More women borrowers are taking charge of accessing credit, preferring to avail loan against gold, and actively monitoring their credit scores, a joint report by TransUnion CIBIL, Niti Aayog's Women Entrepreneurship Platform and MicroSave Consulting has shown.

The report noted a significant 22 percent compound annual growth rate (CAGR) in women accessing credit, up from 20 lakh in 2019 to 2.7 crore in 2024, with 60 percent of the borrowers hailing from semi-urban and rural areas.

"This underscores a deepening financial footprint of women borrowers beyond metro cities," said Manoj Kumar Sharma, Managing Director, MicroSave Consulting.

The report highlights the remarkable strides women are making in reshaping India’s economy. "Empowering women to lead, innovate, and thrive will not only redefine India’s economic narrative but also ensure that women are equal and vital partners in shaping the nation’s

destiny," said Bhavesh Jain, MD & CEO, TransUnion CIBIL.

TransUnion CIBIL is a credit information company that maintains credit files of millions of individuals and businesses.

Also read | How Trump’s ‘Gold Card' visa differs from EB-5 investment-linked programme

Rising Gold Mortgages

Gold loans have emerged as a preferred option for women borrowers, making up 4 crore loans worth Rs 4.7 lakh crore accounting for 38 percent of all loans taken by women during 2024. This is a five-fold increase compared to 2019.

Personal finance credit - comprising of personal loans, consumer durables, home ownership and vehicle loans - is a dominant segment for women borrowers, who availed 4.3 crore loans worth Rs 4.8 lakh crore in 2024. This accounts for 42 percent of all loans taken by women during that year.

Women Actively Tracking Credit Health

The report also noted an increase in women monitoring their credit scores. As of December 2024, 2.7 crore women borrowers were tracking their credit health, a 42 percent surge from 1.9 crore in December 2023.

Women's representation in the self-monitoring credit base increased to 19.4 percent in 2024, a growth of 17.9 percent from the previous year.

"Staying vigilant about their credit status enables women borrowers to make more informed financial decisions," said TransUnion CIBIL's Bhavesh Jain.

Also Read | Buying the dip: Is averaging down really a smart investing strategy?

Consumer Credit

By keeping a close eye on credit, women borrowers are effectively managing their financial well-being, negotiating favourable loans, and safeguarding against potential identity theft and fraud, the report added.

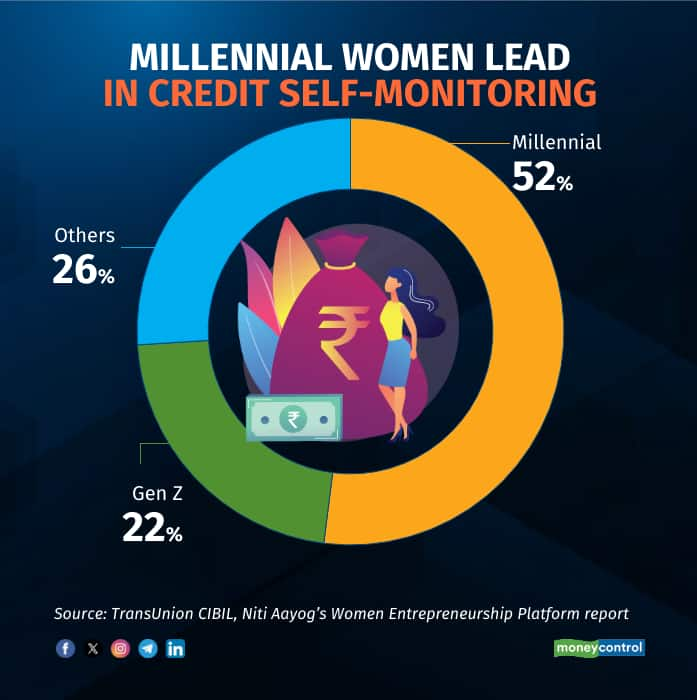

Gen Z women are driving the trend of credit monitoring, with a 56 percent on-year rise, accounting for 22 percent of the self-monitoring women in 2024. Millennials, too, also demonstrated significant growth, with a 38 percent year-on-year rise, making up 52 percent of the self-monitoring women population in the same period.

Millennials are those born between 1981 and 1996, and Gen Z refers to those born between 1997 and 2012.

Credit Monitoring Pays Off

According to TransUnion CIBIL, a significant 13.5 percent of women who monitor their credit information go on to open a loan account within a month, highlighting a clear correlation between credit awareness, monitoring, and subsequent borrowing activity.

Forty-four percent of women borrowers who tracked their information saw their credit scores improve within six months. Notably, among women with overdue payments of 90+ days at the time of credit check, 17.5 percent transitioned to a lower delinquency category, while 11.4 percent became standard borrowers within six months. "This suggests that self-monitoring not only facilitates increased loan access but also promotes better credit health," Bhavesh Jain said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.