The Brightcom Group Ltd (BGL) is in the news for all the wrong reasons. The battle between the fans of the company on social media and the critics is all very entertaining, but no matter how defensive the fans get, the fact of the matter is that the company has lost close to 90 percent of investors' wealth in a matter of 16 months.

While the rise and fall of the stock has been dramatic, it’s in the news also due to the Securities and Exchange Board of India (SEBI) order, which pointed to many irregularities in the company’s financial statements for the period of investigation.

Too late?

While the SEBI investigation output was available to investors only on 13 April 2023, by which time the price had already eroded by around 85 percent from the peak, irregularities were there to be observed much before the dramatic rise and subsequent fall of BGL’s share price.

During this period, investors put their faith and hope in the auditors to save them from such irregularities but apparently, they were so nuanced that even the folks at two separate audit firms were completely caught off-guard.

But was it so difficult? Were there no signals? No proverbial clouds before the storm? Couldn’t a diligent investor have seen something amiss by doing some common-sense financial analysis rather than blindly putting the fate of his wealth in the hands of auditors and the system?

This is what we attempt to show in this article. We take the same investigative period as SEBI and run you through some danger signs that were visible in the financial statements. And in the process, we also give you a sneak peek at a few of the points (relevant to this case) from our checklist that can help investors avoid such landmines.

But remember one thing. We are simply going to explain how an investor could have asked relevant questions. It’s not an implication of any wrongdoing. But one thing which will become very clear is that the company’s disclosures are certainly not getting it any awards.

A detailed questionnaire sent to the company by Moneycontrol on the points noted in this article did not elicit any response.

Subsidiaries dominate

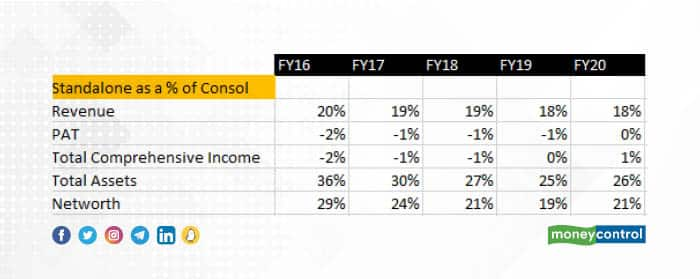

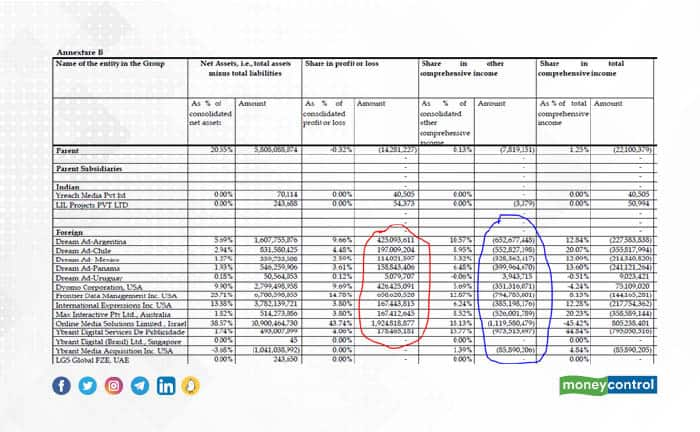

BGL is an export-oriented company and has many subsidiaries. In fact, subsidiaries are a major portion of its business as we can see from the numbers below. Almost the entire profit and total comprehensive income come from subsidiaries, and so do a majority of assets and net worth. And this has been the case for many years.

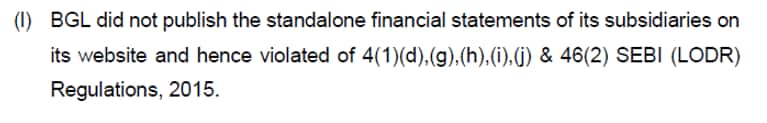

Now, whether the law asks or not (which in this case, it does), for a company like this (with critical subsidiaries), giving detailed financials for subsidiaries is just the right thing to do. SEBI, of course, cares for the law, and rightly so, and noticed the same in its order also.

In fact, even until the last financial year (FY22), the financial statements of subsidiaries were not available on its website. Thankfully, in FY22, it was generous enough to give the statements of four of its 16 subsidiaries on its website. They do, of course, give some reason for not giving the remaining ones.

But then, the financials of even these four subsidiaries are not available for you to see. The moment you download the PDFs and read them, all the relevant pages (the actual financial statements !!!) get locked.

