Shares of Bata India, the leading footwear retailer, continued to fall and registered a decline of over 1 percent to Rs 1,420 in its stock prices on February 20. The fall in price is coming along with a surge in open interest, which is indicative of a short buildup in the stock.

Open interest for Bata India surged by 10 percent reaching its highest level past year. Open interest is the total number of outstanding contracts in a particular security, and a surge in open interest indicates growing interest among traders. However, since the open interest is coming with negative price action, it means more traders are taking bearish bets on the stock.

Rajesh Sriwastava, a Bengaluru-based derivatives trader, said he was bearish on Bata India as he sees more call writing happening in the stock.

However, some indicators are showing signs of a rebound as well. The Relative Strength Index is showing an oversold sign, which indicates some buying may come at lower levels. The put call ratio for the stock has slid to 0.4 times.

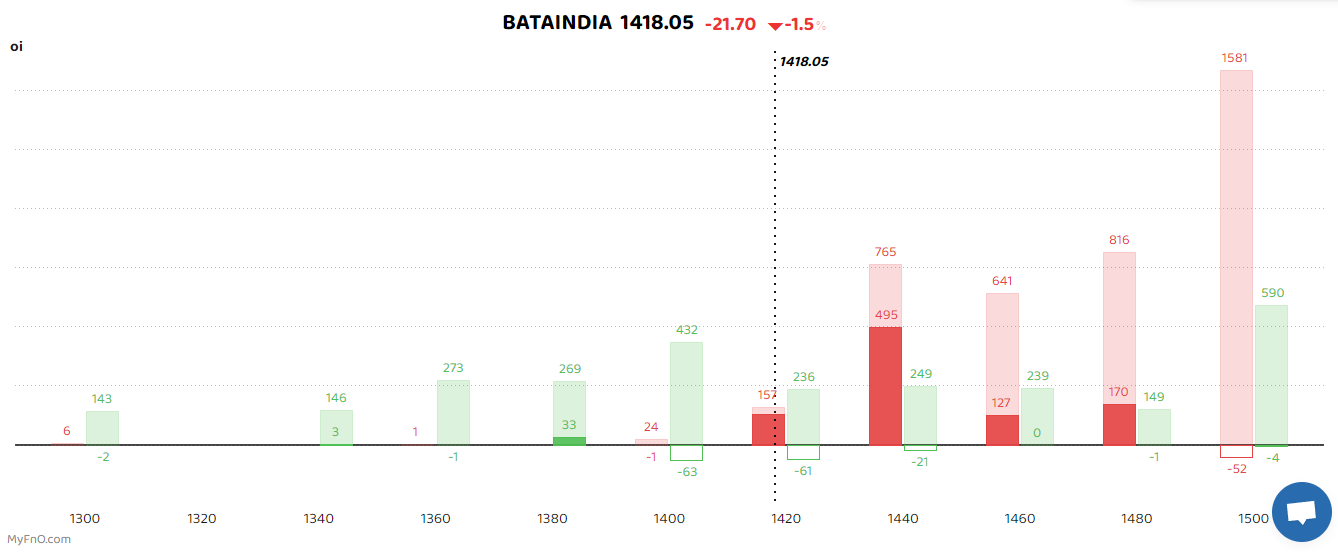

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

On the options front, call writing was seen at 1,440 strikes. Meanwhile, put writers have been shifting their position lower. On February 20, some put writing was seen at 1,380 strikes.

Shares of most footwear companies have been on a decline as purchasing power of people in rural India has taken a hit. This has been hurting discretionary spending such as shoes and chappals.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!