Once an iconic name, Tamil Nadu-based central public sector undertaking Hindustan Photo Films Manufacturing Company Ltd. (HPF) has been put on the auction block.

The official liquidator has now invited bids for sale of HPF as a “going concern” with a “disputed leasehold land to an extent of 291 acres”.

According to a public notice issued by the liquidator, the e-auction of HPF has been fixed for October 12, 2023.

A memo circulated by the official liquidator, Mahalingam Suresh Kumar, states that HPF is being auctioned “as a going concern, which includes all identifiable assets (excluding all cash and cash equivalent assets which will be distributed to the stakeholders) only”.

All liabilities are excluded from the sale and will be settled by the liquidator in the order of priority as defined under Section 53 of the IBC, from the realisation of the sale proceeds. HPF is now deep in the red.

The PSU was incorporated in November 1960, in the backward Nilgiris district in Tamil Nadu to make the country self-reliant in the field of photosensitised products. Its main plant is located at Udhagamandalam. The company’s photographic films were sold under the name ‘Indu’.

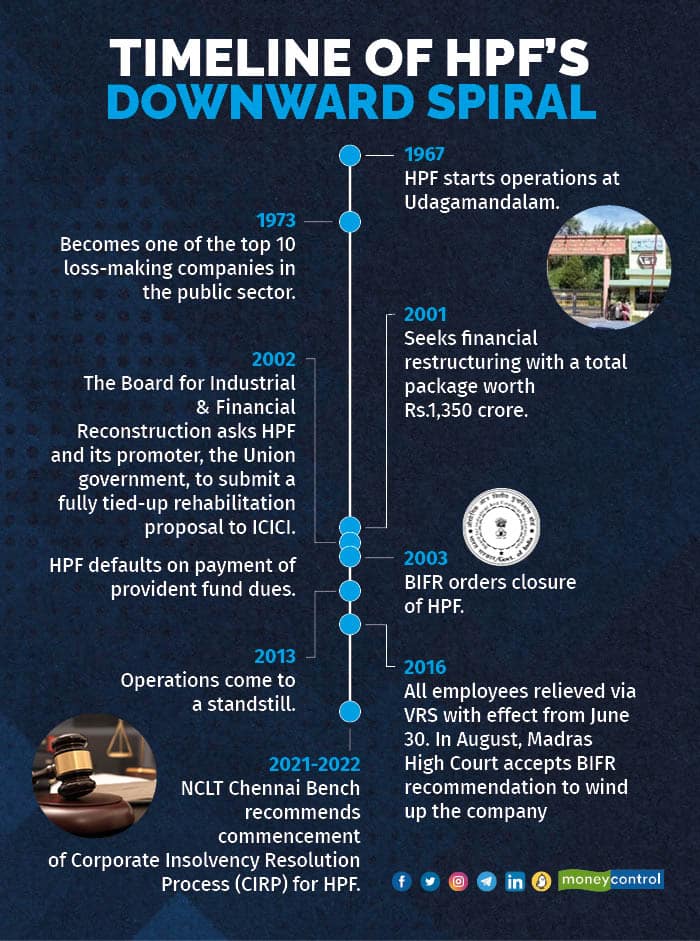

The company’s operations have been at a standstill since June 2013. A combination of factors, from obsolete technology to weak marketing and high input costs, pushed HPF to the brink. The digital revolution proved the last nail in its coffin.

HPF was declared sick by the BIFR in January 1996. This was contested by the company before the Madras High Court, and it managed to get a stay on implementation of the BIFR order. In the meanwhile, the Cabinet Committee on Economic Affairs (CCEA) recommended Rs 181.54 crore towards implementation of a voluntary retirement scheme (VRS) at 2007 notional pay-scales for all employees. It also recommended the closure of the company. The VRS was implemented from January 2015. As of 31st March 2017, 466 employees were relieved under the VRS.

Consequent to the CCEA decision to close the company, the writ petition filed by the company against the implementation of the BIFR order to wind up the company was withdrawn. The Madras High Court also dismissed petitions filed by the trade unions against implementation of the BIFR winding up order.

The Madras High Court did advise the official liquidator to take charge of the assets and make necessary disbursements. In the meantime, Canara Bank, as trustees to the debentures issued by HPF on behalf of the secured creditors, moved the Madras High Court seeking to transfer the case to the National Company Law Tribunal (NCLT), Chennai Bench. The transfer went through in May 2020.

In January 2021, the Chennai bench of the NCLT recommended the commencement of the insolvency resolution process and appointed C Prabhakaran as Interim Resolution Professional (IRP). Further on the recommendation of a committee of creditors, the NCLT Chennai Bench appointed CA Mahalingam Suresh Kumar as the resolution professional.

Timeline of HPF’s downward spiral

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!