Shares of Tata group companies have shed more than Rs 7 lakh crore in market value over the past year, a 21 percent decline that has lagged the benchmark indices, in a period marked by the passing of its longtime patriarch, Ratan Tata.

While this period coincided with the death of Ratan Tata on 9 October 2024 at the age of 86, experts said that the group stocks' market slide is unrelated to his absence.

The period has been shaped by global macroeconomic turbulence, soft demand, and individual company challenges across multiple sectors. The decline in the market value of Tata group companies is in line with broader market trends. While benchmark indices Sensex and Nifty gained 0.8 percent, BSE MidCap and SmallCap indices fell 4.7 percent and 5.5 percent, respectively.

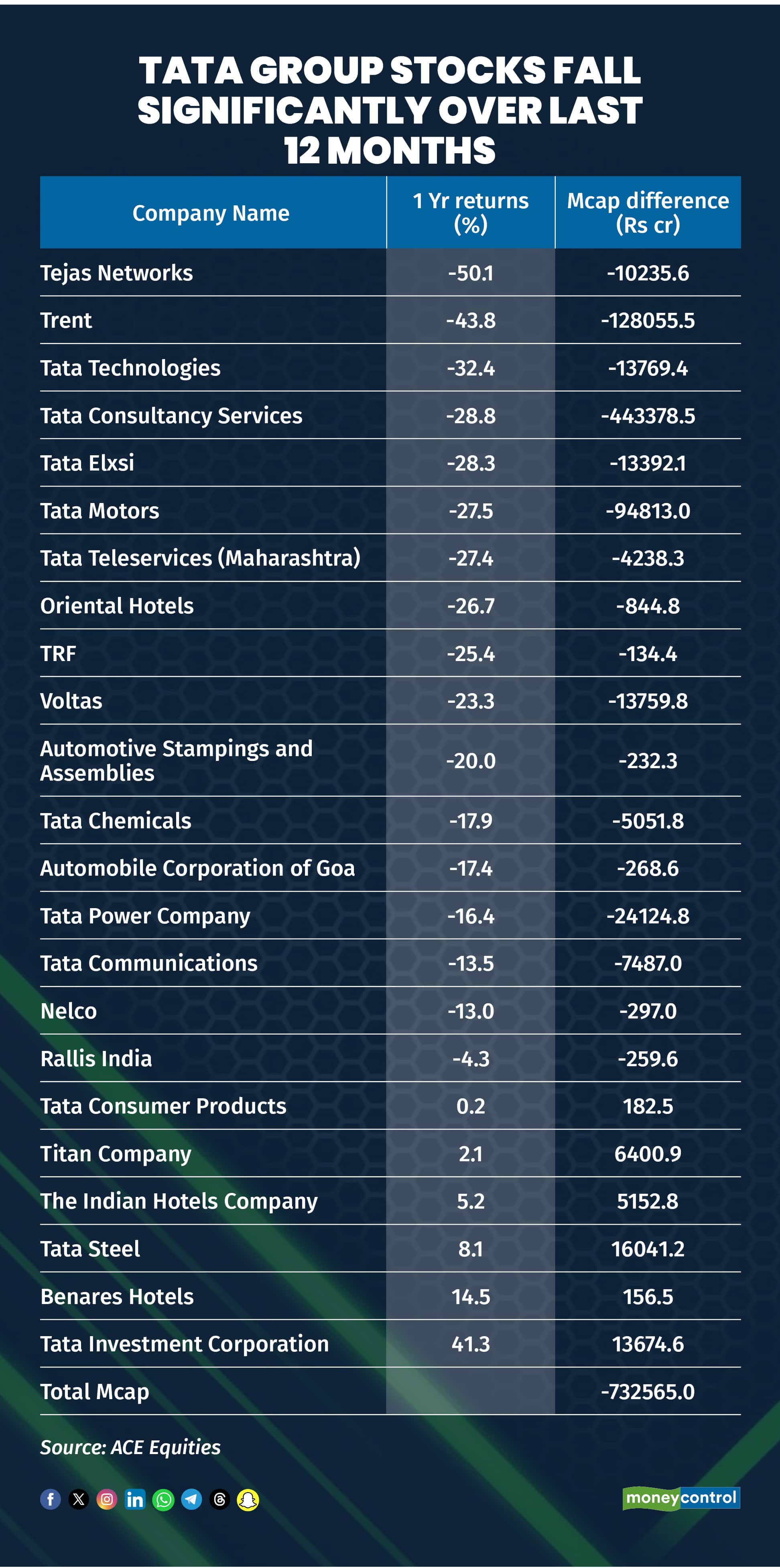

The combined market capitalisation of the group’s 23 listed firms fell to Rs 26.39 lakh crore from Rs 33.57 lakh crore a year ago.

The steepest declines came from Tejas Networks, down more than 50 percent, followed by Trent, which dropped 44 percent, and Tata Technologies, off 33 percent. TCS fell 29 percent, while Tata Elxsi and Tata Motors each slipped 28 percent. Oriental Hotels and TRF fell 24 percent, Voltas and Tata Chemicals declined 23 percent and 18 percent respectively, and Tata Power slipped 16 percent. Tata Communications and Nelco each lost 13 percent.

A few group stocks bucked the trend. Tata Consumer Products rose 0.2 percent, Titan Co gained 2 percent, Indian Hotels 5 percent, and Tata Steel 8 percent. Tata Investment Corp stood out with a 40 percent increase, while Benares Hotels gained 14 percent.

Experts note that the performance of each stock reflects unique company-level factors. TCS, for instance, has been weighed down by a slowdown across the IT sector, compounded by headwinds from US trade developments. Earnings growth for large-cap IT companies is now projected at just 3-4 percent for FY26, prompting a significant correction after years of robust post-Covid growth.

Tata Technologies, another IT-related entity, initially saw strong gains post-listing but later corrected along with sector peers. Recent commentary suggests earnings growth is likely to recover, offering some optimism for the stock.

Tata Motors, meanwhile, faced challenges in its JLR business due to prolonged trade negotiations between the US and Europe, which restricted vehicle imports, and a recent cyberattack at the UK plant. Given that JLR contributes around 80 percent to Tata Motors’ top and bottom lines, these disruptions have sharply affected the stock.

On the consumption front, Tata Consumer Products has seen margin pressures, particularly in its tea business, amid rising input costs. Nevertheless, the company has delivered a reasonable return relative to the broader FMCG sector, which has remained largely flat over the past year.

Tata Steel has fared better, benefiting from a 10 percent safeguard duty imposed by the government, which boosted realisations in the June quarter and is expected to continue in the September quarter.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.