ITC ended today’s trading session down 4 percent as investors voted with their feet in expressing disappointment over the company’s decision to not do a full split of the company’s hotel business. Market participants were hoping for a split mirroring the shareholding pattern. However, in its demerger scheme, ITC has decided to withhold 40 percent of the newly-carved-out hotel company, and distribute only 60 percent to shareholders.

“Retaining 40 percent does not make sense. There is no guarantee that ITC will not deploy any further capital in the hotel business. Shareholders of ITC will still have to live with the investment, which will now be valued lower than the rest of the holding due to the application of a holding company discount," said an analyst on condition of anonymity.

Markets have been gung-ho about the de-merger because the hotels business has been a drag in ITC’s books. Since hotels are a capital-intensive business, it has always delivered significantly lower return on capital than ITC’s other businesses. Last year, its pre-tax return on capital was the lowest, at 10 percent, compared to its other businesses.

Investors have been excited about the possibility of a demerger so they have the option of staying with ITC’s high-returns businesses, without having to necessarily stay with a business that yields sub-optimal returns. ITC’s cigarette business earns a return on capital of more than 800 percent.

As of FY22-23, ITC’s hotel business contributed Rs 2,573 crore to the topline and Rs 540 crore to the EBIT. While in terms of revenue and profit the hotel business comprised less than 5 percent of ITC’s consolidated topline and bottomline, it consumed more than 20 percent of ITC’s capital employed. Hotels has been the least profitable business in ITC’s roster of businesses.

