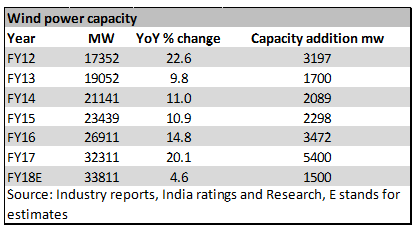

Wind power companies have missed the stock market party as adverse policy tweaks have impacted revenue visibility and extended working capital cycle. The industry is expected to add only 1500 MW of wind power capacity this fiscal, against 5400 MW in FY17.

With the clean energy power tariffs plummeting, various states have shifted from the feed-in-tariff (based on the cost of generation) to auction-based tariff, which in turn, has impacted the earnings visibility on future projects or the projects under execution.

Weighs on wind power stocksCompared to a 10 percent rise in the BSE Sensex, listed players in the wind power space, Suzlon Energy, Inox Wind and the crane supplier to the wind companies Sanghvi Movers, are down 22-40 percent over the last six months.

Back in focusThe government is now trying to start awarding new projects and, therefore, these stocks could get rerated. News reports suggest projects of about 4500 MW could be awarded over the next four months, which is quite significant given market estimates of mere 1500 MW addition this year.

Inox Wind could be one of the biggest beneficiariesCompanies like Inox Wind, which reported 73 percent year-on-year decline in its order book to 300 MW and 72 percent fall in execution to 94 MW in the quarter ended March 2017, could be one of the biggest beneficiaries of the uptick in the awarding of new projects. Moreover, Inox Wind reported the highest customer receivables to the tune of Rs 1900 crore in June quarter. As clarity emerges for auction-based projects, the execution and subsequently, the receivable cycle could see a gradual improvement.

“We believe that Inox Wind would be a major beneficiary in the auction-based market regime, due to its inherent cost-competitive advantage. After the slow-down caused by the transition from a FIT (feed-in-tariff) based market regime to an auction-based market regime, which would continue in Q2 as well, we expect normalisation, from an order inflow perspective, to commence from Q3 onwards, and execution to pick up in Q4 onwards. We believe FY19 to be the beginning of a phase of robust growth for the wind industry,” said Devansh Jain, Executive Director Inox, in a media release recently.

Against its annual execution rate of close to 1000 MW, Inox is sitting on an order book of mere 300 MW, which is very low. By the end of 2022, the government aims to build close to 60,000 MW of wind power capacity. While there was a hiccup in the near-term led by volatility in the spot market, power prices and changes in the procurement policies, any pickup in the near-term will have a huge impact on companies like Inox Wind, which is sitting on underutilised capacity. Apparently, in Q1FY18, because of lack of executable orders, the company incurred a net loss of Rs 39 crore on a turnover of Rs 106 crore.

Suzlon Energy is relatively better placed with a slight deterioration in working capital cycle by 12 days in June quarter. Also, relative to Inox Wind, Suzlon is having better revenue visibility as it has an order book of close to Rs 7,757 crore or about 0.61 times its FY17 annual sales. This is also a reason that investors might have to wait for one or two more quarters for Inox Wind to turn around and that the company might continue to report losses for the next one or two quarters. In comparison, Suzlon is already profitable with a reported net profit of Rs 90 crore in Q1FY17 against a loss of Rs 211 crore during the same period last year.

Follow @jitendra1929For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.