We are 1 month into the new fiscal 2022-2023 and the market is throwing many opportunities. Moneycontrol studied the data for the first half of each of the last three fiscal years and found that 15 stocks from the BSE universe consistently surged over 30 percent during the first six months of each of the last three fiscal years (H1FY20, H1FY21, and H1FY22). We considered only companies with a market cap of over Rs 1000 crore. (Data Source: ACE Equity). Take a look at how these consistent performers do on Moneycontrol's SWOT analysis.

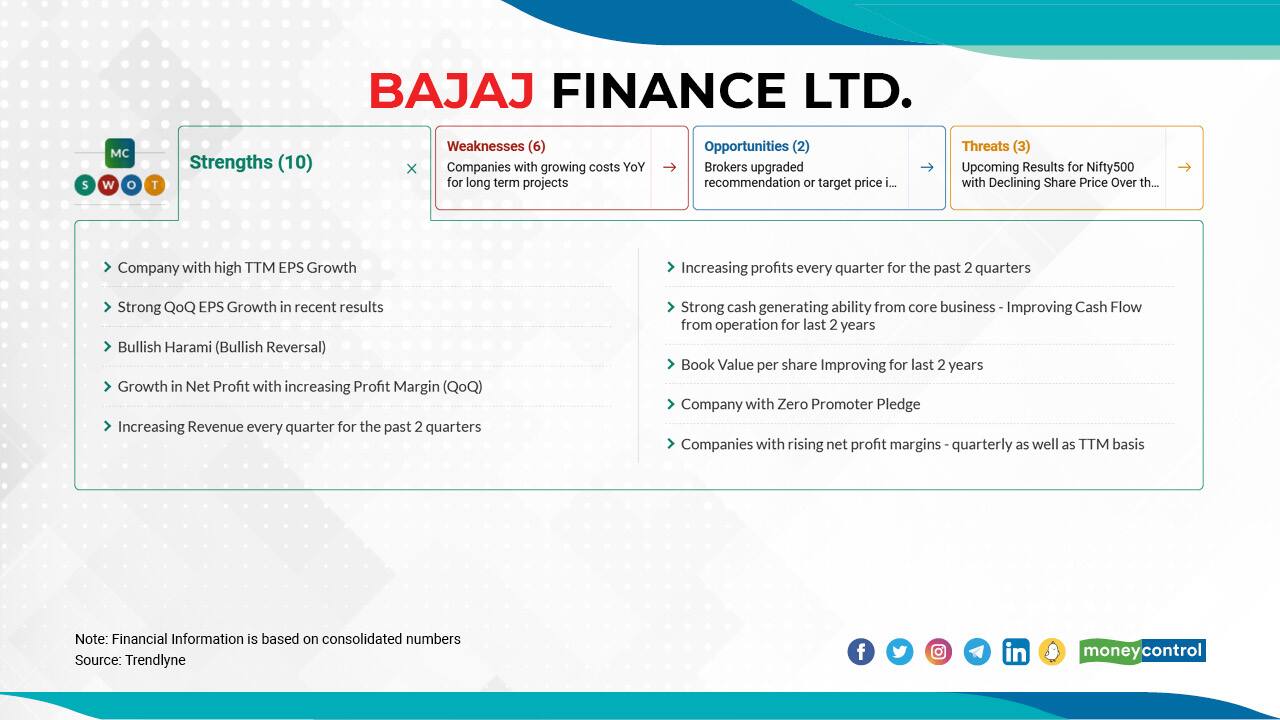

We are 1 month into the new fiscal 2022-2023 and the market is throwing many opportunities. Moneycontrol studied the data for the first half of each of the last three fiscal years and found that 15 stocks from the BSE universe consistently surged over 30 percent during the first six months of each of the last three fiscal years (H1FY20, H1FY21, and H1FY22). We considered only companies with a market cap of over Rs 1000 crore. (Data Source: ACE Equity). Take a look at how these consistent performers do on Moneycontrol's SWOT analysis. Bajaj Finance Ltd. | In H1FY20, the stock price jumped 34 percent; H1FY21: 46 percent; H1FY22: 48 percent. On April 20, 2022, the stock was trading at Rs 7032.35, which is still 14 percent away from its 52-week high of Rs 8043.50. The company's current market-cap is at Rs 425759 crore. Click here to see Moneycontrol SWOT analysis.

