FMCG major Hindustan Unilever (HUL) share prices jumped over 3 percent in the morning trade on May 8 after Societe Generale had bought 1.29 crore shares of the company at Rs 1,902 per share.

The stock is among the most active stocks on NSE in terms of value with 23,62,605 shares being traded at 09:30 hours. The stock is quoting at Rs 2,056.40, up Rs 63.90, or 3.21 percent. It has touched an intraday high of Rs 2,070 and an intraday low of Rs 2,040.15.

British drugmaker GlaxoSmithKline Pte and Horlicks Limited sold 5.69 percent stake in the company via block deals on May 7, 2020. The price band is at a discount of 3-8 percent to the closing price of the HUL stock of Rs 2,010.2 per share on May 6 on the National Stock Exchange (NSE).

Global research firm Credit Suisse has maintained its outperform call on the stock with target at Rs 2,400 per share. It is of the view that GSK's 5.7 percent stake sale removes the key overhang adding that premium to Britannia Industries and Dabur India has narrowed to 5-15 percent after the recent correction, according to a report by CNBC-TV18.

On the other hand, after the correction, discount to Nestle India has widened to 25 percent, it said. Morgan Stanley feels that diversified brand portfolio and track record of execution makes it a better risk reward while the company is likely to deliver flat revenues in core business in FY21. It expects total EPS growth of over 20 percent in Hindustan Unilever.

The stock has seen a steady decline in the last 5 days with GSK selling stake in HUL on May 7, 2020, a deal which will be valued roughly between USD 3.2-3.4 billion, according to a Business Standard report.

Sumit Bilgaiyan, Founder of Equity99 is of the view, "Hindustan Unilever results were certainly weak. We would recommend adding on dips as these are defensives and essential products, demand of which might not be impacted in the downturn."

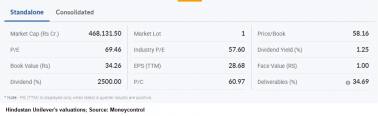

According to Moneycontrol SWOT Analysis powered by Trendlyne Hindustan Unilever has zero promoter pledge with growth in quarterly net profit and increasing profit margin (YoY). However, the technical rating remains very bearish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.