An uncertain global environment, soaring gold imports, and weakening oil prices have led to India reporting a record high merchandise trade deficit of $37.84 billion in November 2024, from $27.14 billion in the previous month.

The country’s services exports, however, continued to be a silver lining.

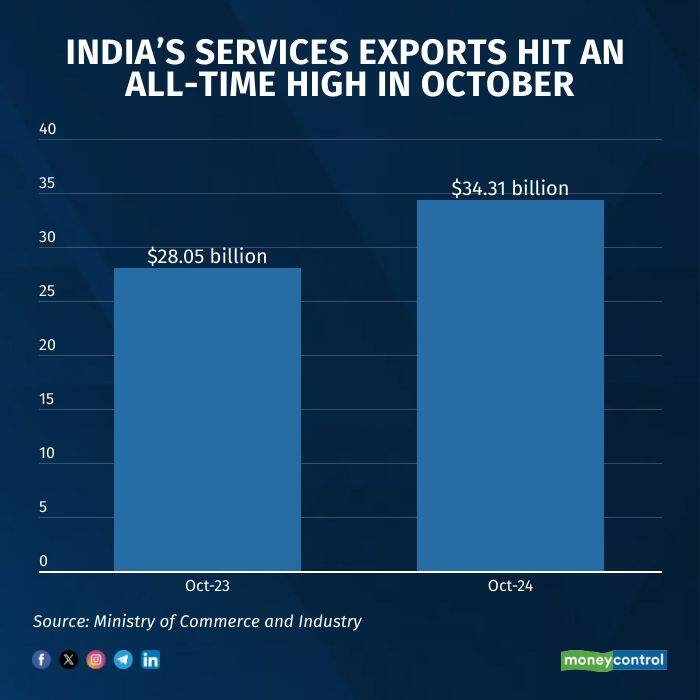

While services exports reached an all-time monthly high of $34.31 billion in October, it is expected to be larger, at $35.67 billion in November (in value terms), versus merchandise exports that came in at $32.11 billion.

Even as merchandise exports for November fell nearly 5 percent, overall outbound shipments, including services, rose almost 10 percent during that month.

Therefore, the country maintained a trade balance in services with a surplus at $18 billion, in contrast to the trade deficit on the merchandise side hitting a record high in November.

Given this, experts are of the view that the country should bet on its services exports to eclipse the misses on the merchandise side.

“The government needs to work out core policy for realising the growth potential of this sector,” Ajay Srivastava, founder, Global Trade Research Initiative (GTRI), said, citing that between 2018-2019 and 2023-2024, India’s merchandise exports grew at a compound annual growth rate (CAGR) of 5.8 percent, while services exports surged ahead at a CAGR of 10.5 percent.

So far in the current fiscal (April-November), India’s services surplus rose to $119.5 billion, a growth of 14.8 percent, compared to the same period last year.

The commerce ministry has already started working on measures to maximise the gains from the services side.

“We have identified six services sectors, including IT and IT-enabled services, where we can post better growth than what normally happens,” commerce secretary Sunil Barthwal said on December 16.

The growth in services exports has been crucial in keeping a lid on the country’s overall trade deficit.

The trade deficit for goods and services came in at $19.84 billion in November, just over half of the figure of the record-high merchandise trade gap.

“We continue to expect robust services exports growth in FY25, led by higher growth in non-software services. Software services growth may slow to mid-single digits,” according to Madhavi Arora, chief economist at Emkay Global Financial Services.

Arora is of the view that better-than-expected growth in net services exports will largely offset sharply higher imports on the merchandise side.

The rising trend in India’s services exports was attributed to the country’s promising IT sector, with mid-sized firms in the sector gaining market share. However, now a stupendous rise of global capability centres (GCCs) is making a significant contribution.

India is home to about 40 percent of the global GCCs.

Evidently, the rapidly growing services exports have been limiting the impact of global headwinds on India’s external finances as well.

The sharp slowdown in exports would typically raise concerns for India’s current account deficit (CAD), the broadest measure of trade in goods and services, but the services sector is keeping its external finances well-cushioned, despite global slowdown woes.

India’s CAD moderated to 0.7 percent of GDP during 2023-24 from 2 percent during the previous year, on the back of a lower merchandise trade deficit.

While this fiscal, it may see a rise, most expect the CAD to remain well under the 2-percent mark, thanks to the country’s robust services trade.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.