A day ahead of Zomato’s quarterly earnings announcement, rival food tech major Swiggy declared that its food-delivery business turned profitable in the March quarter of FY23, after factoring in all corporate costs, excluding employee stock option (ESOP) costs.

In a blogpost on May 18, Swiggy’s Co-founder and Chief Executive Officer (CEO) Sriharsha Majety also said that the company’s quick commerce segment Instamart is on track to become contribution-margin break-even in the next few weeks. This is a metric typically used by e-commerce companies to communicate the profitability of their business on a per order basis, including variable costs like logistics, but excluding fixed costs and marketing spend.

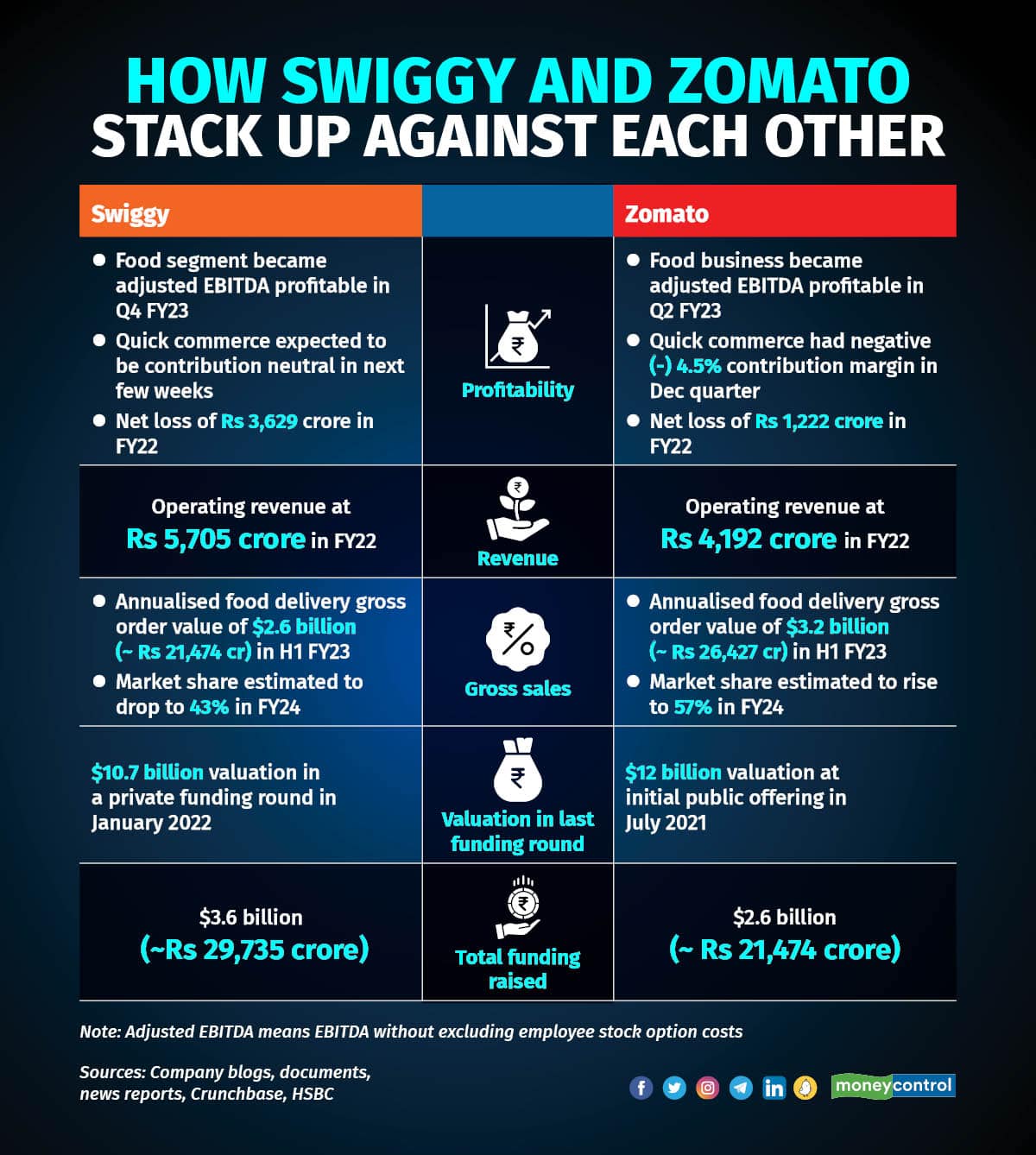

For context, Gurugram-based Zomato had declared adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) break-even for the food delivery segment in the first quarter of FY23, before clarifying later that it was not so. While it achieved the milestone in the next quarter, Zomato announced earlier this year that the entire business is now profitable on adjusted EBITDA terms, excluding its quick commerce business Blinkit.

Adjusted EBIDTA means a company is not accounting for certain costs, like ESOP costs in Swiggy and Zomato's case, while reporting its EBITDA results.

"Swiggy has become one of the very few global food delivery platforms to achieve profitability in less than nine years since its inception," Majety said.

Majety's announcement comes after Invesco and Baron Capital, investors in Swiggy, marked down the fair value of their stakes in the Bengaluru-based start-up over the past few weeks.

After a double blow, Invesco last valued Swiggy at around $5.5 billion, while Baron Capital pegged Swiggy's valuation at around $7.3 billion, higher than Zomato's market capitalisation of around $6.5 billion. Swiggy was valued at $10.7 billion when it last raised $700 million in January last year.

The markdowns come at a time when both Zomato and Swiggy have said the global food delivery market was slowing down. To weather the slowdown, Swiggy shut its meat marketplace, laid off 380 employees in January this year, and even revisited other indirect costs, like infrastructure.

