The Street is ascribing a premium valuation to Jio Financial Services (JFS), lower than that of Bajaj Finance but largely in line with other non-banking financial companies (NBFCs) and fintechs. Given the boom in the financial services industry coupled with the backing of India’s largest conglomerate, the JFS share is already pricing in great growth plans for the future, believe analysts.

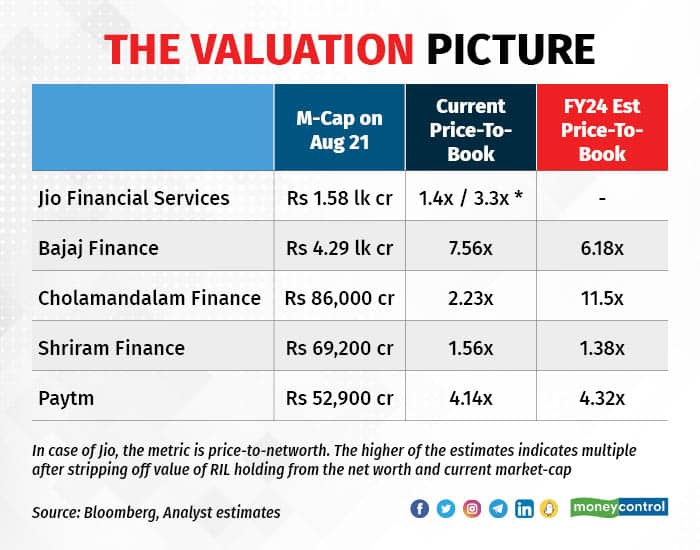

With a market capitalisation of Rs 1.58 lakh crore at the end of day 1, JFS' valuation works out to be about 1.4 times the net worth. Excluding the value of its stake in parent Reliance Industries Ltd (RIL), it is about 3.3 times. D-Street analysts are using both methods.

As per the information memorandum, JFS had a consolidated net worth of Rs 1.14 lakh crore at the end of FY23. This includes a 6.1 percent stake in RIL, which is the result of transfer of treasury shares from the parent. Excluding the cost of that stake, JFS' core net worth may be about Rs 19,300 crore.

“With plenty of avenues for organic growth as well as probable opportunities of inorganic growth available in the financial domain, we expect Jio’s premium valuations to hold for a while,” said Jignesh Shial, director, research, at InCred Capital.

On a trailing basis, the price-to-book value for Bajaj Finance stands at 7.56 times, Cholamandalam Finance at 2.23 and Paytm at 4.14. While Bajaj Finance has an established book and a year-long track record, Chola Finance is aggressively diversifying its book from vehicle financing to other avenues such as loans to small and medium enterprises apart from secured business and personal loans. JFS' valuation is less than that of Paytm, which posted an operating profit for the third straight quarter in Q1 FY24.

Growth plans

While JFS is yet to announce its foray into the lending business, it is expected to focus on merchant and customer lending thanks to its parent's wide reach and connect to kirana or neighbourhood stores. As of June-end, RIL had a total store count of 18,446 and 26.7 crore registered customers.

“In consumer lending, the company will begin with financing consumer durables and devices sold in retail stores. In the medium term, it will have both unsecured and secured products,” said analysts at Morgan Stanley.

Also Read: Jio Financial Services has its feet on the ground and eyes on the stars

On the other hand, the merchant lending business will provide trade credit, personal loans, store improvement loans and unsecured business loans, they added. Both verticals are expected to adopt a digital-first, tech-led business model.

Furthermore, Jio already has a broking business in place with over 17 insurance partners and foreign broking firm CLSA believes this can be scaled up faster. While life insurance penetration in India is in line with world average, non-life insurance penetration is significantly behind the world average. This presents a great opportunity for JFS.

“It will be interesting to see the impact Jio can make on pricing in the industry while we believe covering more lives could be a key focus area for Jio… We believe Jio’s entry point could be corporate-relationship-driven segments such as group health and commercial insurance,” said analysts at CLSA.

On the asset management side, JFS has already announced its tie-up with Blackrock, the world’s largest asset manager, to float a mutual fund company. Together, the partnership will introduce a new player to the India market targeting an initial investment of $300 million.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.