In a bid to keep polluting and old cars off the road, Prime Minister Narendra Modi on August 13 launched the vehicle scrappage policy. According to the policy, commercial vehicles that are over 15 years old and personal vehicles that are more than 20 years old will be eligible for scrapping.

Cars that are over eight years old would have to go for a fitness test. If they fail this test, you would not be allowed to drive the car on the road anymore. But if your car passes this test, a ‘green tax’ (roughly 10-25 percent) would be charged every time you renew the fitness certificate, which itself would be valid for five years. In other words, holding on to older vehicles may become a more expensive proposition.

What is car leasing?

While leasing a car, you get to ride a brand new model from the manufacturer’s portfolio. Car companies offer lease for periods ranging from 12 to 60 months, depending on the city and model.

Leading car makers such as Mahindra & Mahindra, Maruti Suzuki, Hyundai, BMW, Volkswagen and Skoda have been giving car models on lease in India with minimal or no down payment.

For instance, a Maruti Suzuki customer can take one of WagonR, Swift, Dzire, Vitara Brezza, Ertiga, Ignis, Baleno, Ciaz, XL6, and S-Cross on lease. The lease is available with varied mileage options of 10,000 kms to 25,000 kms annually and 12-48-month tenures. You get Wagon R, for a monthly rent of Rs 12,513 and Ignis for Rs 13,324 in Kochi (including taxes). The lease is for a period of four years.

“The lease allows a customer to use a brand-new car without actually owning it. The customer needs to pay an all-inclusive monthly fee that comprehensively covers maintenance, 24*7 roadside assistance and insurance for the complete tenure,” says Shashank Srivastava, Executive Director, Marketing and Sales, Maruti Suzuki India.

Suvajit Karmakar, CEO & Whole-time Director of ALD Automotive India, a car leasing firm, explains that car leasing appeals to millennials “who may not see want to own a depreciating asset. Millennials are more prone to changing cars every 3-5 years.”

Also read: Now, lease cars instead of buying them – directly from auto companies

Sunil Gupta, MD and CEO of Avis India says that car leasing has a penetration of less than one percent in India, as opposed to around 45 percent in countries such as the US. He expects the car leasing market in India to grow by 15-20 percent over the next ten years.

Adhil Shetty, CEO of BankBazaar.com, says that since the vehicle scrappage policy is aimed at discouraging owning vehicles for longer periods, leasing a car would become more attractive than even buying a used car.

Also read: Buying a used car during COVID times? Be aware of the paperwork on loans and insurance covers

Whether to buy a car or lease?

There are pros and cons to leasing a vehicle.

Leasing a car means that you do not own it. “The lease is also limited to a few years, and there may not always be an option to buy the vehicle after the lease period is over from the car maker,” says Shetty. Once you drive your leased car a specified number of miles, you have to surrender it to the company.

A lease may also be less attractive in the long term, especially if you are able to buy a car without taking a loan. You also cannot customize a leased car, unlike your own vehicle.

Also read: Punjab & Sind Bank, Central Bank of India offer the cheapest car loans

But if you like changing your car models every few years, leasing is a good way to do that. “Customers can upgrade their models once the lease scheme is over; you can exchange your car for another model of your choice,” says Veejay Nakra, Chief Executive Officer of Mahindra & Mahindra (Auto Division).

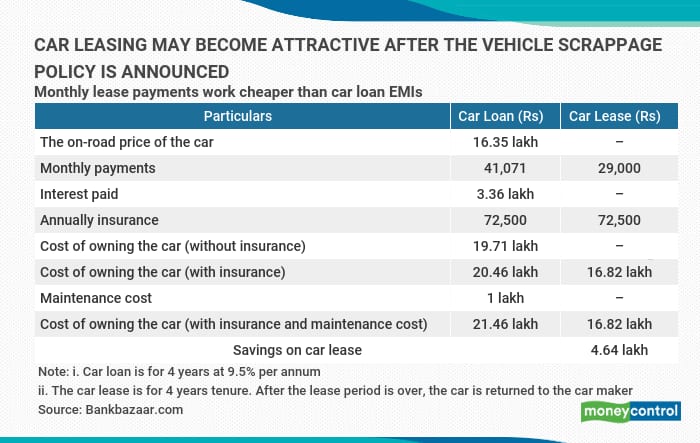

Also, the monthly payment for a lease is considerably less than what it would be for a car loan. This means you can opt for a high-end car you otherwise may not be able to afford. Buying a car with a loan is cheaper compared to the leasing option in the cases of entry and mid-entry segments. “Currently, leasing is still an expensive proposition in certain car segments. For this to take off, leasing will have to become cheaper for the cost benefits to become more visible,” says Shetty.

Also read: Buying a car during COVID times? Avoid special financing schemes

Amol Joshi, founder of financial advisory firm Plan Rupee Investment Services says, “After repaying the loan, you will be the owner of the car and can resell it in the market. So, you get to earn certain resale value of a car in case purchased on loan. In a leased car, you don’t have an option of resale.”

While buying a car with a loan, the EMI will eventually end, but in car lease, monthly payments won’t stop until the car is returned to the manufacturer.

Harshvardhan Roongta, Principal Financial Planner at Roongta Securities says, “Car leasing is recommended to individuals/families on the move from one city to other, with jobs of short tenure (one to three years). They will save on add-on costs, which include registration of the car with the regional transport office (RTO) and other miscellaneous charges while purchasing a car.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.