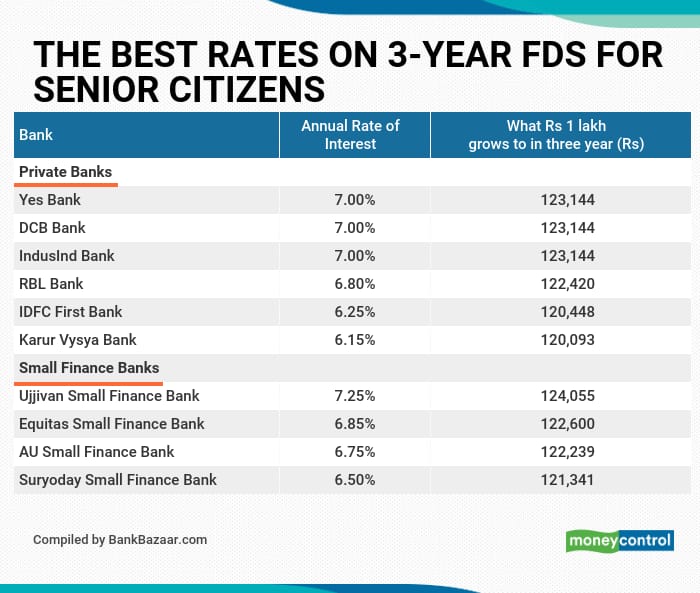

Small finance banks have reduced the interest rates on three-year fixed deposits (FDs) for senior citizens by 30-100 basis points. For instance, Suryoday Small Finance Bank has decreased interest rates on three-year FDs for senior citizens to 6.50 percent from 7.50 percent earlier. Similarly, Equitas Small Finance Bank brought down rates to 6.85 percent from 7.15 percent.

Despite falling interest rates, there are still some banks that offer attractive rates on three-year FDs for senior citizens. Smaller private and small finance banks tend to top the rate charts on fixed deposit rates, given the competition they face in garnering deposits.

Also read: AU Small Finance and Ujjivan Small Finance banks offer 7% on savings accounts

Higher rate given by smaller private and small finance banks

According to data compiled by BankBazaar, smaller private banks are offering interest rates of up to 7 percent on three-year FDs for senior citizens. These are higher compared to those offered by leading private and public sector banks. For instance, Yes Bank, DCB Bank and IndusInd Bank offer 7 percent on three-year FDs for senior citizens.

Leading private banks such as Axis Bank and Kotak Mahindra Bank offer 5.9 percent and 5.6 percent interest respectively on three-year FDs. ICICI Bank and HDFC Bank offer 5.65 percent interest on three-year FDs for senior citizens.

The interest rates offered by small finance banks are higher compared to leading private banks. Ujjivan Small Finance Bank offers 7.25 percent on three-year FDs for senior citizens, followed by Equitas Small Finance Bank offering 6.85 percent interest on three-year FDs.

Among public sector banks, Canara Bank and Union Bank of India are among the highest in the list, with 6 percent interest on their three-year FDs for senior citizens. Bank of India and State Bank of India (SBI) offers 5.8 percent interest. Bank of Baroda offers 5.60 percent interest.

Investments in fixed deposits of up to Rs 5 lakh are guaranteed by the Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of the RBI.

The minimum investment amount varies across banks. At private and small finance banks, the amount ranges from Rs 1,000 to Rs 10,000.

Also read: NPS equity schemes underperform the Nifty 50 over the past three years

A note about the table

The data on FDs is as of 30 June 2021, as given on respective websites. Interest rates given are for senior citizens of 60-80 years of age (deposit amount below Rs 1 crore). All listed (BSE) public sector banks and private banks are considered for data compilation. Banks for which verifiable data is not available are not considered. For all FDs, quarterly compounding is assumed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!