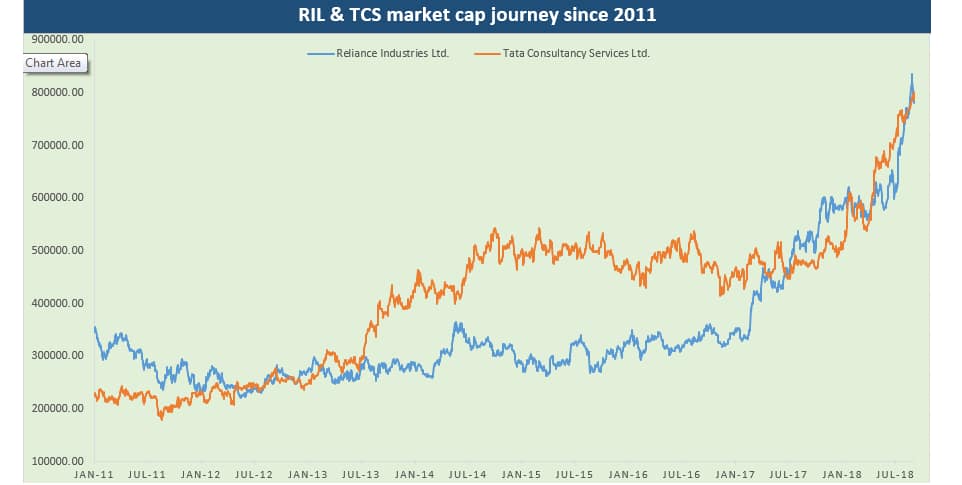

Two big boys of D-Street, Tata Consultancy Services (TCS) and Reliance Industries (RIL), hit a market capitalisation of Rs 8 lakh crore recently, and have contributed majorly in Sensex's run towards record high of 38,989.65 last month.

RIL has risen 38 percent, while TCS has vaulted as much as 55 percent so far in the year 2018.

TCS remains the leader in the IT space and weakness in the Indian currency is acting like a tailwind for the stock, and for RIL, there are a plenty of tailwinds in terms of robust subscriber addition for Jio, strong performance from retail business as well as best petchem margins in the industry.

Most experts feel that if you own both the stocks then this is probably not the time to book your profits and holding them for higher returns would be the right strategy. However, the upside for TCS remains fairly limited when compared to RIL, suggest experts.

“Both RIL and TCS have been major movers in the Index. While RIL was the first to cross the Rs 8 lakh-cr market cap mark, TCS was not far behind to cross the landmark level soon after. While TCS remains a strong market leader in the IT services business with strong growth, we believe that high valuations at 25x FY19 P/E leaves little on the table from a 1-year perspective,” Siddharth Khemka, Head- Retail research, MOFSL told Moneycontrol.

“We have a Neutral Rating on TCS with a target price of Rs 1,950 from a one year view. Reliance Industries has reported strong June quarter numbers led by a superior petchem performance in the standalone business, and robust RJio and retail performance in the consolidated business,” he said.

Khemka expects strong earnings growth for the next two years along with comfortable valuations. The brokerage house has a buy rating on Reliance Industries with a target price of Rs 1,477, which translates into an upside of above 15 percent from Friday’s closing price of Rs 1,276.75.

Mayuresh Joshi - Fund Manager, Angel Broking also feels that the upside remains fairly limited for TCS, while the stock of RIL could see some more traction in value terms.

“RIL still has the best GRM in the refining space and one of the best pet-chem margins in the world. Also, the telecom space may see more value in terms of monetizing its ecosystem,” he said.

However, some experts are skeptical about the rally in RIL because it has come in quick time.

Sumeet Bagadia, Associate Director at Choice Broking shares a similar opinion. “We have a negative view on RIL with a sell rating. We believe that the current valuation is ahead of the fundamentals for RIL. We maintain a 12-month target of Rs 1,085 on the stock,” he said.

The rally could be fast and furious for RIL, but most experts feel that India's largest oil & gas major will continue to win and hit levels closer to Rs 1,450-1,500 in the next 12 months. Both RIL and TCS offer tremendous growth potential which is why the market is rewarding both the companies, suggest experts.

“We continue to remain bullish on both the stocks despite the steep up-move. There is a similarity in both the stocks and that is — the ‘future growth prospects remains intact’. Both stocks expect very good earnings in the future,” Foram Parekh, Fundamental Analyst – Equity, Indiabulls Ventures Ltd told Moneycontrol.

“Market is rewarding both the stocks on the factor of longevity. We feel Reliance will touch Rs 1,400- 1,500 levels in one year on account of good growth in the GRM and the Jio business. On account of rupee depreciation, we feel TCS will fetch good growth on the constant currency basis which will lead to a target price of Rs. 2,300 in one year,” she said.

Both TCS and RIL are the best bluechip stocks. They might not offer multi-bagger returns from current levels in the next one year but could still give double-digit returns from current levels.

TCS is well-positioned in the competitive landscape, especially in digital execution capability. This can be evidenced by the winning of its large deals in the recent quarters. The company is on track to achieve double-digit growth in FY19, suggest experts.

“TCS’ superior digital execution capability along with an expected revival in BFSI vertical provides promising revenue visibility for FY2019/FY2020,” Gaurav Dua, Head of Research, Sharekhan by BNP Paribas told Moneycontrol.

“We believe that the stock would continue to trade at a premium to its peers given its superior digital execution capability and preferred partner for client’s digital transformation program. We maintain our Buy rating on the stock with a price target (PT) of Rs. 2,200,” he said.

For RIL, Dua is positive on the earnings outlook as he expects a robust margin for refining and petrochemical business. We have Buy rating on RIL with a price target of Rs 1,465.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!