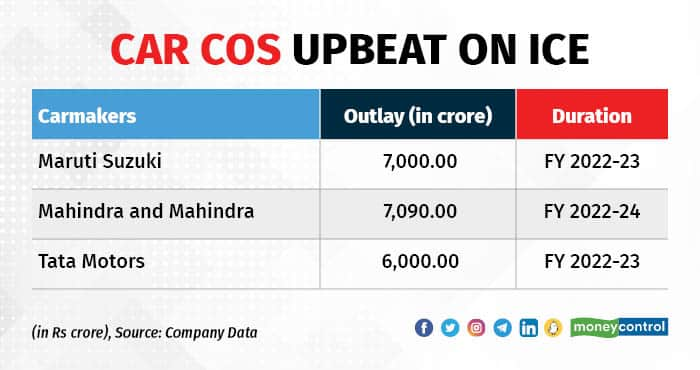

Electric vehicles (EVs) may be the future of transport, but car manufacturers in India are rooted in the present. Despite nudges from the government for increased adoption of EVs, carmakers such as Maruti Suzuki, Tata Motors, and Mahindra and Mahindra (M&M) are not shying away from building additional capacities for internal combustion engine vehicles (ICEVs) to meet unmet demand. As per the guidance shared by the chief financial officers (CFOs) of all the companies above, a combined Rs 20,000 crore will be spent for the next few fiscals on ramping up output of waitlisted models.

Mahindra & Mahindra (M&M), which remains upbeat on its diesel powertrains, has said that it is ramping up total SUV capacity to nearly 6 lakh units a year in the next 12-15 months. The country’s leading SUV maker, which had a monthly output of 29,000 units per month until the last financial year, is currently seeing waiting periods of its bestselling models like the XUV700 stretching up to 22 months. M&M had announced an investment of Rs 7,900 crore over three years ending FY24 to ramp up production.

“The capacity will increase from 29,000 units per month to 39,000 units per month by the end of this fiscal. It would further be enhanced to 49,000 units a month by the end of next fiscal,” M&M executive director Rajesh Jejurikar told reporters at a virtual press conference after releasing quarterly numbers. He added, “The revised capacity will prepare the company for ‘export upsides’ and clear existing bookings of about 2.6 lakh units with a waiting period of 18-22 months on some of the models.”

Also Read: M&M's Rajesh Jejurikar says SUV production will rise in 2023

Tata Motors has revealed that it will be spending Rs 6,000 crore for its standalone business, which includes both passenger and commercial vehicles. Group CFO Pathamadai Balachandran Balaji said the company, which currently produces 50,000 units a month, will be able to debottleneck its existing car plant capacities to produce around 55,000 units a month or 6.5 lakh units per annum. Once its Sanand plant (acquired from Ford) goes on stream, the Mumbai-based automaker will be able to generate an additional 25,000-30,000 units of capacity per month, taking its cumulative manufacturing capacity to over 9 lakh units a year.

“We are already seeing a surge in demand for the last one and a half years in the PV business and have already stepped up our capex last time and have signalled that. On top of that, we have the Ford plant (which we have acquired) which will be outside this and will conclude in Q3/Q4 of this financial year. That will be an added capex spend for this financial year. So a fair amount of investments are going in and we are well covered on the demand side to cater to the surging demand, particularly in the PV business,” Balaji said on a post-results conference call.

Tata Motors is also on course to invest 2.5 billion pounds (over Rs 23,500 crore) for its British subsidiary Jaguar Land Rover in the current fiscal to cater to higher demand for Range Rover Sport and Defender SUVs.

Market leader Maruti Suzuki India has also said that it plans to invest over Rs 7,000 crore this year on various initiatives, including the construction of a new plant in Haryana and new model launches. This is 40 percent higher than it had initially earmarked for this financial year. The company has already commenced work at the new facility in Sonipat district.

Maruti Suzuki CFO Ajay Seth said the amount set aside would cover various activities: “We’ll have to place orders to various vendors. So that will be one major portion of capex. Besides that, all the new model launches that we are doing where we have to have the investment on toolings, et cetera. I think that will be another large piece of capex. These are two areas where the capex will be maximum. Then you have the other routine capital expenditure on the other aspects of the business, which is R&D, the regular maintenance capex. So, these are the key areas where we will be spending.”

Carmakers’ plans to expand production of ICEVs come even as the government is advocating EVs, with an aim to have EV sales penetration of 30 percent for private cars (revised from 100 percent earlier), 70 percent for commercial vehicles, 40 percent for buses and 80 percent for two- and three-wheelers by 2030.

Auto analysts say that EV adoption will take time, given the lack of adequate supporting infrastructure such as charging stations along highways. “Since car manufacturers need to cater to customers’ needs today, continuous capex is required to make new ICE models meeting the latest regulations,” said Puneet Gupta, director, S&P Automotive, adding, “In India, car penetration levels are still low and since the economy is growing at a brisk pace, mobility needs will rise and the need for cars will grow. Since EV will only be 25 percent of the market by 2030, ICE investments will still be meaningful.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.