Bajaj Finance Ltd. | In H1FY20, the stock price jumped 34 percent; H1FY21: 46 percent; H1FY22: 48 percent. On April 20, 2022, the stock was trading at Rs 7032.35, which is still 14 percent away from its 52-week high of Rs 8043.50. The company's current market-cap is at Rs 425759 crore. Click here to see Moneycontrol SWOT analysis.

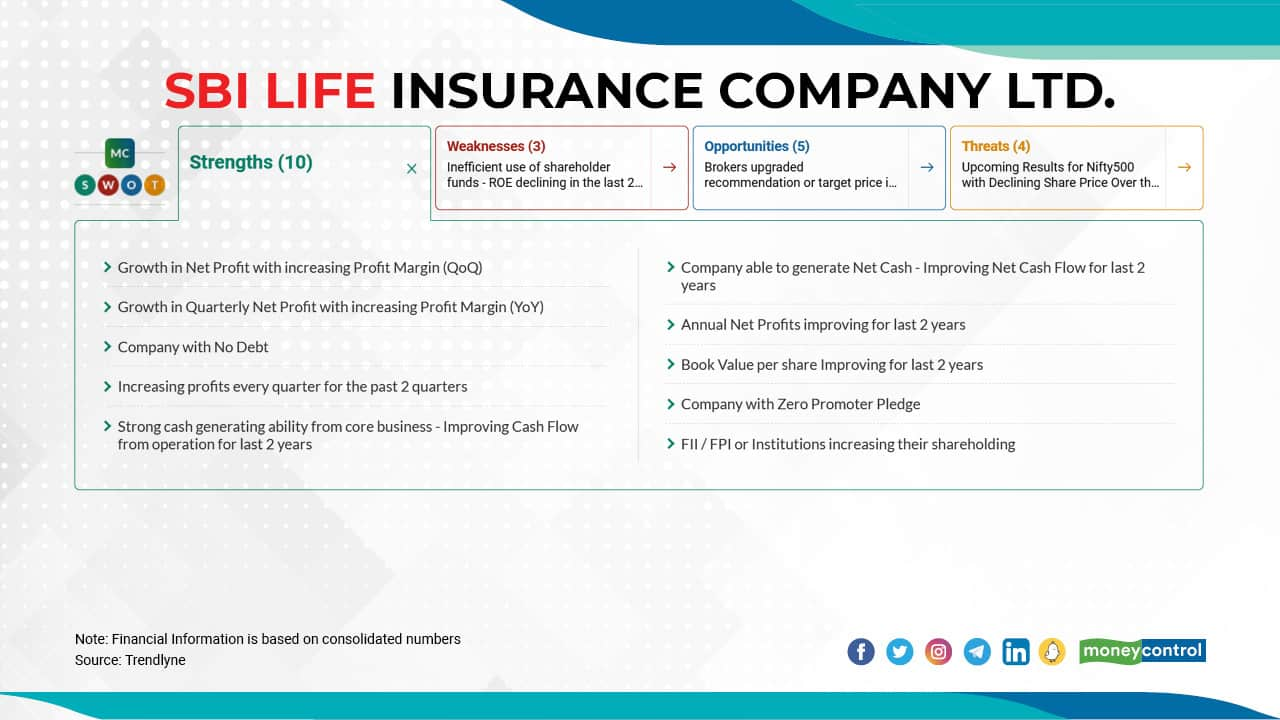

SBI Life Insurance Company Ltd. | In H1FY20, the stock price jumped 46 percent; H1FY21: 30 percent; H1FY22: 39 percent. On April 20, 2022, the stock was trading at Rs 1127.05, which is still 15 percent away from its 52-week high of Rs 1293.00. The company's current market-cap is at Rs 112747 crore. Click here to see Moneycontrol SWOT analysis.

SBI Life Insurance Company Ltd. | In H1FY20, the stock price jumped 46 percent; H1FY21: 30 percent; H1FY22: 39 percent. On April 20, 2022, the stock was trading at Rs 1127.05, which is still 15 percent away from its 52-week high of Rs 1293.00. The company's current market-cap is at Rs 112747 crore. Click here to see Moneycontrol SWOT analysis.

