Promises make up a significant portion of election campaigns. But the ability to deliver on these promises is contingent on the finances of the region. Uttar Pradesh (UP) is no different.

Like every other region of the country, the COVID-19 pandemic hit India’s most populous state hard. Its gross fiscal deficit (GFD) as a percentage of the State Gross Domestic Product (GSDP) increased from -0.7 percent in FY20 to 4.7 percent in FY21. However, the state’s budget for FY22 estimated the fiscal deficit would remain at 4.7 percent this year too.

UP is one of only six states to have budgeted for either an unchanged or higher fiscal deficit in FY22, with the others being Haryana, Himachal Pradesh, Odisha, West Bengal, and fellow poll-bound state, Goa.

All indications, though, are that the fiscal deficit target will not be an issue for UP. According to latest data from the Comptroller and Auditor General of India, UP’s fiscal deficit in the first nine months of FY22 amounted to just 52.1 percent of the full-year target. Unless the state imitates the Centre – which expects to exceed its own fiscal deficit target by 10 basis points despite the fiscal deficit for April-December 2021 standing at just 50.4 percent of the FY22 target – UP’s finances should show some improvement.

However, unlike the Centre, UP’s fiscal deficit number does not tell the whole story. Its revenues have been weak, constraining its ability to spend on the state economy. Both total receipts and expenditure in April-December 2021 amounted to just over 51 percent of the budget target.

Capital expenditure has fared particularly poorly. Having set a stiff capex target of Rs 1.16 lakh crore for FY22, the first nine months of the financial year has seen the Yogi Adityanath government achieve only 34.8 percent of the target. Unless the last quarter of FY22 sees a miraculous turnaround, UP is set to miss its lofty capex target by a country mile.

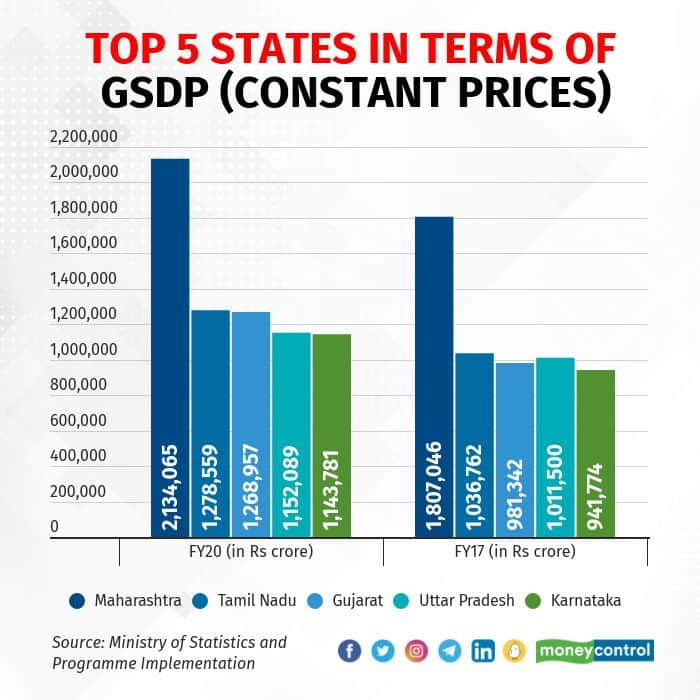

The bottomline, though, is to boost growth. From FY13 to FY20, Maharashtra’s GSDP grew 60 basis points faster than UP’s every year, on average.

Adityanath has claimed UP’s economy has grown to become the second largest in India under his chief minister-ship. Numbers seemingly don’t support that assertion.

In FY20, the latest year for which the Ministry of Statistics and Programme Implementation has complete data, UP’s GSDP was the fourth-highest in the country after Maharashtra, Tamil Nadu and Gujarat. If anything, UP’s economy has been overtaken in the rankings considering its GSDP was the third-highest in the country in FY17.

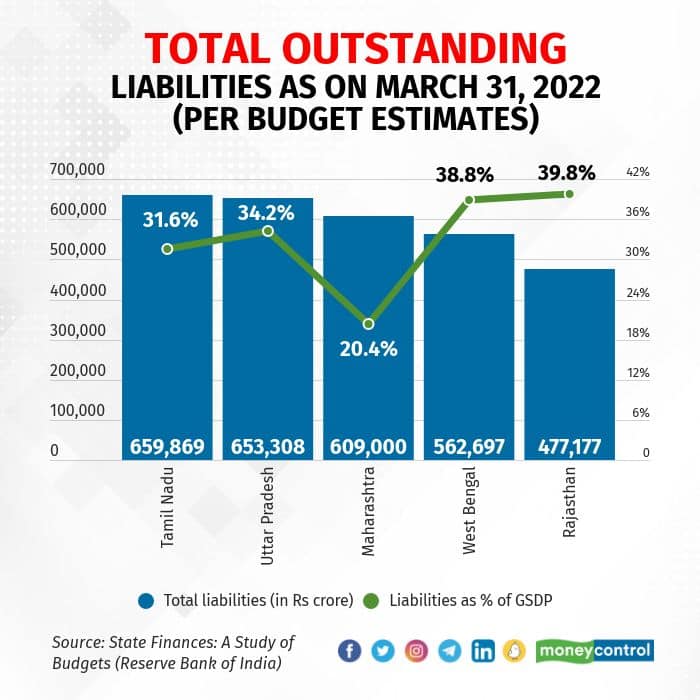

The state also needs to do more in containing its liabilities. After having cut down its total outstanding liabilities from 52.2 percent of GSDP as on March 31, 2005, to 28.3 percent of GSDP as on March 31, 2014, UP has largely seen a rise in this key metric and it hit 35.2 percent as on March 31, 2021.The state’s FY22 budget expects this to come down to 34.2 percent as at the end of the current year.

On the whole, the state’s finances are in a tight spot at the moment. While this is understandable to an extent, given the pandemic, UP must do more to ensure it grows rapidly enough to ease the burden on its exchequer.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!