So much for disclosure!!!

In auditor, we trust

Well, the company may not have disclosed the subsidiary details for investors to see, but thank God, we have auditors. Surely, they studied the financial statements of the subsidiaries before signing at the bottom of the financial statements.

Oh, but wait. The auditors are saying they HAVEN’T done that. Let’s see the auditor’s report.

As mentioned above, the auditors of the company have NOT audited 14 out of 16 subsidiaries. How much is that in percentage terms?

That’s 94 percent of the total consolidated assets, 82 percent of the total consolidated revenue, and over 100 percent of the total reported profit.

Digest that. The entire profit is not audited by the statutory auditor of the company.

And interestingly, the company has been converting the financial statements into local currency and giving it to the auditors to sign off. Working hard at things they shouldn’t, huh!!!

Checkpoint 1

That brings us to the first checkpoint. Some points from our checklist that helped, and you can add to your checklist.

a. Standalone as a percentage of consolidated statements (at the levels of revenue, profit, assets and networth)

b. Percentage of the key financials (revenue, profit, assets) not audited by the statutory auditor.

c. ‘Independent auditor report’ reading in its entirety without fail.

For us, even this much was enough to not pursue the company from an investment perspective, at least not until we get the missing information, but for the sake of learning, let’s move forward.

Honey, who shrunk the profits?

Moving away from what was not provided, let’s now go to the financial statements that were provided. Remember, this is all prior to the meteoric rise and tragic fall of the stock price.

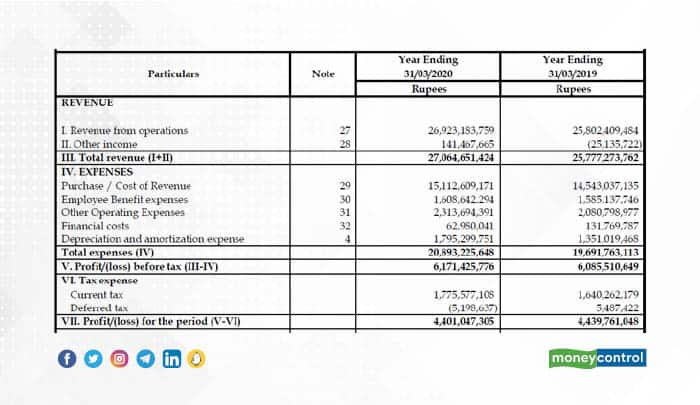

If we look at the profit and loss (P&L) account of FY20, the company has shown a healthy profit of Rs 440 crore for the year, and Rs 443 crore for FY19. That’s a total profit of around Rs 883 crore for two years.

But wait, what happened here below the profit line.

The total comprehensive income is minus Rs 177.2 crore for FY20 and Rs 178.5 crore for FY19, and hence, the actual profit available for the shareholders is nowhere close to Rs 883 crore ― it is just Rs 1.3 crore.

Well, to be fair it can happen, but it’s important to see why. And the reason they have given is, “asset impaired”. That’s a lot of impairment. We will come to that in a bit.

Letter of the law?

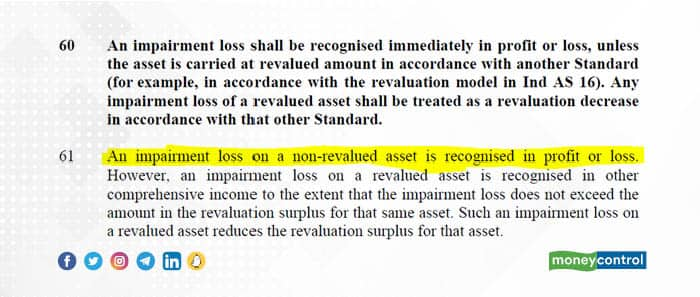

First, why would a company show the asset impairment in other comprehensive income and not in expenses above the profit line? Is this a fair display of the line item? What does the accounting standard say about this?

There is nothing in the annual reports of past or current years about the revaluation. Also, since this impairment is at the subsidiary level (nothing in the standalone statement) and we don’t have subsidiary financials available, it’s difficult to know what exactly has been impaired.

Surely, the company would have given some explanation in the annual report about these Rs 800-odd crore worth of assets. After all, it’s not a small amount ― it’s close to 25 percent of the starting assets of FY19 when this impairment happened for the first time. So, what are these assets?

Sadly, we don’t know. No explanation has been provided anywhere in the annual report. For any investor, this is worrisome, and it warrants answers from the management. But that’s not all, there is more.

