RuPay, the card network by the National Payments Corporation of India (NPCI), managed to capture a 60 percent share of India’s card market in 2020, as per data released by the Reserve Bank of India (RBI). That is much higher than RuPay’s share of just 15 percent back in 2017.

While the number of cards issued is large, RuPay which was launched in 2012 is still smaller than its international rivals in the volume and value of transactions in the market.

For established card networks like Visa and MasterCard which were leading the game until then, increase in RuPay cards issued comes as a setback in a huge market like India. Both card networks are hassled by the fact that the Indian government is promoting the usage of RuPay cards and that is reflecting in numbers.

In fact, the matter has escalated with Visa Inc ‘complaining’ to the United States government that the Indian government’s promotion of RuPay is hurting Visa’s prospects in the country, according to a report by Reuters.

This issue was also raised by MasterCard back in 2018 when the company wrote to the Office of the United States Trade Representative (USTR) that Prime Minister Narendra Modi “associated the use of RuPay cards with nationalism, claiming it serves as ‘kind of national service’.” MasterCard added that these protectionist measures can be detrimental for global players.

But what has led to RuPay’s rise in the Indian card market and where does it lag? Do MasterCard and Visa really have a lot to be worried about? We break it down.

RuPay’s Jan Dhan opportunity

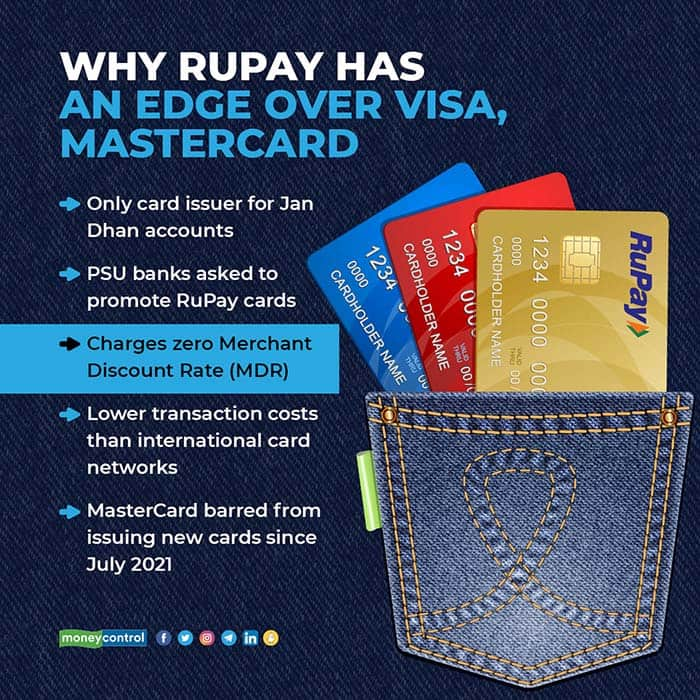

Under the Pradhan Mantri Jan Dhan Yojana (PMJDY) which was flagged off back in 2014, the government issues only RuPay debit cards to new account holders. This is the biggest leg-up for RuPay in terms of lending a fair share of the debit card market to the NPCI card network by default.

According to data by the Department of Financial Services under the Ministry of Finance, 31.74 crore RuPay debit cards have been issued under the scheme until now. That is straight up a 34.5 percent share of the 90 crore debit cards issued in India currently.

However, according to former NPCI CEO AP Hota, it is not just PMJDY which has led to the rise of RuPay, but the product features it offers.

“International card players (like Visa and MasterCard) have been complaining ever since RuPay was made part of PMJDY. Had these international cards players come out with credible and relevant products on financial inclusion, I am sure, they too would have been included in the PMJDY,” Hota said.

Also Read: Rupay debit cards, low-value UPI payments get a Rs 2,600-crore Cabinet boost

Government’s backing

In its latest annual report, Visa Inc said that one of the risk factors for its businesses are the government-imposed obligations and/or restrictions on international payment systems that may prevent them from competing against providers in certain countries, including significant markets such as China, India and Russia.

