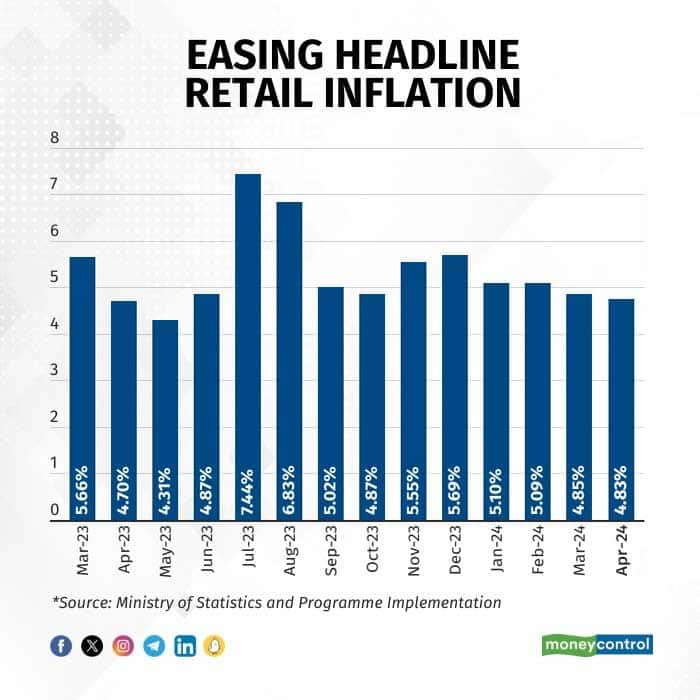

India's headline retail inflation stayed largely unchanged at 4.83 percent in April, according to data released by the Ministry of Statistics and Programme Implementation on May 13.

The Consumer Price Index (CPI) inflation in March was at a 10-month low of 4.85 percent.

Even though inflation eased to an 11-month low in April, it will be the 55th month in a row that it would be above the RBI's medium-term target of four percent. The central bank is keen to bring it down to the target on a durable basis.

The inflation print for April is however slightly above economists' expectations. A Moneycontrol survey pegged CPI at 4.80 percent.

Yet again, the fall in the headline retail inflation rate in April was limited by prices of food and beverages that remained elevated at 7.87 percent, edging higher than 7.68 percent a month ago.

Primarily, a contraction in fuel and light inflation of 4.24 percent helped keep the CPI rate within the Reserve Bank of India's (RBI) tolerance range of 2-6 percent for the eighth consecutive month.

Just like fuel, Clothing and footwear as well as housing inflation also eased, albeit slightly, in April to 2.85 percent and 2.68 percent respectively on a month-on-month basis.

Core inflation, which excludes volatile components such as food and fuel, trended downwards at 3.2 percent, which is the lowest in the 2012 base CPI series, as per DK Srivastava, Chief Policy Advisor, EY India.

April CPI internals

Food inflation rose marginally with the index coming in at 8.7 percent in April, as compared to 8.52 percent in previous month.

On the up were prices of meat and fish at 8.17 percent versus 6.36 percent a month ago and of fruits at 5.22 percent versus 3.07 percent in March. Meanwhile, vegetables and pulses exhibited a marginal declining trend.

"CPI came in at 4.83 year-on-year, in line with expectations. All broader indices are well contained other than food prices. Overall in line with RBI trajectory and hence may not have any material impact on policy or markets," according to Akhil Mittal, Senior Fund Manager-Fixed Income, Tata Asset Management.

Though vegetables and pulses-led inflation eased sequentially it remained in double-digits in April.

ICRA fears that the food and beverages inflation will retrace above the 8-percent-mark in May 2024, partly on account of the adverse base as well as the above-normal temperatures and heatwave conditions during the summer season, which would push up the headline CPI inflation to a five-month high of 5.1-5.2 precent in the ongoing month, said chief economist Aditi Nayar.

Given persistent food inflation, some economists expect RBI to continue with its current stance of a pause in policy rates.

According to Upasna Bhardwaj, Chief Economist, Kotak Mahindra Bank, "unchanged headline and core inflation reading from previous month will continue to provide respite to the Monetary Policy Committee. However, erratic weather and heatwaves should keep the overall sentiment cautious. We do not expect much change to RBI’s narrative for now, as a prolonged pause in policy rates remains the base case.”

The RBI in April decided to keep its key lending rate unchanged at 6.5 percent for the seventh consecutive time with Governor Shaktikanta Das highlighting the volatility in food inflation as an impediment to the ongoing disinflation process.

According to the central bank's latest forecast, CPI inflation is seen at 4.5 percent in the current financial year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!