Krishna Karwa

Moneycontrol Research

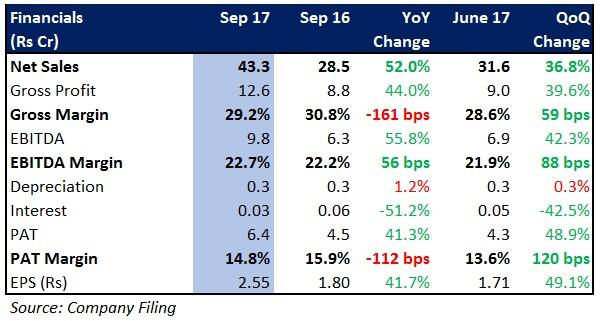

Sreeleathers, a reputed footwear manufacturer cum retailer with significant presence in eastern India, reported a robust set of numbers in Q2FY18.

From a quarter on quarter (QoQ) perspective, the performance was all the more impressive inspite of GST led disruptions in the quarter gone by.

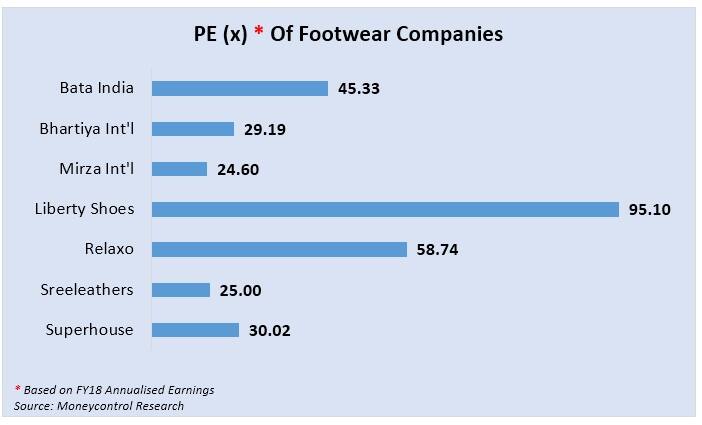

Sreeleathers outperformed its peers, including majors such as Bata and Relaxo, yet again. This was attributable to a high operating leverage resulting in strong bottom-line growth.

Outlook and valuation

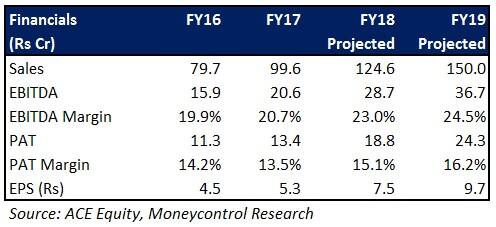

Emphasis on volume-driven sales in price-sensitive markets, the ability to derive operating leverage to an extent considerably higher than the industry, asset-light expansion (which entails outsourcing manufacturing processes to third-party entities, apart from network augmentation largely through franchise-run stores), negligible debt on the books (due to steady cash flows), and macro-economic tailwinds (GST transition from unorganised players to organised ones, increasing brand awareness and disposable incomes) are expected to augur well for Sreeleathers, going forward.

We had initiated coverage on Sreeleathers in June 2017, and the stock has rallied by nearly 46 percent till date on the back of its superlative performance. At 22x FY19 projected earnings (compared to 35 - 50x for industry leaders), despite the multiple re-rating in recent months, the stock’s upside prospects appear optimistic, thereby making it worthy of consideration.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!