In December 2020, Moneycontrol personal finance had profiled five extra- women who made their work mark in selling financial products ordinary across India. In the process, they ended up creating wealth for their customers. But the bigger picture was that they understood money matters and demonstrated amply that women can take charge of their finances.

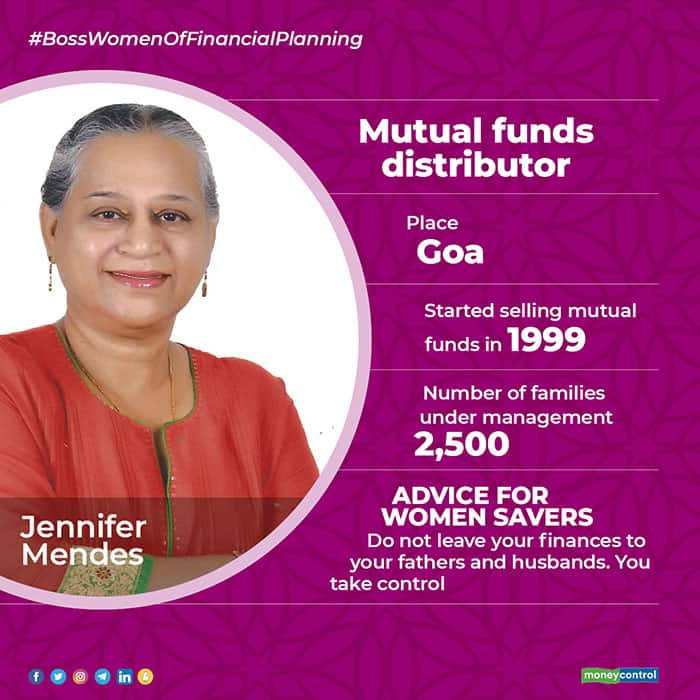

Ahead of Women’s Day that falls on March 8, we bring you stories of five more such women financial advisors and distributors who continue to spread financial literacy and bring more people to the world of savings and investments. Yesterday we profiled Sapna Narang, Managing Partner, Capital League. Today, meet Jennifer Mendes from Goa

At 67, Goa-based Mutual Fund Distributor, Jennifer Mendes, has seen it all – at least four full market cycles (1999-2020) and the growth of Rs 30 trillion mutual fund (MF) industry. But it was thanks to a letter she got accidentally in the summer of 1999 from SBI Mutual Fund that changed her career path to eventually make her one of Goa’s largest mutual fund distributors.

But Jennifer (she prefers being called by her first name) wasn’t new to the world of finance. She, her husband, Prof Mathew Mendes and two of their three children who were born by then used to live in Mumbai. Jennifer had taken a break from her banking career in the early 1980s. But the hustle and bustle of city life was too much for the family. So they shifted to Goa in 1986, “for a better quality of life.” Her husband was a western music professor and started his classes in Goa.

Starting off with safe investments

While in Goa, Jennifer decided to put her banking experience to use and took up the postal recurring deposit agency. That was a license to sell postal recurring deposit schemes. Back then, Jennifer says, the post office used to give product-specific licenses. So, a post office recurring deposit Agent could not sell, say, a National Savings Certificate (NSC). Jennifer used to go door-to-door for collecting monthly instalments. Eventually, she got the license to sell all postal schemes.

In 1999, she got a letter at her Goan home from SBI MF about a workshop to be held there titled ‘Mutual Funds: An idea whose time has come.’ Jennifer still doesn’t think she was meant to receive that invitation. “When I went to the workshop, there were only Chartered Accountants (CA). I was the only non-CA there.” But the workshop convinced her that mutual funds were the way forward.

Giving the taste of mutual funds

But selling mutual funds in Goa was a challenge. “Goans were largely risk-averse, especially in those days. They were used to assured-return products. But mutual funds do not assure returns,” she says. But having sold post-office recurring deposit schemes for over 15 years, Jennifer could effectively communicate the merits of a systematic investment plan (SIP). Today, Jennifer is integral to the investing lives of 8,000 customers ( 4,000 are active). Her monthly inflows into SIPs are well over Rs 2 crores – the average monthly instalment she gets is Rs 7,000. “I also have customers who put as little as Rs 100 every month in SIPs,” she adds.

Goa held other challenges too. Jennifer recollects that one afternoon in those days, she went to Panjim for some work at about 12:45 pm. Most of the shops got shut between 1-4 pm. She and her husband were stranded and were kept waiting till the shop opened. That’s when she decided that her mutual fund distribution office would be open throughout the day; from 9 am to 6 pm. “My staff members go for their lunch break, but somebody will be there to man the desk,” she says. Across four locations in Goa, Jennifer has a three employees as well as her eldest son Schubert, who has been a part of her firm for the last 20 years. Her husband is also hands-on with administering, marketing and advising on how the business should move forward.

Having seen many market cycles, what would her advice be? “Avoid sector funds,” she says. “Retail investors prefer average returns and look for consistency,” she says. Diversified equity funds are best-suited for such retail customers.

Jennifer also nudges you to increase your SIP every year In fact she says she was the first MF distributor to popularise top-up SIPs in Goa when ICICI Prudential Mutual Fund launched it in 2011. Today most fund houses offer it.

On this women’s day, Jennifer’s advice to all women investors: “Take interest in your finances. Do not leave it to your fathers, husbands or the men of your house, even if you are a homemaker.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!