Housing Development Finance Corporation (HDFC) share price was up over a percent intraday on January 5 after individual loan disbursements rose 26 percent in the third quarter ending December 2020.

The stock was trading at Rs 2,623.10, up Rs 43.75, or 1.70 percent at 10:02 hours. It has touched a 52-week high of Rs 2,634.70. It has touched an intraday high of Rs 2,634.70 and an intraday low of Rs 2,571.75.

"The individual loan business continued to see improvements during the quarter ended December 31, 2020. Disbursement growth over the corresponding quarter of the previous year was 26 percent. Individual loans sold in the preceding 12 months amounted to Rs 16,956 crore," HDFC said in an exchange filing.

The corporation assigned loans to HDFC Bank amounting to Rs 7,076 crore compared to Rs 4,258 crore in the corresponding quarter of the previous year. Individual loans sold in the preceding 12 months amounted to Rs 16,956 crore as against Rs 21,066 crore in the previous year.

Gross income from dividend in third quarter December 2020 was Rs 2 crore compared with Rs 4 crore in the same period last year.

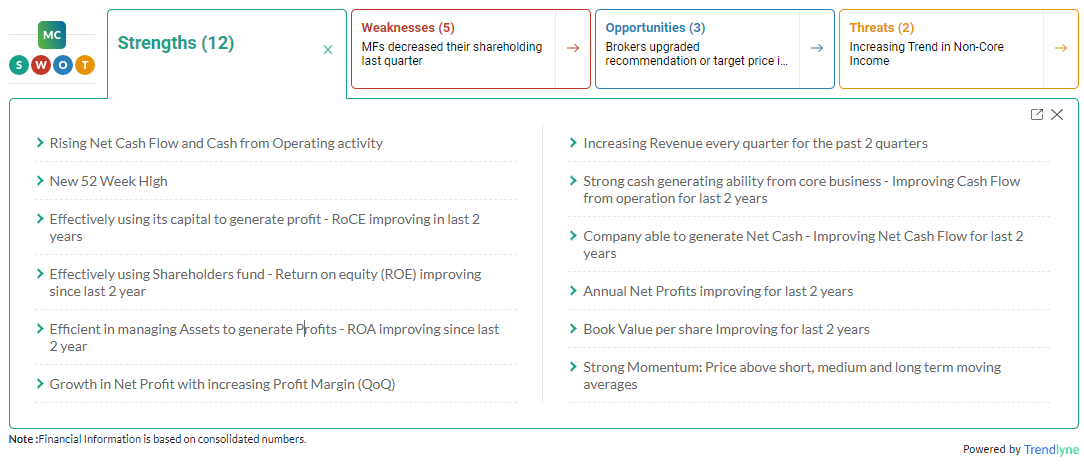

According to Moneycontrol SWOT Analysis powered by Trendlyne, the stock is showing strong momentum: Price above short, medium and long term moving averages. The company has been effectively using its capital to generate profit - RoCE improving in last 2 years.

Moneycontrol technical rating is very bullish with moving averages and technical indicators being bullish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.