More confusion at the subsidiary level

This problem of the profit shown at the profit after tax (PAT) level but then a loss at the total comprehensive level is not in the main consolidated statement alone. Nor does it pertain to just one or two problematic subsidiaries. It seems to be a consistent practice across most subsidiaries. We don’t have all the details but the basic summary of the financials of the subsidiaries given in the annual report shows this problem. So, what happened? Asset impairment at most subsidiaries in just two years? What kind of assets are these?

Sounds weird. Doesn’t it? Well, this brings us to our checkpoint 2. What part of our checklist catches stuff like this?

Checkpoint 2

We compute a ratio called the ‘reserve ratio’. It tracks whether the reserves are changing in line with the profits. Ideally, this number should be close to 100 percent and have very little volatility over the years. In Brightcom, however, that’s not the case.

A subsidiary in troubleWhile we are on the subject of ‘impairments’, it’s interesting to note one additional issue. Despite extensive losses in the subsidiary companies, their carrying value in the standalone financials has not been marked downwards. Take a look at a subsidiary called Ybrant Media Acquisition.

As seen above, it has a negative networth but the carrying value of this investment in standalone financials has not been adjusted downward.

Given that IND AS prescribes otherwise, this can be considered as an aggressive treatment of the assets on the standalone balance sheet. But let’s move forward. There are more serious issues than this one.

A common theme observed so far in all the discussed points is a constant lack of good-quality disclosures that empowers investors to make informed decisions. The trend continues when one goes further into the analysis of financial statements.

Too much ‘others’

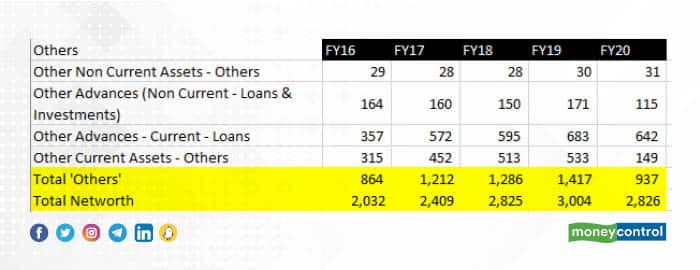

‘Others’ is a funny line item in financial statements. It’s provided as a convenience box. Think of it as a small cabinet where you keep all those things which you otherwise cannot categorise in their own separate space.

For companies, it is provided to combine those assets/expenses/revenue, etc. that are otherwise too small and too many to create separate heads for. And hence, it is meant to be a small balancing number wherever it exists.

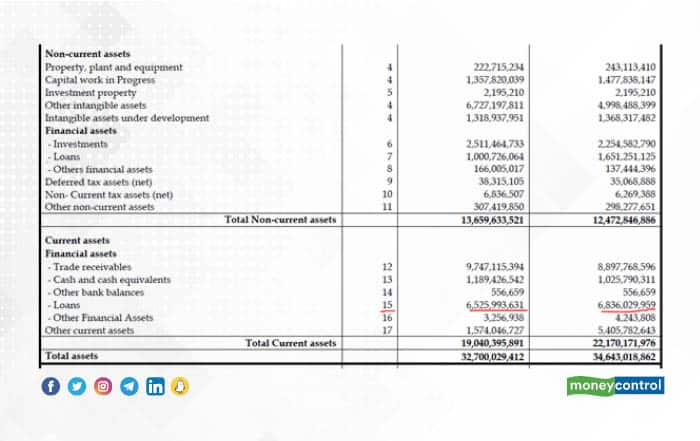

But see what you find when you look at Brightcom Financials. What you see below is the snapshot of the consolidated balance sheet of FY20.

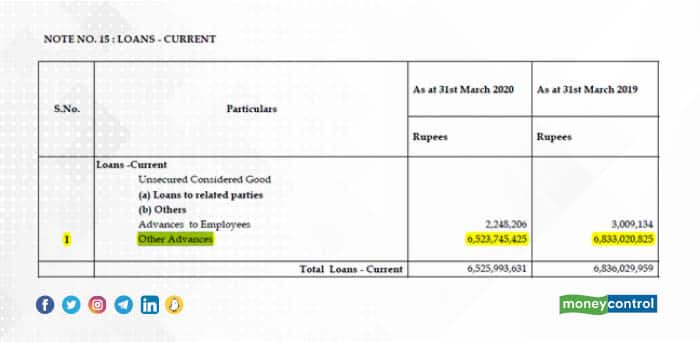

As can be seen above, the loans (or advances) in FY20 are Rs 652 crore, which is approximately 20 percent of the total assets and 23 percent of the company’s networth. Not a small number by any stretch of imagination. So, obviously, you would want to know who the beneficiary of this high amount is, and ideally, it should be available in the ‘notes to accounts’, but when you look, here is what you see:

That’s it. It’s mentioned as ‘other’ advances. And then no mention of it in the annual report. Don’t know about others, but we can’t blame an investor if he/she is concerned and has no idea about close to a quarter of the firm’s networth he/she is investing in.