Trent Ltd. | In H1FY20, the stock price jumped 35 percent; H1FY21: 47 percent; H1FY22: 35 percent. On April 20, 2022, the stock was trading at Rs 1264.40, which is still 7 percent away from its 52-week high of Rs 1347.10. The company's current market-cap is at Rs 44948 crore. Click here to see Moneycontrol SWOT analysis.

Trent Ltd. | In H1FY20, the stock price jumped 35 percent; H1FY21: 47 percent; H1FY22: 35 percent. On April 20, 2022, the stock was trading at Rs 1264.40, which is still 7 percent away from its 52-week high of Rs 1347.10. The company's current market-cap is at Rs 44948 crore. Click here to see Moneycontrol SWOT analysis.

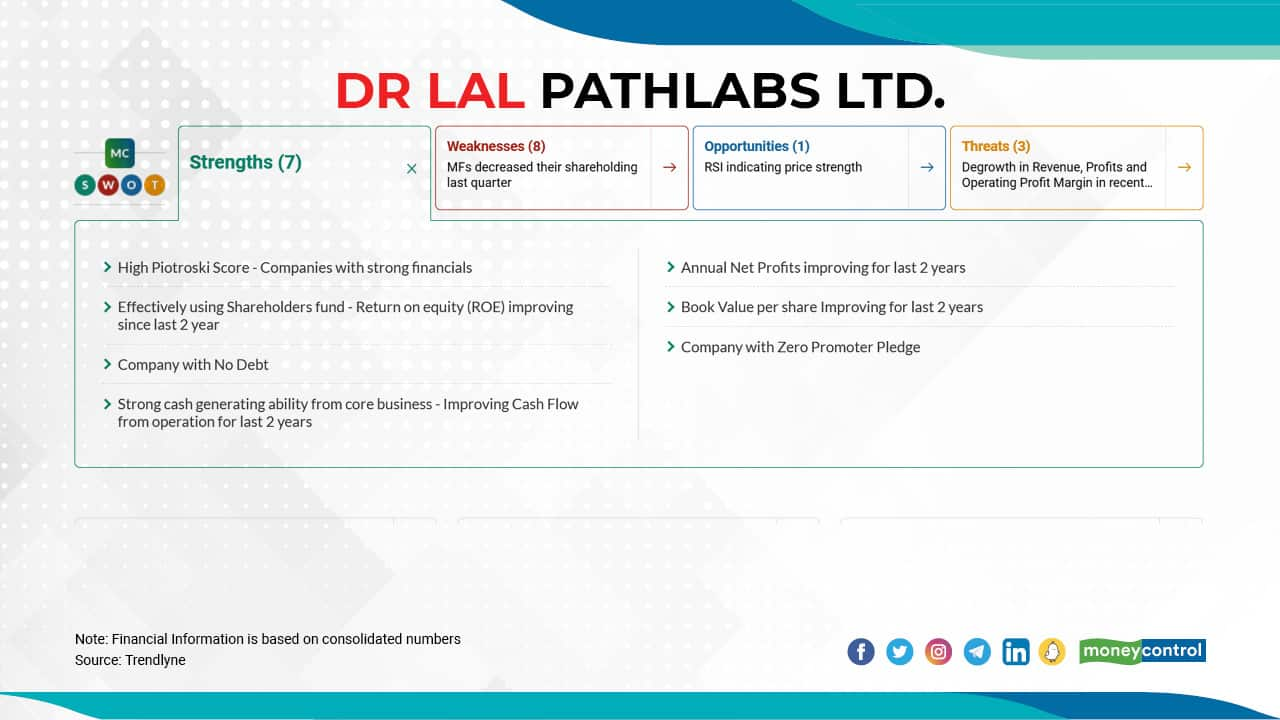

Dr. Lal Pathlabs Ltd. | In H1FY20, the stock price jumped 32 percent; H1FY21: 32 percent; H1FY22: 41 percent. On April 20, 2022, the stock was trading at Rs 2729.40, which is still 55 percent away from its 52-week high of Rs 4243.00. The company's current market-cap is at Rs 22748 crore. Click here to see Moneycontrol SWOT analysis.

