Price rise has been one of the most hotly debated issues in the campaigns for the ongoing Lok Sabha polls with key political parties promising support measures to the poor by ranging from more cash hands in the hands of women to lowering the cost of gas cylinders if voted to power.

India’s headline retail inflation hovered around 5.14 percent on average in the last six months from November 2023-April 2024, within the central bank’s policy band of 2-6 percent. However, during the same time, the food index stayed above 7 percent.

Moneycontrol takes a look at how inflation has played out in India in the last few years, including in relation to the country’s neighbours as well as the world.

India’s inflation metricsIn the current financial year, inflation has been edging downwards after hitting a high of 7.4 percent in July 2023 to 4.83 percent in April. But this is primarily on account of steps taken by the government on the non-food side, especially a cut in LPG prices.

For two consecutive months – March and April, India’s headline retail inflation has come in under 5 percent. To be sure, this is still outside the central bank’s medium-term target of 4 percent, however, the figure is seemingly moving towards this aim gradually.

But softer headline inflation rates have not translated into lower food prices, which is a headache for any government, especially in an election year.

The NDA government led by Prime Minister Narendra Modi that stormed to power in 2014 has seen an average inflation rate of 5.1 percent during 2014-15 to 2022-23, according to data from India’s statistics ministry.

In the previous United Progressive Alliance (UPA) regime, the rate was at a much higher 8.7 percent on average from FY06 to FY14.

India’s food inflation has been consistently eclipsing the fall in the overall headline rate.

In April, prices of food and beverages edged higher at 7.9 percent than 7.7 percent a month ago.

Reserve Bank of India (RBI) Governor Shaktikanta Das on April 5 acknowledged the issue of considerable vulnerability in food inflation, adding that such price pressures have been interrupting the ongoing disinflation process, posing challenges for the final descent to the target.

“Going forward, the inflation trajectory would be shaped by the evolving food inflation outlook. Rabi sowing has surpassed last year’s level. The usual seasonal correction in vegetable prices is continuing, though unevenly. Yet considerable uncertainty prevails on the food price outlook from the possibility of adverse weather events,” Das said.

For FY25, the central bank projects inflation at 4.5 percent, still outside the medium-term target.

Unsurprisingly, therefore the RBI’s Monetary Policy Committee (MPC) is expected to maintain the status quo in June as it continues to remain cautious on inflation.

The heavy lifting triggering the downward trajectory for CPI inflation has been done by the fuel and light category which has seen contractions in the past few months with the April print coming in at a negative 4.24 percent.

This is primarily on account of steps taken by the government, including a cut in LPG prices.

On March 8, 2024, the Centre slashed prices of domestic gas cylinders by Rs 100. This followed a decision to extend the Rs-300 per LPG cylinder subsidy to poor women under the Ujjwala Yojana from April 1.

While measures on fuel prices have worked, steps to keep a lid on the cost of food have not been as effective. These include a string of interventions ranging from a ban on certain varieties of rice to offering subsidised tomatoes.

Pain pointsThe likelihood of a prolonged heat wave till June has added to the problem with experts expecting the cost of some essential commodities, especially vegetables to stay elevated for the next few months due to above-normal temperatures.

Extreme heat can impact crops in a number of ways either by damaging the produce directly or by triggering droughts because of higher temperatures thereby impacting water-dependent items such as cereals and pulses.

