It is time to be stock specific, maybe that’s the approach mutual fund managers are taking right now at a time when the market trades near record highs. The Nifty50 which has come off slightly from its record high but has gained over 17 percent so far in the year 2017.

Fund managers remained selective when they shopped for stocks in the month of May. They remained net buyers in 65 percent of the Nifty50 stocks, Motilal Oswal said in a report.

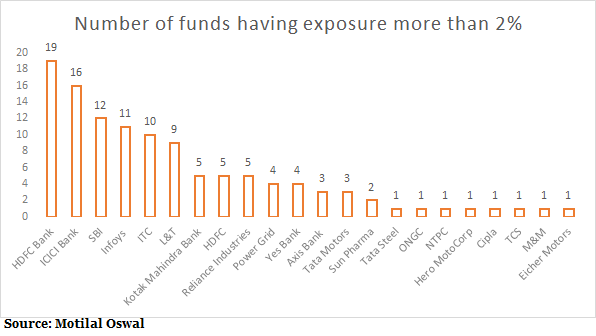

Stocks in which funds have more than 2 percent stake include names like Kotak Mahindra Bank, HDFC, Sun Pharma, Tata Steel, Power Grid, Infosys, TCS, L&T, State Bank of India, ITC, M&M, ICICI Bank, Eicher Motors etc. among others.

Among the Nifty50 names, highest net buying in the month of May on a month-on-month (MoM) basis was witnessed in Vedanta (up 27 percent), Kotak Mahindra Bank (up 17 percent) and Tech Mahindra (up 17 percent).

The Equity asset under management (AUM) rose for the sixth consecutive month in May to scale a new high of Rs 5.2 trillion, highlighted the report.

In the month of May, MFs showed interest in private banks, metals, consumer, technology, auto and infrastructure — these sectors saw a MoM increase in weights.

Among the Nifty50 names, top conviction buys include names like HDFC Bank where almost 19 funds have more than 2 percent exposure, followed by ICICI Bank with 16 funds having an exposure of 2 percent and 12 funds have exposure to State Bank of India.

Almost 5 funds have exposure in both Kotak Mahindra Bank and HDFC while 4 funds have exposure in Yes Bank and 3 funds have holdings in Axis Bank.

Rate sensitive stocks have been fund managers’ darling in the last few months especially private sector banks. Private Banks sectoral weight rose 17.3 percent which as the top sector holding in May, followed by Auto (10.7 percent), Capital Goods (8.7 percent) and NBFC (7 percent).

“Since banks are a play on the economy, they can sustain earnings growth for a long time. Particularly, ICICI Bank is attractively valued while HDFC and Kotak are high-quality stocks that have a track record of delivering superior returns,” Dr VK Vijayakumar, Chief Investment Strategist, Geojit Financial Services told Moneycontrol.

Among the IT or technology sector names Infosys remained in the spotlight. Despite global headwinds which have contracted margin for some of the top IT companies, almost 11 funds have holdings of more than 2 percent in Infosys while for TCS it is just 1 fund.

Mutual funds are betting on stocks which have good earnings visibility are stocks from sectors like IT and pharma which are facing some headwinds are valued very low.

Some quality names in both these segments are available at attractive valuations which are attracting smart money into these stocks.

“Clarity from Managements of IT majors on underperformance has helped to rope in some Bargain Hunters into the sector,” Rajesh Shanbhag, Advisory Head – Alternate Channels, Way2Wealth Brokers Pvt. Ltd told Moneycontrol.

“However, Indian Prime Minister’s meet with US President which is scheduled for this month-end will be closely watched where the H1 B VISA issue is to be addressed,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.