Dr. Lal Pathlabs Ltd. | In H1FY20, the stock price jumped 32 percent; H1FY21: 32 percent; H1FY22: 41 percent. On April 20, 2022, the stock was trading at Rs 2729.40, which is still 55 percent away from its 52-week high of Rs 4243.00. The company's current market-cap is at Rs 22748 crore. Click here to see Moneycontrol SWOT analysis.

Vinati Organics Ltd. | In H1FY20, the stock price jumped 31 percent; H1FY21: 68 percent; H1FY22: 37 percent. On April 20, 2022, the stock was trading at Rs 2179.25, which is still 4 percent away from its 52-week high of Rs 2274.00. The company's current market-cap is at Rs 22399 crore. Click here to see Moneycontrol SWOT analysis.

Vinati Organics Ltd. | In H1FY20, the stock price jumped 31 percent; H1FY21: 68 percent; H1FY22: 37 percent. On April 20, 2022, the stock was trading at Rs 2179.25, which is still 4 percent away from its 52-week high of Rs 2274.00. The company's current market-cap is at Rs 22399 crore. Click here to see Moneycontrol SWOT analysis.

Timken India Ltd. | In H1FY20, the stock price jumped 30 percent; H1FY21: 61 percent; H1FY22: 33 percent. On April 20, 2022, the stock was trading at Rs 2111.10, which is still 9 percent away from its 52-week high of Rs 2301.65. The company's current market-cap is at Rs 15879 crore. Click here to see Moneycontrol SWOT analysis.

Timken India Ltd. | In H1FY20, the stock price jumped 30 percent; H1FY21: 61 percent; H1FY22: 33 percent. On April 20, 2022, the stock was trading at Rs 2111.10, which is still 9 percent away from its 52-week high of Rs 2301.65. The company's current market-cap is at Rs 15879 crore. Click here to see Moneycontrol SWOT analysis.

