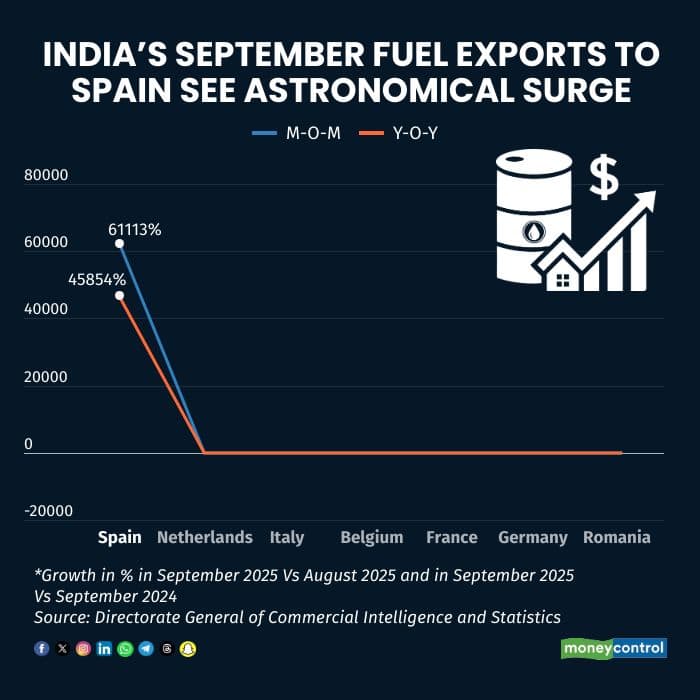

India’s exports of refined petroleum to Spain skyrocketed nearly 46,000 percent in September from the year-ago period, outpacing shipments to traditional European buyers like the Netherlands, which saw a 36 percent decline, a Moneycontrol analysis of the official data shows.

Exports of petroleum products to Spain soared from $1.1 million in September 2024 to $513.7 million this September. The month-on-month jump is even more staggering at over 61,000 percent.

These shipments were the primary reason for India’s exports to Spain surging 151 percent on-year in September.

Global Trade Research Initiative’s (GTRI) Ajay Srivastava attributed the surge to Indian refiners exploiting the rising demand in Iberia and southern Europe for mid-distillates and aviation fuel.

India’s competitive refining margins, favourable freight economics and the gradual re-orientation of European supply chains away from traditional suppliers also supported the explosive growth.

January deadline

The shift comes at a time when the EU is set to prohibit the import of refined petroleum products into the bloc from January, if they are derived from crude oil originating in Russia, even if processed in a third country.

Both the European Union and the United States have been tightening sanctions on Russia in response to the war in Ukraine.

Last month, the US Treasury blocked global transactions involving Russia’s two largest oil companies, Rosneft and Lukoil, accusing them of fueling Moscow’s war efforts. The European Union followed with a new set of energy sanctions, including a complete ban on imports of Russian liquefied natural gas (LNG) under long-term contracts starting January 2027."

A significant portion of India’s petroleum refining still relies on Russian crude, with Moscow supplying around 34 percent of India’s total oil requirements, up from just 0.2 percent before the Ukraine war began in 2022.

Why Spain?

“India’s refined-product shipments to the Netherlands have slackened because the country serves primarily as a distribution hub into Europe, and growing regulatory scrutiny and sanction risks, especially linked to diesel and fuels refined from Russian crude, is prompting a rerouting of flows and tighter compliance,” Srivastava told Moneycontrol.

The Netherlands and Spain together accounted for nearly all of India’s fuel exports to the bloc.

Petroleum products, therefore, emerged as Spain’s top import from India in September, followed by iron and steel and motor vehicles. This marked a dramatic shift from both the same month last year and August 2025, when petroleum products did not even rank among the top 50 imports to the European nation.

“This underscores a clear shift in India’s European fuel trade pattern, away from northern distribution hubs like the Netherlands and toward direct end-markets such as Spain,” Srivastava added.

India’s petroleum product exports to the European Union as a whole declined by 3.6 percent in September year-on-year, falling from $1,473.2 million to $1,420.1 million.

In September, India’s petroleum exports to the world rose 14.8 percent on-year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!