Nods for initial public offerings worth Rs 5,000 crore are set to lapse soon as the IPO approvals given by the capital market regulator last year expire this October. Given the extremely turbulent market, analysts expect as many as four firms may let the approvals lapse.

As many as four firms that filed their draft red herring prospectus last year with SEBI need to re-file their papers if they fail to launch their IPOs in October. As per SEBI guidelines, the IPO or rights issue needs to open within one year of approval or issuance of observations by the capital market regulator.

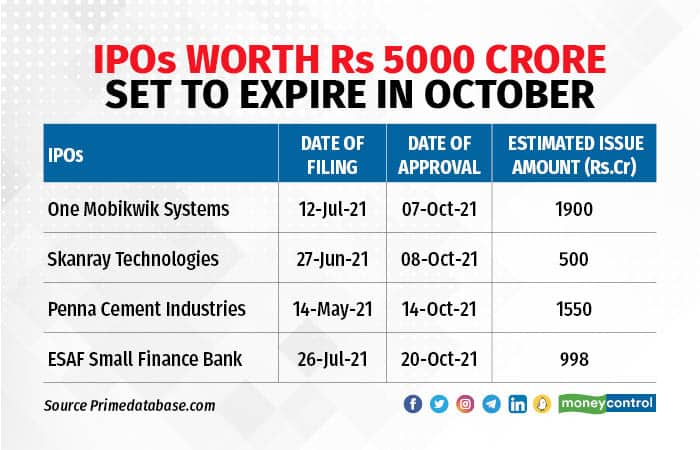

The companies are One Mobikwik Systems, Skanray Technologies, Penna Cement Industries, and ESAF Small Finance Bank. One Mobikwik Systems filed IPO draft papers with the regulator last year to raise around Rs 1,900 crore before delaying the issue launch amid challenging market conditions. According to market experts, another reason for the delay was Paytm owner One97 Communications’ disappointing listing last year.

Skanray Technologies was hoping to raise around Rs 500 crore, Penna Cement around Rs 1,550 crore, and ESAF Small Finance Bank about Rs 1,000 crore.

In August, Pharmeasy owner API Holdings decided to withdraw its plans to go public, while Vedanta Group unit Sterlite Power Transmission also recently deferred its IPO. Nusli Wadia-backed airline Go Airlines’ (GoAir) public issue nod expired in August.

GoAir, which was planning to raise Rs 3,600 crore, had been postponing its IPO since the start of this year amid weak consumer sentiment surrounding aviation stocks.

"Stability in primary markets is essential for a successful IPO listing, which is missing. Even though the pipeline is strong, there is a wait-and-watch strategy adopted by IPO-bound companies,’’ said Manan Doshi, Co-Founder, UnlistedArena.com, a firm dealing in unlisted and pre-IPO shares

"Companies are looking for alternative funding sources as the market remains unfavourable. When the market stabilises, we may see significant launches, as well as the re-filing of draft papers that have now missed the IPO timeline,’’ Doshi added .

Primary markets have remained dry in FY22-23. Also, investors are now extremely cagey about loss-making new-age firms, analysts said.

As many as 17 IPOs worth Rs 22,000 crore that were approved last year are also set to expire by the end of December. Forty three firms aiming to raise an aggregate of Rs 70,000 crore, which received their IPO approval this year, are yet to launch issues.

So far this year, Indian as well as global equities remained volatile amid rate hikes across the world.

Both of India's benchmark indices, the Sensex and the Nifty, were up around 0.1 percent each. Among global indices, South Korea's Kospi fell 25 percent, Taiwan’s TWSE 24 percent, Germany's DAX 21 percent, France's CAC 16 percent, and the MSCI EM and China's Hang Seng nearly 24 percent each.

"Most of the proposed IPOs that are expiring shortly have not been able to raise monies so far due to mismatch between valuation expectations of promoters and that they are likely to get based on lead manager's feedback. Some others could be waiting for even better times based on the performance that could have improved in the interim. Poor post listing performance of some IPOs that were floated post Q2FY22 could have dissuaded some other promoters", said Deepak Jasani, Head of Retail Research, HDFC Securities.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.