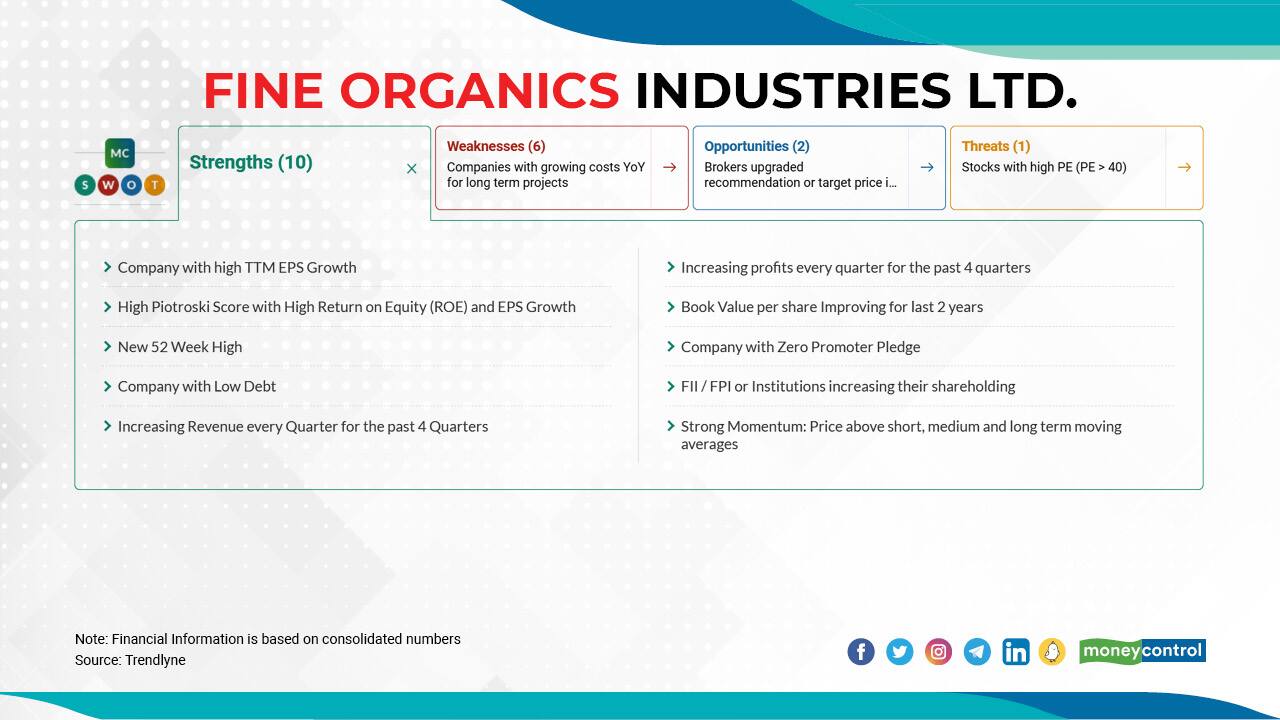

Fine Organic Industries Ltd. | In H1FY20, the stock price jumped 40 percent; H1FY21: 41 percent; H1FY22: 35 percent. On April 20, 2022, the stock was trading at Rs 4461.35, which is still 3 percent away from its 52-week high of Rs 4586.65. The company's current market-cap is at Rs 13678 crore. Click here to see Moneycontrol SWOT analysis.

Fine Organic Industries Ltd. | In H1FY20, the stock price jumped 40 percent; H1FY21: 41 percent; H1FY22: 35 percent. On April 20, 2022, the stock was trading at Rs 4461.35, which is still 3 percent away from its 52-week high of Rs 4586.65. The company's current market-cap is at Rs 13678 crore. Click here to see Moneycontrol SWOT analysis.

