For the last few decades, the financial markets have been operating on the assumption that given the safe haven status of the dollar, the US would continue to print the currency and infuse liquidity into financial assets forever without creating hyperinflation or high interest rates for its consumers.

Events of the first five months of 2025 indicate that this old arrangement is coming to end with multiple risk events—such as a US debt rollover, high treasury yields and tariff wars—expected to trigger volatility spikes across the world's financial landscape over the next 12 months.

As seen in 2008 and 2011, global headwinds are leading to sharp drawdowns in the Indian equity market in 2025 as well, with the Nifty 50 marking a 2025 low at 21,750 points (a 10 percent loss from its Jan 2025 high) on April 7. Though, Nifty 50 has recovered all losses in next 5 weeks, prospects of stagnant EPS growth (10% vs expectation of 15%-18%), global/AI headwinds, and Tariff tantrums (50% on US exports at time of writing this article) indicate that there is reasonable probability that Nifty might test 2025 lows multiple times in next 12 months.

Having said that, the equity market tends to follow a non-linear path and with the long-term India story of attaining a GDP of $15 billion by 2040 still intact, these future dips (if they materialise) represent a generational wealth-building opportunity. Moreover, with time-diversification coming in-built, event risk is already largely neutralised for those who go in for systematic investment plans or SIPs.

For example, a lump sum investment in a fund benchmarked to the Nifty 50 in December 2007 would have seen a sharp drawdowns during the 2008 GFC or global financial crisis (60 percent) and the 2011 US debt ceiling crisis (25 percent),resulting in an annualised return of just 0.4% over the six-year holding period. On the other hand, monthly SIPs over the same period delivered an average of 8.45 percent annualised return—even in the worst phase, SIP returns were better than fixed deposits on a post-tax basis.

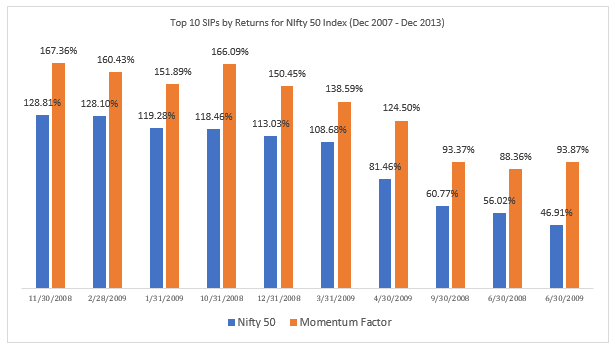

As can be observed in Figure 1, Nifty 50 SIPs achieved break-even as early as the first half of 2009 while the Nifty 50 itself took nearly three years to recover the principal, in December 2010. Dips actually allowed SIPs to deliver superior returns in a stagnant market with nearly 50 percent returns accounted for by 10 SIPs, made in the worst periods during the GFC.

However, investors can potentially enhance SIP returns by opting for factor index funds. Continuing with the December 2007–2013 example, an SIP in an index fund tracking the Nifty 100 Low Volatility 30 Index would have delivered an annualised return of 13.33%, compared with 8.45% for the Nifty 50, largely due to stronger performance during volatile market phases.

Also read | ICICI Bank’s higher minimum balance: Here's how to make your idle money work for you

Even the high-risk momentum factor SIP delivered returns of 13.23 percent. It must be considered that the momentum factor is typically considered suitable for bull markets but SIP investments made at much steeper bottoms during bear markets had a multiplier effect during recovery.

Figure 2 shows that even in the top 10 months where the Nifty 50 delivered its best returns, momentum factor funds outperformed the Nifty 50 by nearly 40 percentage points or more in every case. For example, while Nifty 50 delivered returns of 128 percent, an investment made in November 2008 (to December 2013), momentum factor fund delivered a return of 167 percent over the same investment horizon.

Moving on from bad times, if we consider the market rally from December 2013 to December 2019, the Nifty 50 moved up by around 93 percent while volatility and momentum factor funds delivered returns of 107 percent and 191 percent, respectively. The data seems to suggest that a diversification of monthly SIPs towards factor index funds can not only enhance returns during bearish phases but also has the potential to provide similar or even significantly higher returns than the Nifty 50 benchmark during bullish phases.

Also read | Halfway Through 2025: What mutual fund flows tell us about investor sentiment

Even in the recent past, the last major bearish phase was when hyperinflation, rising yields and the Russia-Ukraine war shook the markets in 2022. An investment in a Nifty 50 index fund at the end of October 2021 would have yielded a return of 7.9 percent on a cumulative basis over the next two years while a Nifty 50 SIP would have returned 11.5 percent. If the money was put into a factor fund SIP, the return would have been at least 100 basis points higher, at 12.5-13 percent.

Figure 3 shows the sharp drawdown in the momentum factor actually having helped in delivering outperformance after March 2023.

As already mentioned, with the Indian equity market looking vulnerable to uncertainties and volatility spikes associated with a global ‘reset’, there is high risk of multiple drawdowns over the next 12 months, which might test 2025 bottoms.

Considering the all-season nature of long-term alpha associated with factor investing, SIPs in so-called smart beta products or factor index funds can actually allow investors make the most of market dips without compromising on an eventual breakout on positive surprises.

The writer is co-founder and CIO, Elever, a quant-based PMS & portfolio manager.

Disclaimer: The views expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!