Barely a few days after online food delivery firm Zomato announced plans to launch buy now pay later (BNPL) services for customers, rival Swiggy has plunged into the water and is evaluating offering the postpaid service where customers can eat first and pay later.

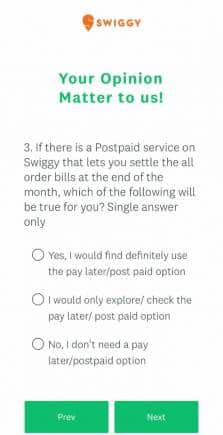

In a notification sent to select customers, Swiggy has asked them if they would like to order food and then settle bills towards the end of the month.

Last week Zomato announced it was setting up a non-banking financial company (NBFC) with an aim to offer short term credit to the delivery partners and restaurants.

The NBFC will give the company easy access to target customers for its buy now or eat now and pay later offerings. According to sources, while the NBFC is a work in process, Zomato will tie up with other NBFCs to offer the BNPL service to consumers for the time being.

BNPL has become a prominent mode of payment in the last few years especially among youngsters. Unlike other forms of lending, BNPL is a low-cost short term credit which does not require a credit score.

"This offering will help them with users who do not have or plan to use credit cards. Also, clearing up credit after 30-60 days makes it more convenient for the user,” said Mihir Gandi, Partner, Payments Transformation Practice at consultancy firm PwC.

He added that the underlying intent to launch this service at this juncture would be to enhance convenience and increase the average order value.

According to a recent report by PwC, the average transaction limit for BNPL ranges between Rs 1,500 and Rs 25,000 with a repayment cycle of 15-45 days.

On the other hand, on the food-tech segment the average order value in India falls between Rs 300 and Rs 400.

The NBFCs mostly try to make money by charging a merchant fee or extracting a late merchant fee from customers. As per the PwC report quoted above, the merchant fee currently is in the range of 2-5 percent of the total payment. The companies charge a nominal late fee from customers. It could be to the tune of 1-1.5 percent.

In the online commerce payments space, BNPL has captured 3 percent of the market share already. The number is expected to go up to 9 percent by 2024.

Swiggy had also launched Swiggy Money last year which did not gain much traction. “After UPI, the usage of wallets have drastically dropped. Even Swiggy Money did not see much traction as wallets are no longer that popular,” said Gandhi.

Swiggy declined to comment on the matter.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.