The annual report also said that some of these countries including India have ‘taken actions to promote domestic payments systems.’

NPCI itself was set up by the RBI to create a homegrown payment and settlement infrastructure in India and it functions as a ‘not-for-profit’ company. With the government and the RBI’s aim being financial inclusion in a country like India where many are left out of the ambit of formal banking services, NPCI automatically becomes a vehicle to focus on subsidised services.

The government has been promoting RuPay’s usage since long in a bid to give a boost to the domestic card network and has also equated usage of RuPay to nationalism and supporting the nation.

An industry source said on the condition of anonymity, “This introduces a boundary between what is considered a real business versus what is considered a national duty. It brings in the aspect of a sense of pride and also achievement.”

PSU banks push

In line with this push, all public sector banks necessarily have to offer RuPay cards to customers. According to multiple reports, the government has asked PSU banks to issue more RuPay cards to customers.

In a meeting with bankers back in November 2020, Finance Minister Nirmala Sitharaman had said, “RuPay card will have to be the only card you promote. Whoever needs a card, RuPay will be the only card you would promote and I would not think it is necessary today in India when RuPay is becoming global, for Indians to be given any other card first than RuPay itself."

“PSU banks are contributing the most to RuPay’s numbers. The way card issuance works at a bank is that in the five working days, each day a single network’s card is issued. In that model, RuPay gets more days of the week,” added the above-mentioned source.

However, many banks also upgrade first-time and PMJDY users from RuPay cards to Visa and MasterCard after their account balance and usage pass a certain threshold.

The cost advantage

RuPay, along with Unified Payments Interface (UPI) also comes under the Zero-MDR norm by the Indian government, i.e. no fees can be levied to merchants for transactions on these networks.

Additionally, operating costs are lower for banks while using RuPay versus global networks. Banks issuing MasterCard and Visa cards pay a quarterly fee to be on their network. But with RuPay being a domestic network, banks do not have to pay this fee leading to no processing or transaction fees being passed on to customers.

MasterCard’s woes

To add to the already growing competition in the Indian market, MasterCard witnessed a huge setback in July this year.

The RBI in a notification barred the network from issuing new cards with effect from July 22, 2021 – a plus for both RuPay and mainly Visa. MasterCard was found to be non-compliant with the RBI’s directions on Storage of Payment System Data which directed system providers to ensure that all data related to payment systems must be stored only in India. The move forced various banks to move to RuPay and Visa cards.

Low share in the credit card market

While RuPay has a large share of the debit market, it lags in the credit card space. As per sources, currently, RuPay only has a 20 percent share of India’s credit card market which is led by Visa, followed by MasterCard.

While RuPay’s adoption is slowly picking pace in credit too, Visa and MasterCard are expected to remain the preferred choice for banks as credit cards are a key revenue earner for banks.

“International networks can provide fancier deals and better customer experience. Banks cannot trade that and risk losing customers as their credit card related charges are crucial for them,” the source said.

As the first-time customer market evolves, customers too are expected to move to international networks in a bid to meet aspirations and for better experiences with global payments.

AP Hota said, “The Indian market is large and Visa and MasterCard have ample opportunity to keep their market share. They need not get scared. They should focus on what India needs and review their products wherever necessary instead of complaining about the success of RuPay. Let there be no debate on this non-issue."

What lies ahead

An industry expert who did not wish to be named said, “Visa and MasterCard have been serving the premium segment, while RuPay is serving first-time consumers. So RuPay is now trying to transition to high-spending premium customers.”

RuPay plans to grow its credit card business and is also working on growing its contactless payments offerings which allow to make payments through smartphones and watches. Experts also believe that RuPay could be successful in transitioning its existing customers into using their premium products over time.

With its ambitions to grow in areas where it currently is lagging, will RuPay be a big threat to Visa and MasterCard even in the credit space?

The above-mentioned expert added, “India’s credit market is highly underpenetrated. It is expected to grow by 3x in the next few years and that means all players can get a fair share of the market based on their offerings. It is an open and competitive market.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.