The Reserve Bank of India (RBI), on October 6, kept the repo rate unchanged at 6.5 percent for the fourth consecutive time, as the focus remained on bringing down inflation.

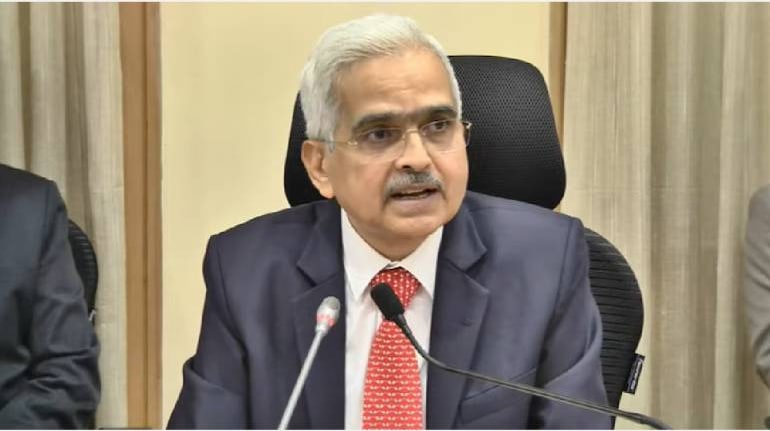

In a post-policy announcement press conference, Governor Shaktikanta Das spelt out why the RBI is considering open market operation (OMO) sales to manage liquidity.

Das added that the timing and quantum of such an operation will depend on evolving liquidity conditions. Edited excerpts:

Will there be a calendar for OMO, and is this in preparation for the JP Morgan bond index inclusion?

Shaktikanta Das: The first thing I would like to say is that it has nothing to do with the bond index inclusion. It's a part of our domestic liquidity management.

With regard to the calendar, I have said that we will wait and watch the evolving trends. There are several moving parts in the whole liquidity scenario. We will watch the evolving trends, and we will notify (the auction) as and when it becomes necessary. So, we do not, at the moment, propose to give a calendar.

Does the RBI expect banks to further adjust their rates so that transmission is complete? Are you worried that a change to a neutral stance will signal a dilution of your results to act on inflation?

Shaktikanta Das: A change of stance to neutral will be on the table when the situation becomes so. At the moment, the rate hike is still incomplete. I have given the numbers in my statement. We have increased the repo rate by 50 basis points, but it has not fully translated to either the deposit rates or the lending rates of banks.

There is still some distance to be covered. So, we would expect that to align with the increase in the repo rate. So, at the moment, the stance remains withdrawal of accommodation.

How will OMO sales be conducted?

Shaktikanta Das: This will be done through the auction process and not through the NDS-OM platform. We will notify it, and then we will undertake the auction.

Is there a need for the RBI to rework the liquidity framework?

Deputy Governor Michael Patra: I think the liquidity management framework is robust. The ICRR was not a reaction to low subscriptions in the regular auctions. It was an instrument intended to deal with a special, specific occurrence, the Rs 2,000 note. Regular operations are essentially intended to enable banks to maintain their reserve requirement cycles.

Have you planned any action on the personal loan front in terms of regulations? What is the RBI's thought process? And where is the problem?

Shaktikanta Das: The financial sector, especially the banks and the NBFCs, continues to be robust. All parameters with regard to banking, with regard to NBFCs, they are better. In fact, the GNPA figures of the banking sector, the unaudited figures, which we have now got for the end of June, look even better.

NBFCs are also experiencing a similar situation. I have said earlier that we have to be mindful of what can, going forward, pose a challenge and what can become a future risk. In certain segments of retail credit, we saw high credit growth.

So, it is only to caution the banks to strengthen their internal surveillance systems, watch the trends, and take whatever measures are required. And so far as the Reserve Bank is concerned, the Reserve Bank Supervision Department monitors it very intensively.

What is the state of the financial health of the government? And as the banker to the government, are you satisfied?

Shaktikanta Das: So far as the current year's fiscal deficit is concerned, a statement has been made by the Finance Ministry that the government will stick to the fiscal deficit, and they are targeting this fiscal consolidation roadmap. So far as the Central government finances are concerned, I don't see any major problems or anything that worries the central bank.

In the Monetary Policy Report, you said the inflation forecast for FY25 is 4.5 percent and inflation is seen averaging 4.3 percent in the last quarter of that year. So is a sub-4 percent quarterly inflation forecast necessary for the MPC to lower the repo rate?

Deputy Governor Michael Patra: No. The MPC has said that they are focused on aligning inflation outcomes with a target. So, a tendency for the inflation numbers to move towards 4 percent is what we are looking for. If it goes below 4 percent on a durable basis, then we will shift to accommodation. We are trying to keep inflation at the target or around it.

Shaktikanta Das: That is why we have used the word align the inflation to the 4 percent target. And again, if there is a sudden spike or a sudden fall, we have to see how durable that decline is.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.