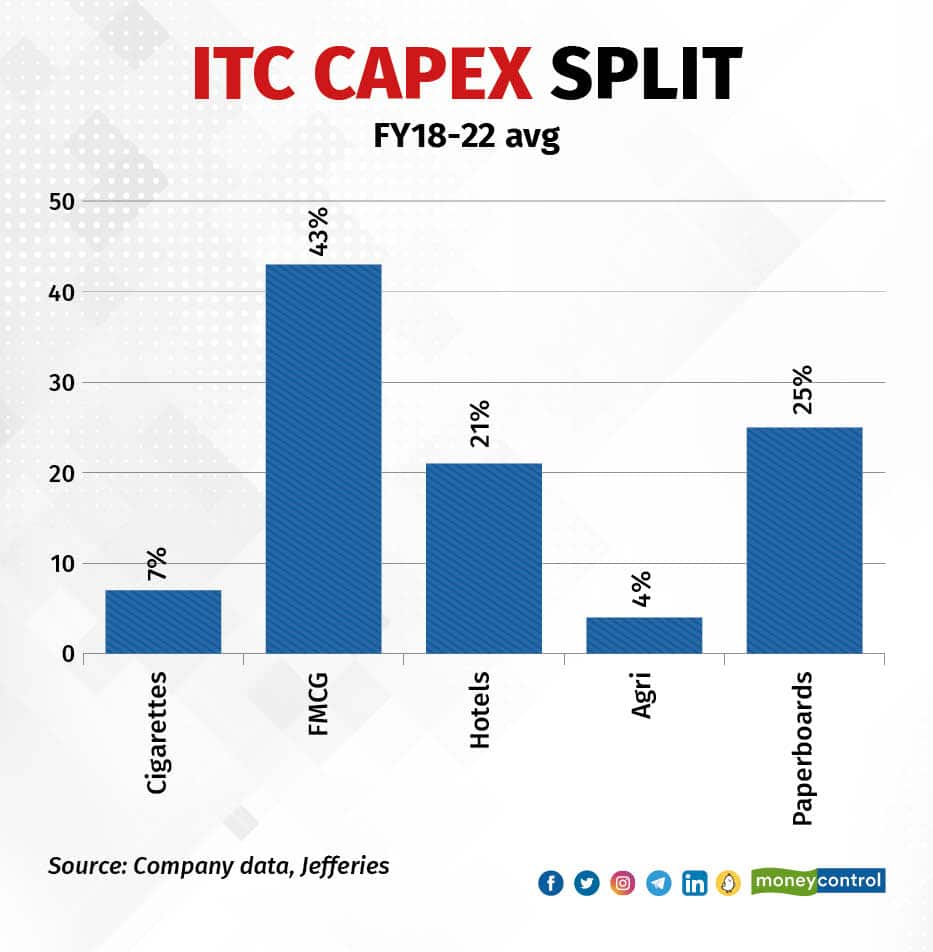

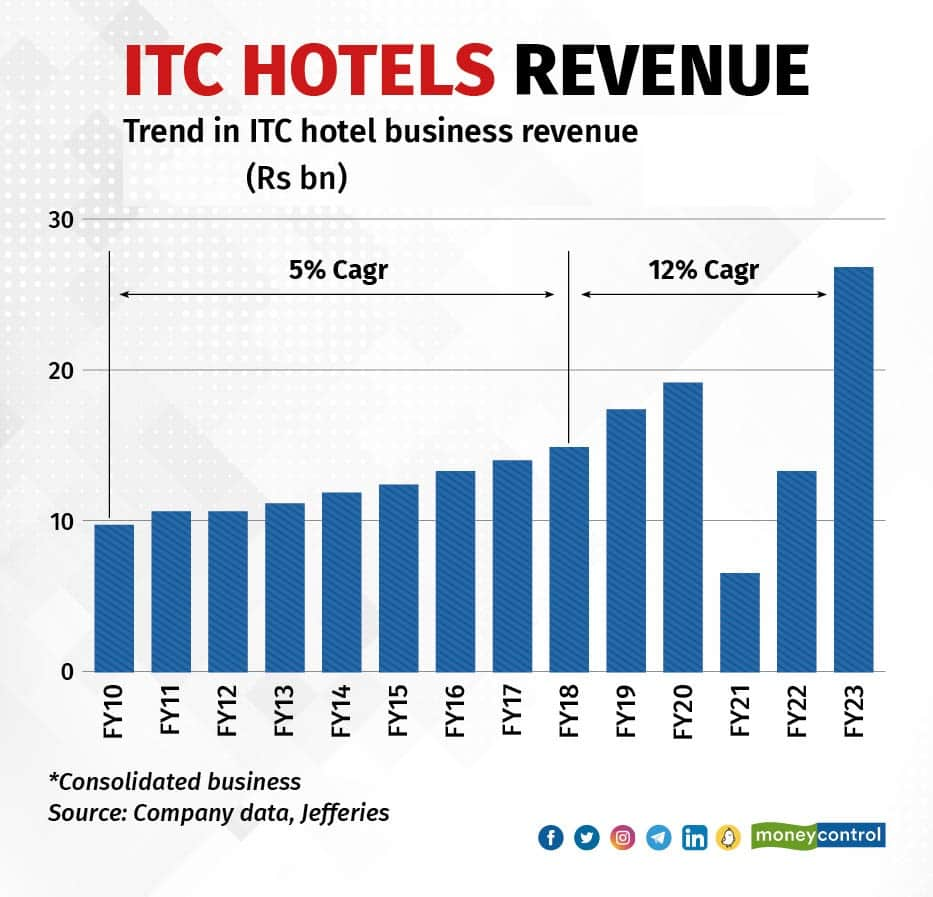

Over the past 10 years, the hotel business compounded revenue at 9 percent per annum. From a peak of 40 percent in FY07-08, EBIT margins went down to 4 percent in FY14-15, and the business ran into losses during Covid. Despite the poor returns, ITC has spent about 22 percent of its capex on this business.

But in the revenge travel that has followed over the past year, the business has bounced back briskly, with the EBIT margin at a decadal high of 21 percent. “High capex requirement has always been a bone of contention for investors. For example, over the last 5/10/15/20 years, the average annual free cash flow has been in the range of negative Rs 1.5-3 billion. RoCE has also been in single-digits for most years, well below the cost of capital,” noted Jeffries, a brokerage.

Although the company has made efforts to move towards an asset-light approach in line with the industry trend of large players moving towards management contracts, ITCs revenue continues to be skewed towards owned hotels, although over half of the room inventory is through management contracts. Under a management contract, a brand enters into an agreement with the owner of the real estate to operate the hotel based on mutually acceptable commercial and other terms.

Set up in 1975, ITC Hotels is currently the second largest hotel chain in the country with an inventory of more than 11,500 rooms across 120+ hotels in more than 70 locations. The portfolio straddles the luxury, premium, and mid-market segments. The premium and luxury segments account for approximately 60 percent of rooms and lion's share of the revenues and profits.

Outlook for ITC stock

Brokerages say that the demerger gives an option to shareholders to directly own shares in the hotels business. However, it does not move the needle much for ITC. "This business was just 5 percent of the SOTP (sum of the parts) and had an ROCE of 9.7 percent," noted Prabhudas Lilladher.

The domestic broking firm has a target of Rs 455 on ITC stock, which includes Rs 23 for hotels. Jefferies has a target of Rs 530, of which only Rs 15 has been ascribed to hotels.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.