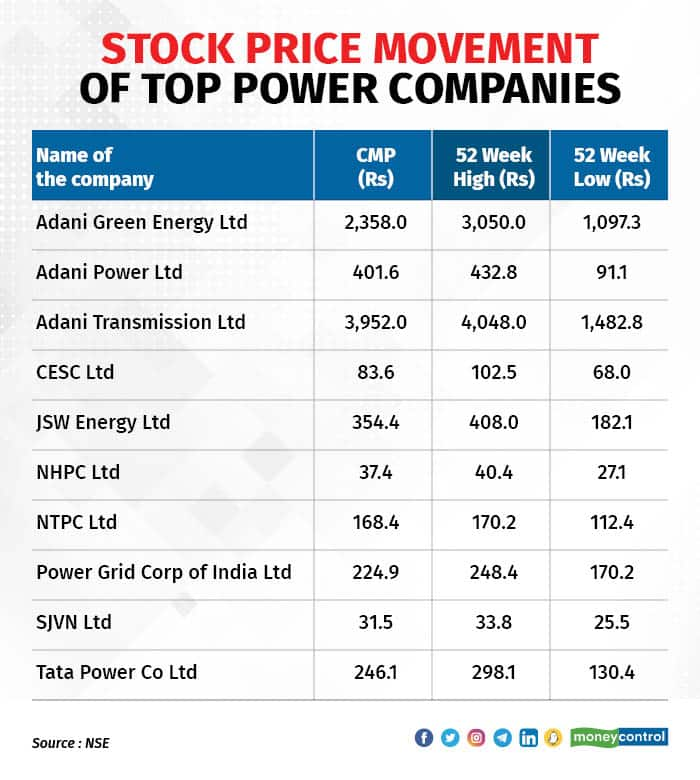

Experts suggest investors to focus on stocks such as Adani green energy, Tata Power, and Adani Transmission for the coming 8-12 months. They are of the opinion that NTPC, Powergrid, NHPC and CESC also have substantial upsides from current price levels.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.