Nitin Agrawal

Moneycontrol Research

Motherson Sumi Systems (MSSL), India’s largest automotive wiring harness company and one of the largest auto ancillary companies, posted a strong set of numbers for the quarter ended September 2017. While the company posted significant growth in consolidated revenues, EBITDA margin remained flat on the back of decline in margins of its standalone business.

New plants are getting commissioned which should result in increasing operating leverage. This, coupled with the push towards EV (electric vehicles) should result in healthy growth in the topline and gradual increase in margins. MSSL is currently trading at reasonable valuations which warrants investors’ attention.

Quarter in a nutshell

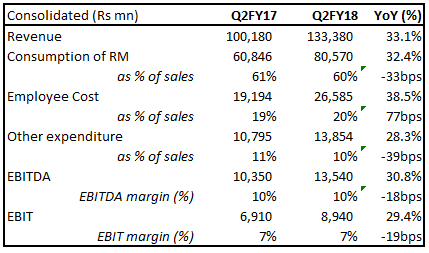

MSSL posted the highest ever quarterly revenue of Rs 13,338 crore, up 33 percent (YoY), driven by 17 percent and 12 percent growth (YoY) in standalone and SMR businesses (a leading global supplier of exterior mirrors), respectively. SMP (a subsidiary that is into modules & polymer component business and is a leading global supplier of door and instrument panels and bumpers) and PKC (a Finland-based wiring harness Specialist company) also witnessed strong sales growth of 19 percent and 23 percent, respectively.

Consolidated EBITDA margin remained flat at 10 percent on the back of 66bps margin contraction of standalone business. PKC posted strong EBITDA growth and 182bps margin expansion.

MSSL has multiple growth levers ahead

Strong order book

The company has reported the highest ever order book of euros 15.2 billion at SMRPBV (a subsidiary) with euros 5.2 billion (Rs 18,922 crore) of new orders coming in 1HFY18. Execution of orders worth euros 1.5 billion (Rs 11,705 crore) has started during 1HFY18.

Huge expansion on track

Currently, the company has ten plants at different stages of completion. SMP’s plant in Mexico is the largest plant for the company which has commenced production. The management expects it to ramp up by the end of this fiscal year. Additionally, the US and Hungary plants are expected to commence operations in FY19.

Once the new plants start operations and ramp up fully, operating leverage will kick in thereby contributing to margin expansion. The company’s capex guidance is around Rs 2,000 crore for FY18.

Strong volume growth:

The management attributed the growth in topline in India operations to demand likely for new model launches and refreshers. The growth was also led by an increase in content per vehicle.

With all regulatory headwinds in Indian automobile industry coming to an end, MSSL was able to register strong growth, indicating the strong position of the company in the Indian market. Going forward, as Indian automobile industry witnesses demand pick-up post-GST, we believe that MSSL is in a vantage position to participate in the growth.

Additionally, the management believes that demand growth remains strong across businesses and across key markets, especially in US CV market, which is benefitting the PKC business.

PKC – Smooth integration

Integration of PKC is happening smoothly as is evident from the 23 percent growth (YoY) registered during the quarter. On the back of strong demand scenario in the US, the management believes PKC to continue to register healthy growth, going forward.

EVs – An important catalyst

The government’s thrust on EVs (electric vehicles) will be an important catalyst for the next leg of growth of MSSL’s India operations. As per the management, EVs would need more wiring component which would increase the content per vehicle by close to 10-20 percent. Other businesses related to polymer and mirror-based products would also not be affected because of the shift to EVs.

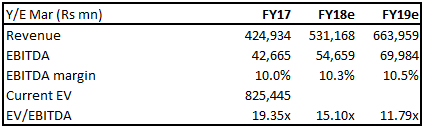

ValuationsMSSL is currently trading at 15.10 and 11.79 times FY18 and FY19 projected EV/EBITDA multiples, which we believe are reasonable seen in the context of the opportunity. On the back of multiple growth levers and reasonable valuations, we advise investors to accumulate the stock in order to be a part of this journey.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.