Hotels occupancy, which declined in the April-June quarter, is expected to pick up in the near term with G20 events, ICC ODI Cricket World Cup and an increase in foreign travellers driving the demand, brokerage firm Motilal Oswal said in a report on September 4.

It also expects increased occupancy with sustained momentum in average rate per room (ARR) growth to drive strong performance for hotels in FY24.

According to data from real estate consultancy firm Anarock, the occupancy rate was down 200 basis points (bps) year-on-year (YoY) at 63 percent in April, 200 bps down at 62 percent in May and 100 bps lower at 64 percent in June.

One basis point is one-hundredth of a percentage point.

Also read: JM Financial initiates coverage on hotel sector with a positive outlook

ARR, however, increased 23 percent YoY in April to Rs 7,200 and 16 percent and 15 percent in May and June.

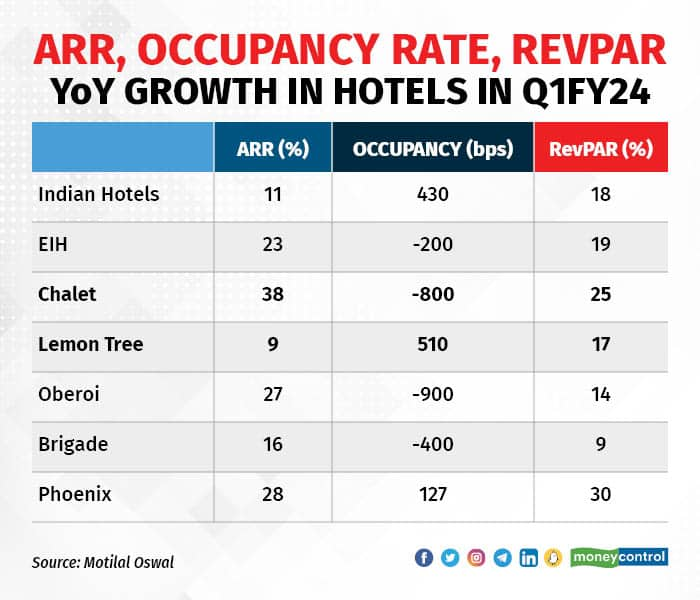

Growth in occupancy levels was the highest for Lemon Tree, while Chalet Hotels had the highest ARR growth in the April-to-June quarter. Revenue generated per room (RevPAR) growth was the highest for Phoenix Mills during the period.

Demand outpaced supply. The demand increased 8 percent in Q1 FY24 from the same period in FY20, a pre-Covid year, but supply grew only by 6.7 percent, Motilal Oswal analysts said.

The demand during the quarter was strong on the back of increased passenger traffic and foreign tourist arrivals.

In May, passenger traffic hit a record high at 13.2 million. Foreign tourist arrivals had a strong growth with YoY increase of 54 percent, 41 percent, and 24 percent in April, May, and June respectively.

Foreign tourist arrivals, however, are still below pre-COVID-19 levels but are expected to inch up from the current levels, the brokerage firm said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!