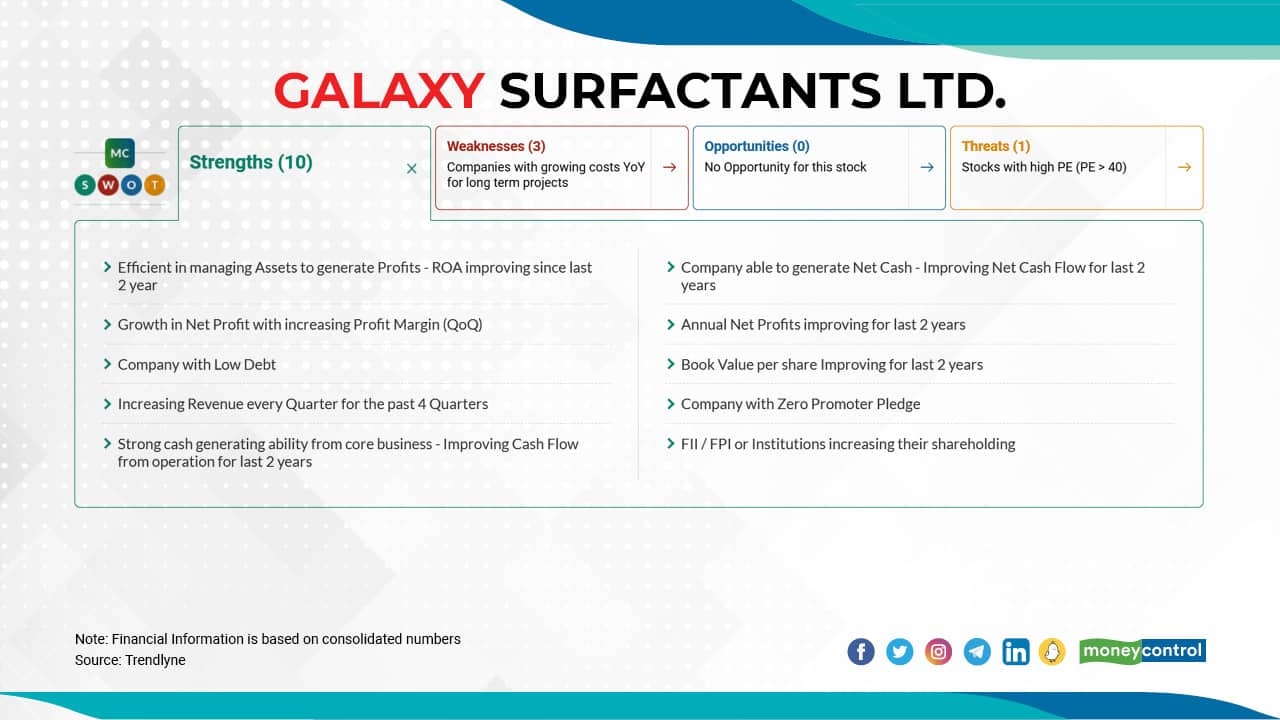

Galaxy Surfactants Ltd. | In H1FY20, the stock price jumped 37 percent; H1FY21: 60 percent; H1FY22: 35 percent. On April 20, 2022, the stock was trading at Rs 2975.65, which is still 21 percent away from its 52-week high of Rs 3600.00. The company's current market-cap is at Rs 10550 crore. Click here to see Moneycontrol SWOT analysis.

Galaxy Surfactants Ltd. | In H1FY20, the stock price jumped 37 percent; H1FY21: 60 percent; H1FY22: 35 percent. On April 20, 2022, the stock was trading at Rs 2975.65, which is still 21 percent away from its 52-week high of Rs 3600.00. The company's current market-cap is at Rs 10550 crore. Click here to see Moneycontrol SWOT analysis.

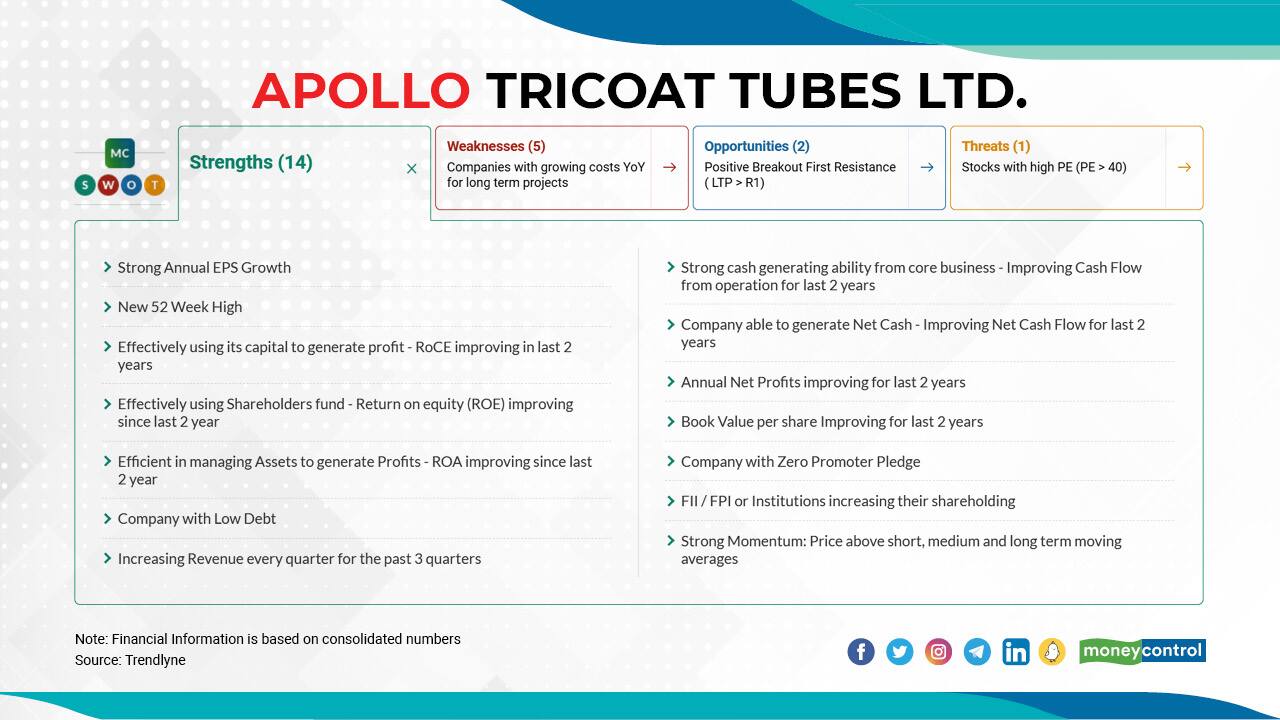

Apollo Tricoat Tubes Ltd. | In H1FY20, the stock price jumped 32 percent; H1FY21: 113 percent; H1FY22: 38 percent. On April 20, 2022, the stock was trading at Rs 951.50, which is still 1 percent away from its 52-week high of Rs 960.00. The company's current market-cap is at Rs 5785 crore. Click here to see Moneycontrol SWOT analysis.