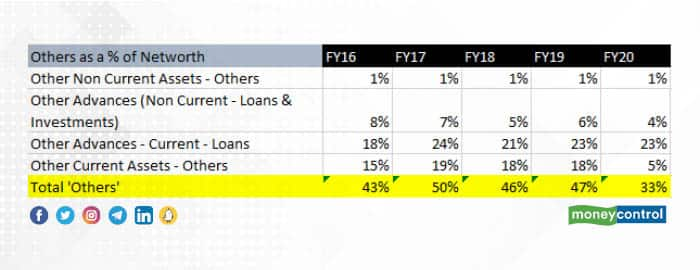

In fact, we looked at more ‘other’ heads too. If we just combine the assets that are given under the ‘other’ head, it comes to an extremely high percentage of the networth.

Now ask yourself, if you don’t know about assets constituting 30-50 percent of the networth of a company, how can you make sense of such a business?

That’s not all though.

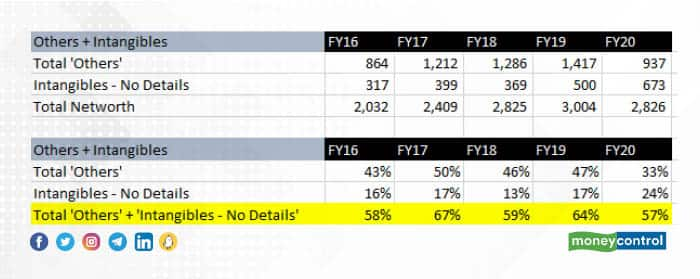

To make matters even worse for investors, the details of yet another critical asset are entirely missing. It’s the intangible assets (other than goodwill and intangibles under development). The company, as of FY20, had Rs 672 crore of intangible assets. Again, not a small number, and one which certainly needs some explanation, but it’s not there.

So, if we consider intangibles also alongside ‘others’, we have very little understanding of roughly 60 percent of the company’s networth. Difficult to put it in the ‘investment grade’ category for us at least. What about you?

Time for another checkpoint.

Checkpoint 3

Always look for unexplained assets or liabilities, unexplained income or expenses, especially the number hidden in “others”. It’s not a good sign if “others as a percentage of the main head” is a large number. It clearly is a disclosure issue that gets a very high weightage in our red-flagging.

Rich cash flow, then why default?

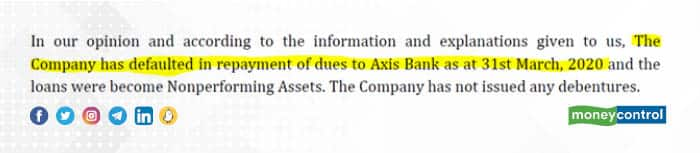

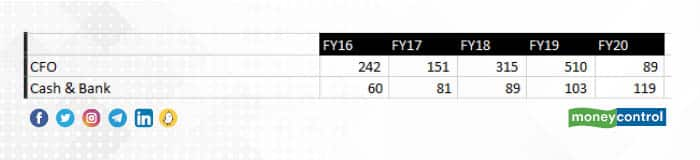

If you aren’t already wary enough, here is another point that raises a red flag, and that is related to defaults on loans. Here is what the auditors noted in the Auditor’s Report (another reason why this segment of the annual report is a must-read (Check Point 1))

The company has a decent cash flow from operations (at least, what they have declared) and some cash in the bank too. Then why default?

Breadcrumbs here and there

Since we wanted to stick to the main issues raised by SEBI in its order and its predictability beforehand, we are not going into more detail about other items that we found uncomfortable. For example, the company has not been regular in depositing its tax dues.

There are also other discrepancies we found in the cash flow statements. But the objective of this piece was only to show how investors could have avoided the Brightcom disaster by simply running some basic checks on the financial statements. Clearly, the company’s books had several warning signs to make investors wary.

(Nitin Mangal is an independent analyst and forensic accounting expert. Puneet Khurana is chief investment officer at Stoic Investment Managers.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.