"Over the last year, under challenging macroeconomic conditions, companies around the world are adjusting to the new normal, with refreshed investment horizons and accelerated timelines for profitability. We’re no exception here, and have already advanced our own timelines for profitability on food delivery and Instamart," Majety had said then.

That was after Swiggy's net losses had doubled from Rs 1,616.9 crore in FY21 to Rs 3,628.9 crore in FY22. The company's revenue from operations, however jumped from Rs 2,546.9 crore to Rs 5,704.9 crore on a year-on-year (YoY) basis.

"We have reached this milestone while bringing tremendous benefits to all partners in our ecosystem. Our core value ― that the customer comes first ― has consistently been reciprocated with deep consumer love and industry-best NPS (net promoter score), repeat and retention rates. We continue to make strides in gaining customer favour, including strong traction in Tier 2 and 3 markets."

Swiggy has indeed shown an improvement in its business. Swiggy and several other SoftBank-funded start-ups have sharply reduced their cash burn and extended the cash runway by at least 12 months.

The extension was because the company's monthly cash burn has come down to $20 million from about $45-50 million that it was losing each month during its peak in 2021. The reduction in cash burn was also aided by the shuttering of unprofitable divisions like Handpicked, a unit for premium groceries.

"Congratulations! Nicely done," Deepinder Goyal, Co-founder and CEO, Zomato, said in response to Majety's tweet on May 18.

Update on InstamartOn Instamart, Swiggy's quick-commerce business, Majety said the unit was on track to turn positive on unit economics level, or contribution neutrality, with the bulk of its investments in the business already behind it.

"The peak of our investments is behind us, and today, Instamart is one of the leading players in the quick commerce space globally. In addition, we’ve also made strong progress on the profitability of the business, and we’re on track to hit contribution neutrality for this three-year-old business in the next few weeks," his post added.

Instamart competes with the likes of Zomato-owned Blinkit, Y Combinator-backed Zepto, Reliance-funded Dunzo, and Tata's Big Basket.

"We pioneered and built this category from the grounds up, and have made disproportionate investments in Instamart given the attractiveness of the consumer proposition and its strategic importance to us," Majety concluded.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.