Apollo Tricoat Tubes Ltd. | In H1FY20, the stock price jumped 32 percent; H1FY21: 113 percent; H1FY22: 38 percent. On April 20, 2022, the stock was trading at Rs 951.50, which is still 1 percent away from its 52-week high of Rs 960.00. The company's current market-cap is at Rs 5785 crore. Click here to see Moneycontrol SWOT analysis.

Bharat Rasayan Ltd. | In H1FY20, the stock price jumped 42 percent; H1FY21: 76 percent; H1FY22: 30 percent. On April 20, 2022, the stock was trading at Rs 13121.25, which is still 15 percent away from its 52-week high of Rs 15100.00. The company's current market-cap is at Rs 5452 crore. Click here to see Moneycontrol SWOT analysis.

Bharat Rasayan Ltd. | In H1FY20, the stock price jumped 42 percent; H1FY21: 76 percent; H1FY22: 30 percent. On April 20, 2022, the stock was trading at Rs 13121.25, which is still 15 percent away from its 52-week high of Rs 15100.00. The company's current market-cap is at Rs 5452 crore. Click here to see Moneycontrol SWOT analysis.

Best Agrolife Ltd. | In H1FY20, the stock price jumped 521 percent; H1FY21: 213 percent; H1FY22: 80 percent. On April 20, 2022, the stock was trading at Rs 972.50, which is still 44 percent away from its 52-week high of Rs 1399.70. The company's current market-cap is at Rs 2299 crore. Click here to see Moneycontrol SWOT analysis.

Best Agrolife Ltd. | In H1FY20, the stock price jumped 521 percent; H1FY21: 213 percent; H1FY22: 80 percent. On April 20, 2022, the stock was trading at Rs 972.50, which is still 44 percent away from its 52-week high of Rs 1399.70. The company's current market-cap is at Rs 2299 crore. Click here to see Moneycontrol SWOT analysis.

