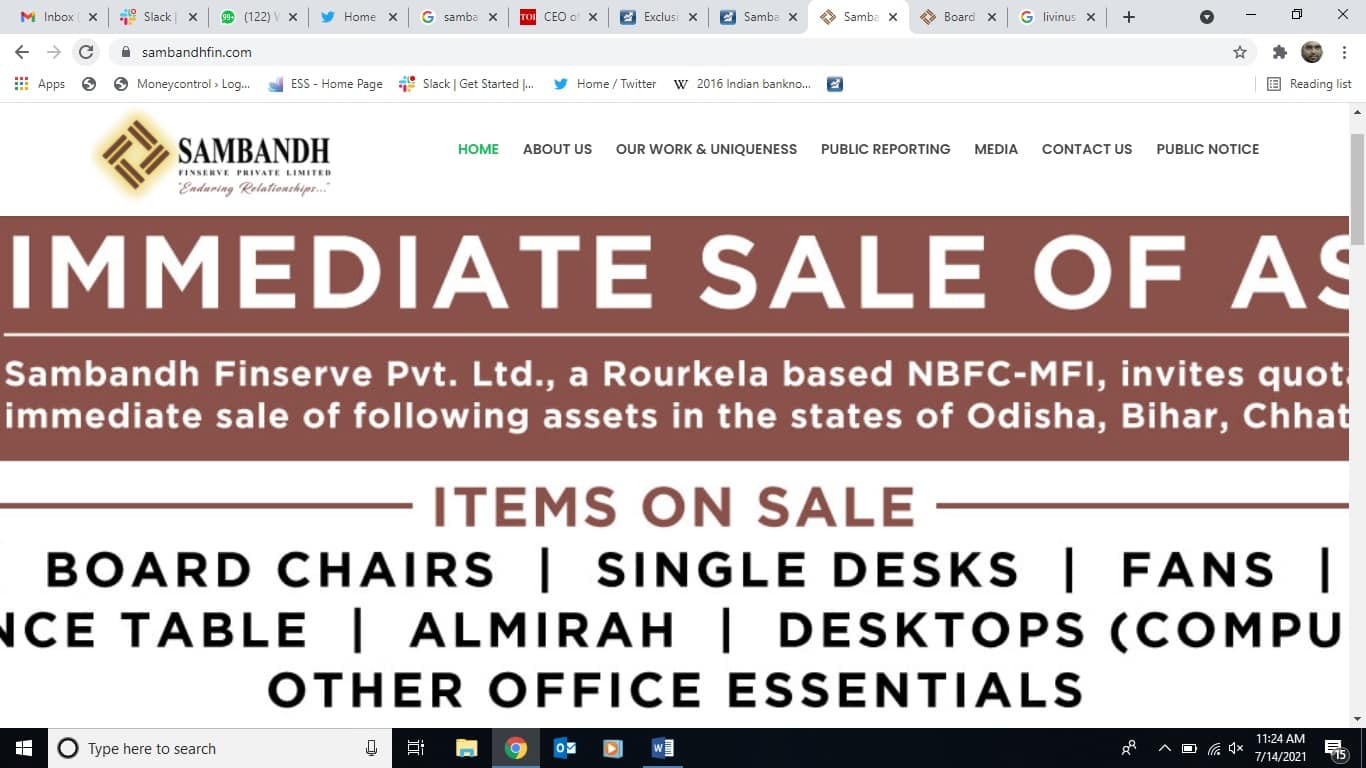

The first thing a visitor will notice on the website of Odisha-based Sambandh Microfinance is an advertisement that says its office furniture and other assets are on sale in the states of Odisha, Bihar, Chattisgarh.

The items put on sale include ‘board Chairs’, single desks, fans, almirah, desk tops and other ‘office essentials’.

The website also gives the name and contact number of one Bibhudata Das as a point of contact to buy these items. When Moneycontrol reached out to Das, the former employee said he worked till recently as ‘Deputy Manger’ in charge of infrastructure management of Sambandh and has sold almost entire office assets in branches except in Headquarters.

Why did Das resign? “There is some legal issue going on in the company and I want to look for some other job,” said Das before he hung up the call saying he has a meeting to attend.

A state of disarray

Nine months after the biggest scam in microfinance industry broke out, Sambandh Finserve is now just a shadow of what it was till October last year. Most of the 100 odd branches has closed down operations. At one point Sambandh was a well-known name in the microfinance sector.

At the end of March 2020, SFPL has total assets under management at Rs 461 crore and has a profit after tax of Rs 5.22 crore. It has gross NPAs of 0.67 percent and has total capital adequacy ratio of 21.5 percent. But, that was on paper. Later, it was found that around Rs 251 crore was fake portfolio.

During its good times, Sambandh had a stunning Board. Interestingly, the Board of Sambandh was once headed by Chairman Livinus Kindo, the father of Deepak Kindo (CEO) and a former IAS office. Other Board members included Dia Vikas Capital nominee director, Saurabh Baroi, BOPA PTE nominee director Niroshani Sawanawadu, SIDBI nominee director Girish Meher, independent directors Kuchibhatla Prasad and Vinod Jha.

Livinus Kindo passed away in April this year.

The company operated with 100 branches in 39 districts across Odisha, Chhattisgarh, Jharkhand, Bihar and Gujarat. In FY20, the company expanded its operations to Bihar and Gujarat through 34 new branches, and now has an active customer base of 2.28 lakh.

