Foreign research firms remained mixed on Infosys’ March quarter performance. While some cited margin guidance issues, others expect the IT major to catch up with peer growth rates.

Brokerages such as Jefferies have hiked their target to Rs 1,340 per share from Rs 1,000 per share earlier, an upside of 34 percent, citing favourable risk reward. However, Citi has maintained its neutral stance on the stock, reducing its target price to Rs 1,195 per share.

Post market hours on Friday, Infosys, India’s second largest information technology company, reported a 28 percent sequential fall in Q4 FY18 net profit to Rs 3,690 crore, in line with analysts' expectations.

The sequential drop in fourth quarter profit was because Q3 included the positive impact of $225 million due to conclusion of an advance pricing agreement (APA) with the US Internal Revenue Service.

The management guided for a 6-8 percent growth in its full year constant currency revenue and 7-9 percent growth in dollar revenue, which was in line with analyst estimates.

However, it revised its EBIT margin guidance downwards to 22-24 percent from 23-25 percent. This will include impact from the revised compensation for FY19.

Infosys announced it has entered into a definitive agreement to acquire WongDoody Holding Company, a US-based digital creative and consumer insights agency, for a consideration of $75 million.

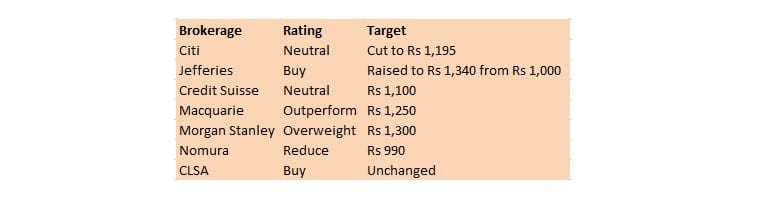

Here’s what global brokerages are saying about the stock and the firm’s Q4 earnings:

Brokerage: CLSA | Rating: Buy | Target: Unchanged

The global research firm said the Q4 revenue was in line, but margins were ahead of its estimates. Its FY19 dollar revenue guidance is strong at 7.9 percent year-on-year. It said a 100 basis points cut to FY19 margin guidance implies investments of 140 bps, which allows the company to re-accelerate by refocusing strategy and gaining market share. Going forward, it expects the company to catch up with peer growth rates.

Brokerage: Citi | Rating: Neutral | Target: Cut to Rs 1,195

Citi sees Infosys' EBIT margin guidance of 22-24% as a negative surprise. It has revised downwards its EBIT estimates for FY19/20 by 2 percent.

Brokerage: Jefferies | Rating: Buy | Target: Raised to Rs 1,340 from Rs 1,000

The global research firm believes the risk-reward is favourable. It sees growth accelerate over FY19-21. The stock, it said, is trading at a reasonable valuation.

Brokerage: Credit Suisse | Rating: Neutral | Target: Rs 1,100

The Swiss global research firm said Infosys Q4 revenue growth at 0.6% was below its estimate of 1%. In fact, Q4 margin was higher than its expectation by 20 bps. However, it believes the company's margin guidance was disappointing.

Brokerage: Macquarie | Rating: Outperform | Target: Rs 1,250

Macquarie said the lower-end of margin guidance will help growth in the medium-term. It has raised its target multiple due to capital allocation and revenue outlook. The company is one of its top picks in the IT space.

Brokerage: Morgan Stanley | Rating: Overweight | Target: Rs 1,300

The US investment bank said the negative margin outlook can be partially offset by capital allocation. It expects the stock to pare some gains.

Brokerage: Nomura | Rating: Reduce | Target: Rs 990

Nomura said the cash return of over $2 billion could cushion a fall, but expects the stock to react negatively on account of the cut in its margin guidance.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.