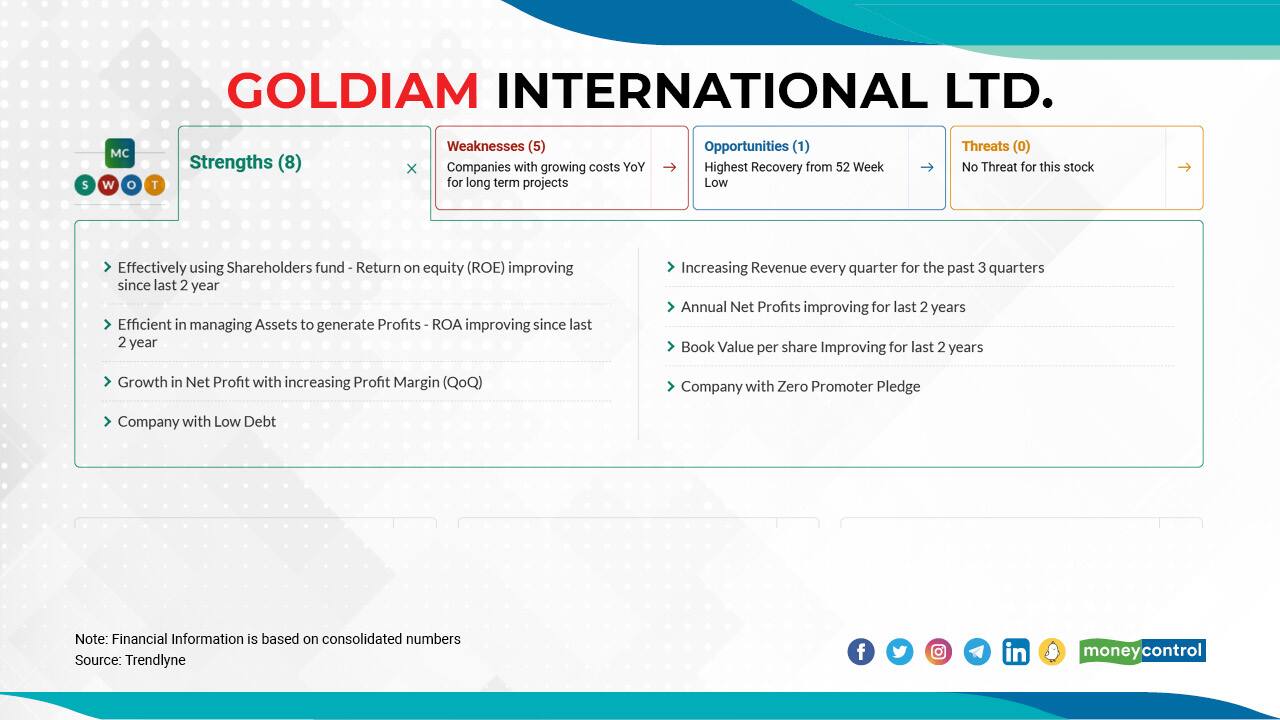

Goldiam International Ltd. | In H1FY20, the stock price jumped 86 percent; H1FY21: 52 percent; H1FY22: 174 percent. On April 20, 2022, the stock was trading at Rs 147.90, which is still 55 percent away from its 52-week high of Rs 228.52. The company's current market-cap is at Rs 1612 crore. Click here to see Moneycontrol SWOT analysis.

Goldiam International Ltd. | In H1FY20, the stock price jumped 86 percent; H1FY21: 52 percent; H1FY22: 174 percent. On April 20, 2022, the stock was trading at Rs 147.90, which is still 55 percent away from its 52-week high of Rs 228.52. The company's current market-cap is at Rs 1612 crore. Click here to see Moneycontrol SWOT analysis.

Manorama Industries Ltd. | In H1FY20, the stock price jumped 33 percent; H1FY21: 168 percent; H1FY22: 95 percent. On April 20, 2022, the stock was trading at Rs 1246.30, which is still 56 percent away from its 52-week high of Rs 1950.00. The company's current market-cap is at Rs 1486 crore. Click here to see Moneycontrol SWOT analysis.

Manorama Industries Ltd. | In H1FY20, the stock price jumped 33 percent; H1FY21: 168 percent; H1FY22: 95 percent. On April 20, 2022, the stock was trading at Rs 1246.30, which is still 56 percent away from its 52-week high of Rs 1950.00. The company's current market-cap is at Rs 1486 crore. Click here to see Moneycontrol SWOT analysis.

63 Moons Technologies Ltd. | In H1FY20, the stock price jumped 55 percent; H1FY21: 49 percent; H1FY22: 33 percent. On April 20, 2022, the stock was trading at Rs 290.80, which is still 29 percent away from its 52-week high of Rs 373.70. The company's current market-cap is at Rs 1340 crore. Click here to see Moneycontrol SWOT analysis.

63 Moons Technologies Ltd. | In H1FY20, the stock price jumped 55 percent; H1FY21: 49 percent; H1FY22: 33 percent. On April 20, 2022, the stock was trading at Rs 290.80, which is still 29 percent away from its 52-week high of Rs 373.70. The company's current market-cap is at Rs 1340 crore. Click here to see Moneycontrol SWOT analysis.

5Paisa Capital Ltd. | In H1FY20, the stock price jumped 34 percent; H1FY21: 233 percent; H1FY22: 81 percent. On April 20, 2022, the stock was trading at Rs 360.80, which is still 60 percent away from its 52-week high of Rs 577.40. The company's current market-cap is at Rs 1061 crore. Click here to see Moneycontrol SWOT analysis.

5Paisa Capital Ltd. | In H1FY20, the stock price jumped 34 percent; H1FY21: 233 percent; H1FY22: 81 percent. On April 20, 2022, the stock was trading at Rs 360.80, which is still 60 percent away from its 52-week high of Rs 577.40. The company's current market-cap is at Rs 1061 crore. Click here to see Moneycontrol SWOT analysis.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.