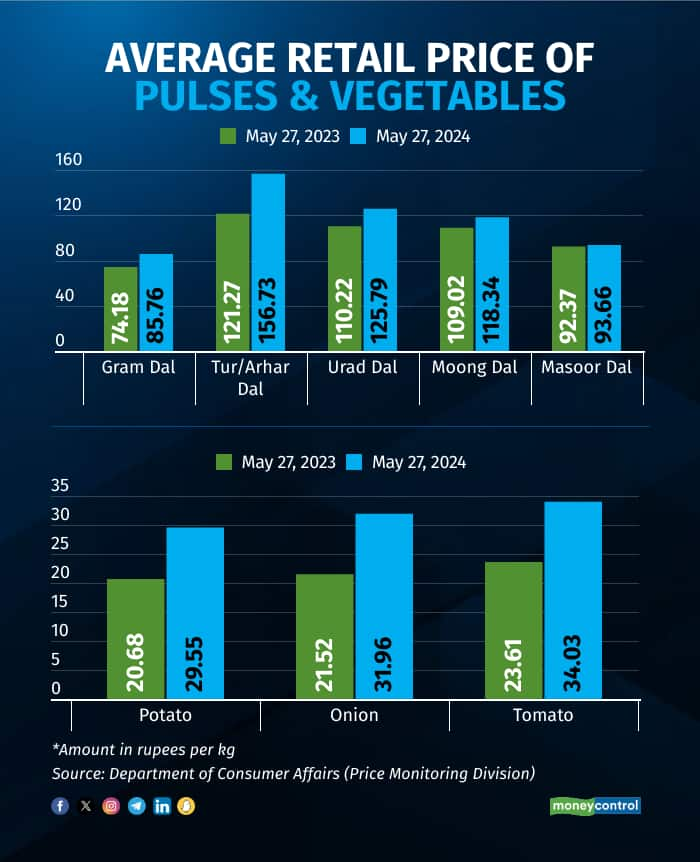

Take for instance, the all-India average retail price of a kilogram of onions at Rs 31.96 on May 27, 2024 is nearly 50 percent higher than the cost during the same day last year. The story runs the same for potatoes and tomatoes that have seen a jump of around 43 percent and 44 percent respectively during the same period.

And retail prices of essential variants of pulses have also been on the rise. The cost of a kilogram of Arhar\Tur daal has risen close to 30 percent on May 27 versus the same day last year.

In the capital of Delhi, consumers had to shell out Rs 38 more for a kilogram of Tur\Arhar on May 27 compared to the same day last year, while for the same amount of potatoes residents of Maharashtra paid Rs 36, higher than Rs 24 in the same comparative period.

Experts are now betting on higher monsoon output to trigger a fall in food prices given India’s weather department’s prediction of above-normal rainfall in 2024, estimated at 106 percent of the long-term average.

And, for May, some economists expect retail inflation to edge upwards due to sticky food prices.

As ICRA's Chief Economist Aditi Nayar, points out, the headline CPI inflation may come in at a five-month high of 5.1-5.2 percent in the ongoing month, adding that “the impending favourable base effects during the second quarter of FY2025 are expected to materially soften the headline inflation print to 2.0-4.0 percent in July 2024 and August 2024.”

ALSO READ: All bets on timely, widespread rains to cool food inflationThe finance ministry also acknowledged that going forward, the inflation trajectory will be influenced by several factors, including government initiatives like open market sales, monitoring of stocks, import of pulses, and export restrictions, which are expected to help stabilise food prices. The forecast of above-normal rainfall for the Southwest Monsoon 2024 bodes well for food production and could alleviate price pressures.

India versus GlobeJust like India, inflation is on a declining trend in key economies of the world as well. Consumer prices in the UK came in at 2.3 percent on an annual basis in April, a fall from the 3.2 percent rise in March.

US inflation too rose less-than-expected last month registering an increase of 0.3 percent sequentially. In the 12 months through April, the CPI increased 3.4 per cent year on year, following a 3.5 percent rise in March 2024.

And, among India’s neighbours, China’s consumer prices slowed to their weakest pace in two years in April, but in Pakistan, inflation last month rose to a record 36.4 percent driven mainly by food prices, the highest rate in South Asia and up from March’s 35.4 percent.

The International Monetary Fund (IMF) sees global inflation declining steadily, from 6.8 percent in 2023 to 5.9 percent in 2024 and 4.5 percent in 2025, with advanced economies returning to their inflation targets sooner than emerging markets and developing economies.

However, experts warn that the path to anchoring inflation will still not be easy.

Recently Pierre-Olivier Gourinchas, IMF's chief economist told the media that though Inflation is falling, the progress in bringing it back to central bank targets has slowed in recent months.

India’s finance ministry this week said that the unrelenting geopolitical tensions and volatility in global commodity prices, especially of petroleum products, present substantial multi-frontal challenges.

“Nonetheless, the expectation is that the macroeconomic buffers nurtured and strengthened during the post-Covid management of the economy will help the Indian economy navigate these challenges reasonably smoothly,” the ministry’s April 2024 review said.

Polls and inflationThe topic of inflation has been often raked up by the opposition in ongoing political campaigns given its direct impact on the livelihood of people. Citing the steps taken to combat inflation, the government too has responded to criticism over rising prices.

And, promises to further ease the burden of cost on people are being made by both sides.

Take for example, Chhattisgarh Chief Minister Vishnu Deo Sai comments earlier this month in Odisha that the BJP will ensure higher MSP to farmers along with financial support to the poor and weaker sections of the society if they are voted to power in the state.

And, on the opposition block, INDIA alliance’s star campaigner Tejashwi Yadav promised to slash gas cylinder price from Rs 1,200 to Rs 500 at a rally in Bihar on May 28, if the state votes for the Rashtriya Janata Dal (RJD).

The 18th Lok Sabha election is nearing its end with only one phase of polling left on June 1.

And, political arguments aside, what is clear is that any incoming government will have its hands full combating a consistently stubborn food inflation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.