When a National Pension System plan matures, it is mandatory for subscribers to buy an annuity plan with at least 40 percent of the accumulated funds. The remaining 60 percent can be withdrawn as a lump sum and is tax-free, although subscribers can increase the amount over and above the mandatory 40 percent that needs to go into annuities.

When the subscriber buys the annuity plan, the insurance company promises to pay a certain amount every month (or periodically). This ensures that the subscriber continues to get a regular income (pension) after retirement. Many investors don’t like the NPS for this forced annuitisation. But this may be a blessing in disguise for many. Do read why the NPS deserves more attention from retirement savers.

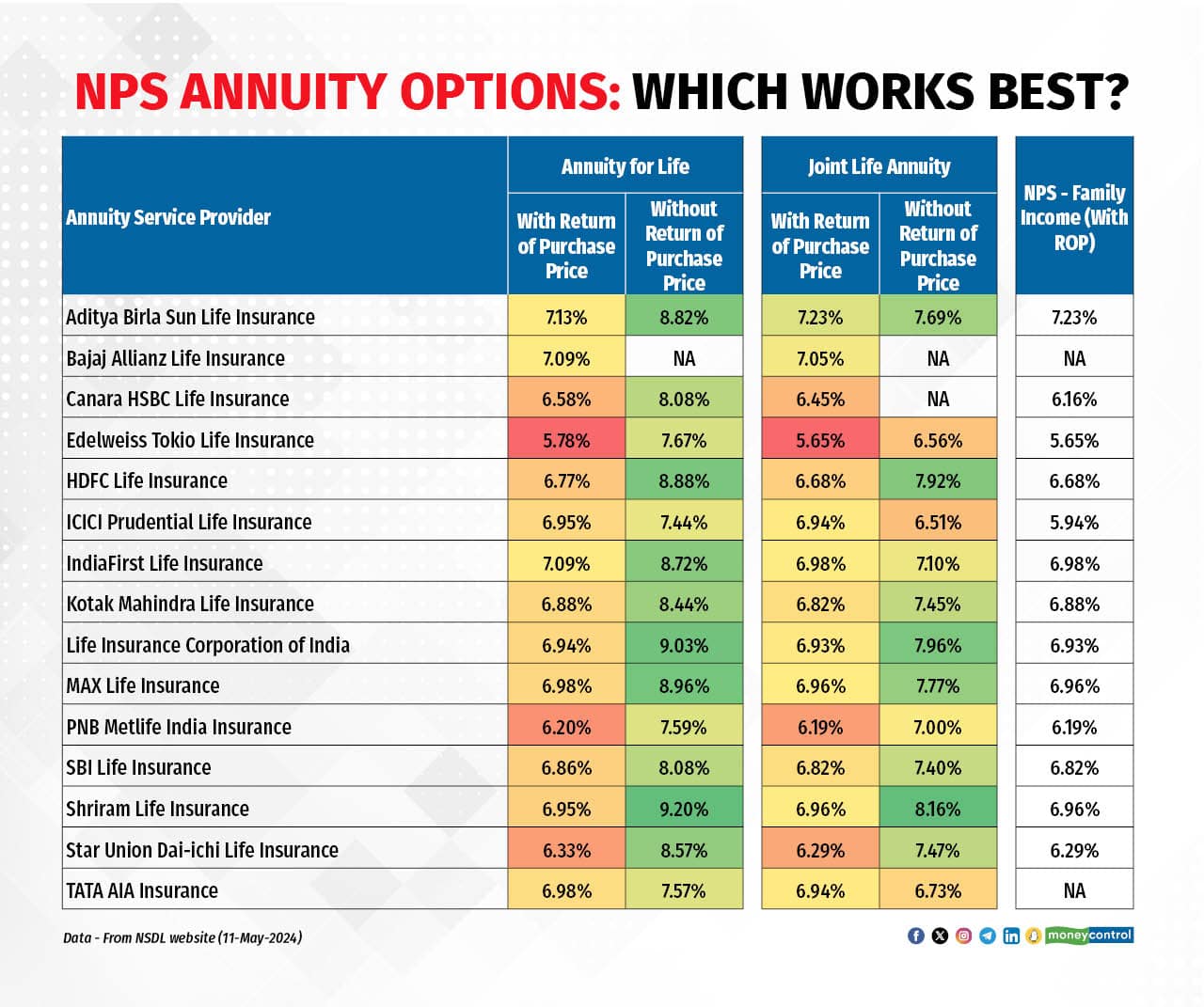

Coming to annuities, you can buy them from one of 15 annuity service providers empanelled with the Pension Fund Regulatory & Development Authority (PFRDA).

Annuity choices

Currently, there are five major options available for annuities:

Annuity for Life with ROP (Return of Purchase Price): The subscriber will get an annuity for their lifetime. On the death of the subscriber, the annuity payment stops, and the entire amount (100 percent of the purchase price) is returned to the nominees.

Watch | Want to withdraw from NPS funds before retirement? Here’s how you can

Joint Life Annuity with ROP: The subscriber will get an annuity for their lifetime. On the death of the subscriber, the annuity is paid to the spouse for their lifetime. On the death of the spouse, the annuity payment stops, and the entire purchase price is returned to the nominees.

Family Income with ROP: The subscriber will get an annuity for life and upon death, the annuity will be payable to the spouse for their lifetime. On the death of the spouse, the annuity payment goes to the dependent mother and then to the dependent father of the subscriber.

On the death of the last annuitant, payment of annuity stops, and 100 percent of the purchase price is returned to the surviving children of the subscriber/legal heirs, as applicable.

Annuity for Life without ROP: The subscriber will get an annuity for their lifetime. On the death of the subscriber, the annuity payment stops immediately. There is no payment made/returned to the nominees.

Joint Life Annuity without ROP: The subscriber will get an annuity for their lifetime. On the death of the subscriber, the annuity will be payable to the spouse for their lifetime. On the death of the spouse, the annuity payment stops immediately. There is no payment made/returned to the nominees.

Also read | How to make withdrawals under National Pension System

The first three options (with ROP) are the best for those who wish to get pension income throughout their life (and spouse’s) and eventually, want to leave lumpsum amount for their children.

The last two options (without ROP) are best suited for those who don’t have children/dependents or whose children are well-settled and don’t need any income/money from parents.

It is important to note that the annuity rate/payout in the ‘with ROP' option is lower than in the ‘without ROP’ option. (See table.)

Even then, given the nature of Indian society, where almost all parents want to leave behind something for their children, 70 percent of pensioners have chosen the Annuity for Life with Return of Purchase Price (ROP) option, as per PFRDA data (Handbook of NPS 2023). Under this plan, the annuity income is paid to the subscriber and after the demise of the subscriber, the principal amount is paid to a nominee option.

Recently, NPS subscribers have been given the flexibility to buy several annuities instead of just one at maturity. This option is available for NPS subscribers who earmark an annuity corpus of more than Rs 10 lakh, wherein Rs 5 lakh is utilised to buy each annuity scheme.

Which option is best for you?

The answer depends on many factors including individual requirements and circumstances, dependents, need for income, availability of other income sources, and other assets.

Also read | Why NPS Tier-II tax saver scheme has failed to gain traction with central government employees

Not only do you need to pick the annuity service provider and the annuity option, but also how much of the funds to invest in an annuity. The minimum is 40 percent, but you can choose to invest anywhere from 40 percent to 100 percent of your NPS funds in annuity at maturity.

The higher the amount you invest in an annuity, the higher the pension you will get. Of course, you will first need to consider if there is any immediate one-time large need of money at the time of retirement.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.