"Sambandh used to be a prominent name in the MFI space till last year. The company used to operate among the underprivileged. It is unfortunate that a firm operating for the poor was subjected to a fraud which is akin to a mini Satyam type scam,” said P Satish executive director of microfinance industry lobby, Sa-Dhan.

“The fraud was mainly related to the diversion of funds by the CEO for activities other than MFI business. The auditors should have noticed these happenings. The fact that did not do so raises questions on the thoroughness and quality of audit," Satish said.

SFPL started microfinance activities in 2006 as an exclusive project under Regional Rural Development Centre (RRDC), a state-level NGO in Odisha originally promoted by former IAS officer Livinus Kindo, the chairman of SFPL.

It was converted into an NBFC in 2009. In 2013, SFPL secured an NBFC-MFI licence from the Reserve Bank of India. Its head office is located at Rourkela in Odisha. SFPL offers microfinance loans under both joint liability and self-help group models.

How Kindo orchestrated the fraud

A letter written by the senior management personnel to the Board of Directors on 7 October shows that under the “express instructions and directions” of managing director and CEO Deepak Kindo, the management has been cooking the books from financial year 2015-2016.

Fake loan accounts aren’t new in the Indian banking industry. There have been several instances in the past when fake loan accounts or financial instruments have come up as a modus operandi in banking frauds. These include the Nirav Modi-Punjab National Bank fraud where fake Letters of Undertaking were issued to defraud the bank, the Yes Bank scam where many loan transactions were conducted in violation of rules, and the Punjab and Maharashtra Bank (PMC) scam in which 60 percent of the loan book was for a single entity, and so on.

According to a letter sent by a section of management to the company’s Board, the management was allegedly forced to create fake loan accounts for inflating the AUM figures under the direction of MD & CEO Deepak Kindo and the current credit head. The CFO and internal auditors flagged the issues to the Board, but perhaps a bit too late. The actual portfolio as assets under management (AUM) is approximately Rs 140 crore as against the reported figure of Rs 391 crore as on September 30, 2020. “The reported AUM is inflated and non-existent. The gap is approximately Rs 251 crore,” the letter said.

The letter is signed by James Raj, Chief Financial Officer of Sambandh, and three other officials including the internal audit head.

According to the letter, the gap in the portfolio was managed by fictitious disbursements, subsequent withdrawals and deposited as fictitious collections under the direction of the MD & CEO, saying “it would be managed soon...”

“This has been going on since the Financial Year 2015-16 and the gap has simultaneously gone up beyond control,” said the letter.

Further, the management information system (MIS) has been generated with fictitious clients with repayment schedules and shown as loan portfolio in the MIS system “under the direct supervision of MD & CEO,” the letter said.

The resultant demand and collections were generated as per the MIS reports. The actual portfolio was tracked separately and the MIS in total has the actual and fake portfolio under one system, the letter said.

The role and knowledge of auditors in this financial manipulation has come under scrutiny. According to the whistleblower letter, the internal audit of the company managed to check only the actual clients on the books and reports were prepared accordingly. Further, monitoring by stakeholders was managed with the actual clients and linked correspondingly with MIS and accounts.

The letter makes strong allegations about the role of CEO Kindo, including diversion of funds.

“There is also pilferage in the cash withdrawn for disbursement by the MD & CEO and diverted to other entities namely Diya Dairy & Agroprocessors Pvt Ltd, Kshamta Foundation, Regional Rural Development Centre, D K Enterprises, Utkal Dairy and other unknown persons or entities,” the letter says.

The CFO and other signatories of the letter have said that the fraudulent transactions were committed under the “express instructions and directions of Kindo. “We all have followed the instructions and executed the same under extreme duress and intimidation over the period thinking that it would be managed soon,” the letter said.

The fake transactions were introduced by the current credit head who was earlier working as the operational head of the company, the letter said. “The fake portfolio on the ground was managed by the current COO and regional business leader responsible for Odisha and Chhattisgarh state, including indirect control of ‘fake’ portfolio in Jharkhand," the letter alleged.

The letter, however, does not reveal the identity of the current credit head.

According to the website of the company, Kindo is the Founder and Managing Director of SFPL and has “extensive experience in the microfinance sector”.

Kindo has also earned a Certificate in Microfinance from the Boulder Institute of Microfinance, USA and recently has been selected to participate in the Harvard Business School – ACCION Program on “Strategic Leadership on Inclusive Finance, Boston, USA.

Multiple attempts to reach out to Kindo for comments through calls and email didn’t elicit any response at the time of filing this story. On 13 July, Central Crime Station (CCS) sleuths arrested CEO and MD for defaulting Rs 2 crore loan obtained from a subsidiary of Nabard.

What lies ahead?

According to people familiar with the development, the RBI is in the process of cancelling the permit of Sambandh. Early this year, the central bank issued a show cause notice prior to cancelling the licence of fraud-hit Sambandh Finserve Pvt Ltd, after its networth eroded below the regulatory minimum and financial situation worsened beyond redemption over the recent months.

“The process of de-licencing is on. Unless the company manages to recover significantly, its permit will be cancelled,” said one of the persons quoted above.

Sambandh’s Board doesn’t feature Kindos now. According to the company website, there are three nominee directors and one independent director. There are only a few employees left in the Headquarters. Lenders to Sambandh are staring at huge losses. About 34 lending institutions have exposure to Sambandh Finserve, including commercial banks and NBFCs. Total exposure to these lenders stands at around Rs 383 crore, according to available data.

(Part of this story was published earlier on Moneycontrol)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.