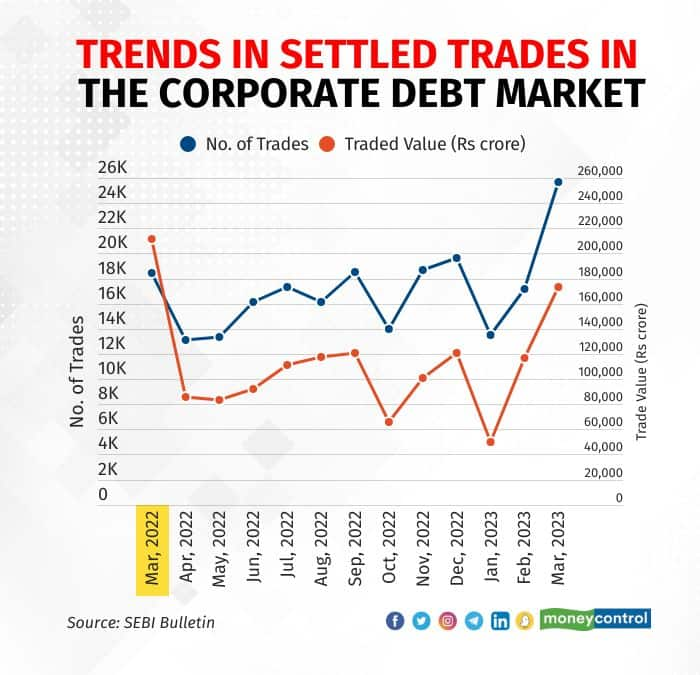

The settlement of trades in the corporate debt market, in value terms, rose to a 12-month high of Rs 1.73 lakh crore in March 2023, according to data from the Securities and Exchange Board of India (SEBI).

This is due to higher issuances of corporate bonds, coupled with profit booking by traders and investors for the purpose of mark-to-market (MTM), experts said. MTM refers to a method of measuring the fair value of holdings, such as assets and liabilities, that can move over time.

According to SEBI data, the value of trades settled in March this year was Rs 1.73 lakh crore, compared to Rs 2.11 lakh crore in March 2022.

While the consolidated total number of trades settled on the BSE and the National Stock Exchange of India (NSE) stood at 25,706 in March 2023, in the previous month it was 17,175, the data showed.

“Generally, during the month of March, most of the corporate bond issuers try and complete their borrowing programme, including those needing to fulfil regulatory compliances, before the financial year closes,” said Venkatakrishnan Srinivasan, Founder and Managing Partner, Rockfort Fincorp.

He further said that most of the market traders and investors too, have booked profits for the purpose of MTM.

“There were several factors leading to the high volumes in March ― lesser-than-expected hike in policy rate by RBI, the banking crisis in Europe and the US, good inflation prints, expectations of central banks pausing the rate hike cycle, and short-covering leading to these events,” said Nagesh Chauhan, Head of DCM, Tipsons.

High issuances

According to the SEBI data, corporate bonds worth Rs 91,958.29 crore were issued in March 2023, compared to Rs 74,752.78 crore in February 2023.

Also, the issuance of corporate bonds rose to an all-time high of Rs 8.25 lakh crore in financial year 2022-23 (FY23), as most companies and banks raised funds heavily before yields started increasing, as there were expectations of further rate hikes, and given the market volatility globally and tightening monetary policies, overseas bond issuances moderated.

According to data compiled by Prime Database, companies and banks raised Rs 8.25 lakh crore in FY23, compared to Rs 6.34 lakh crore in FY22.

In the last 10 years, FY21 witnessed the previous highest issuances, worth Rs 7.51 lakh crore, followed by FY17 at Rs 7.07 lakh crore, data showed.

Also read: Bank of England lifts interest rate to 15-year high

Easing rates to the rescue

The fall in rates on these instruments in March as well as April helped increase the activity in the bond market.

The yield on corporate bonds eased 7-15 basis points (bps) in March across maturities. One basis point is one-hundredth of a percentage point.

While on three-year papers the yields fell 12-15 bps, on five-year papers it eased 7-9 bps, and on 10-year bonds it slipped 5-7 bps, said market participants.

Dealers further said this helped most traders and investors to revisit their books and manage MTM during that period.

“RBI's key decision to pause the rate hike and keep the repo rate at 6.50 percent, crude prices coming down, inflation print remaining in the upper tolerance band of RBI, and the Fed indicating a pause in the rate hike cheered the market for a fresh rally, leading to a spread compression between the repo and the 10-year bond,” Chauhan added.

Outlook

Going forward, dealers are of the view that activity or trade settlement in value terms will rise in the coming months as most companies are expected to tap the market for their working capital needs and to take benefit of the lower yields.

Yields on these debt instruments have eased in the last few weeks due to the unexpected pause by the RBI in the April monetary policy and expectation of a pause by the US Federal Reserve.

“Most of the corporates will try now and utilise this opportunity to borrow money at competitive rates compared to their previous issuance levels,” Srinivasan added.

In addition to that, both HDFC and HDFC Bank may like to borrow long-term funds till the date of merger.

“As the economy opens up and growth picks up, volumes in corporate bonds will also likely pick up. Further, if we see an uptick in private capex, then that may also add to growth in corporate bond volumes,” said Abhishek Bisen, Head - Fixed Income, Kotak Mahindra Asset Management Company.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.