Jindal Steel scrip is exhibiting a uptrend, with its price action finding support at the previous swing low on the daily chart. This, in conjunction with a concealed positive divergence on the daily chart, points to an inherent strength in the stock. Rupak De, Senior Technical Analyst at LKP Securities, has provided insights into the stock's potential movements, stating, "In the short term, we anticipate the stock to advance towards the range of Rs 685-700. However, on the downside, there is a possibility of a weakening trend if the stock dips below Rs 644"

At 11:28 am on October 25, the stock was trading at Rs 655.10 on the National Stock Exchange, marking a nearly 2.34 percent increase.

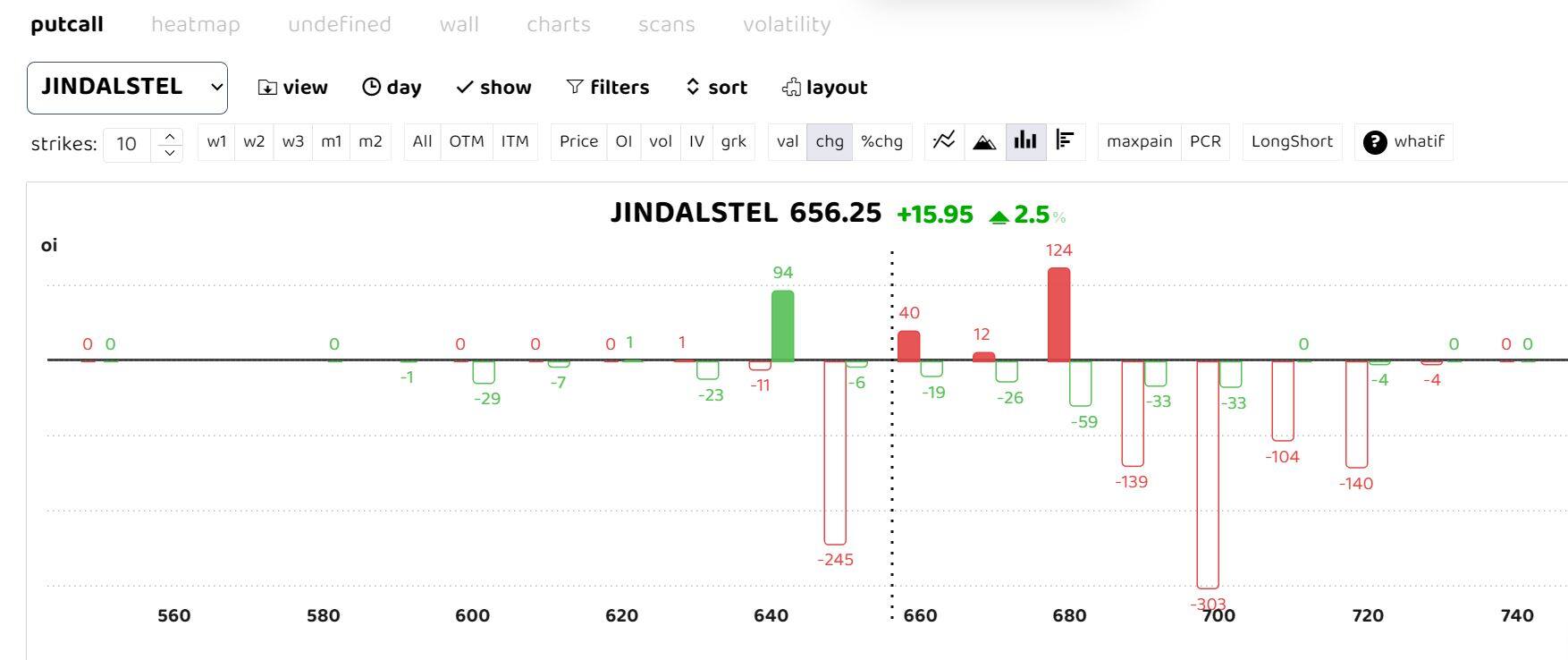

Options open interest data suggests that the Jindal Steel scrip has crucial support at the 640 levels, characterized by substantial put writing. The immediate key resistance is observed at the 680 strike.

Taking these insights into consideration, Rupak De suggests that investors consider buying JINDALSTEL November series futures within the range of Rs 660-665.

Here are the recommended levels:

Stop loss: Rs 644

Target price: Rs 700

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.