It is not easy being a smallcap investor. The segment is highly volatile, not just at an individual (smallcap) stock level but also at the category level itself. But to be fair, the recent returns have been spectacular.

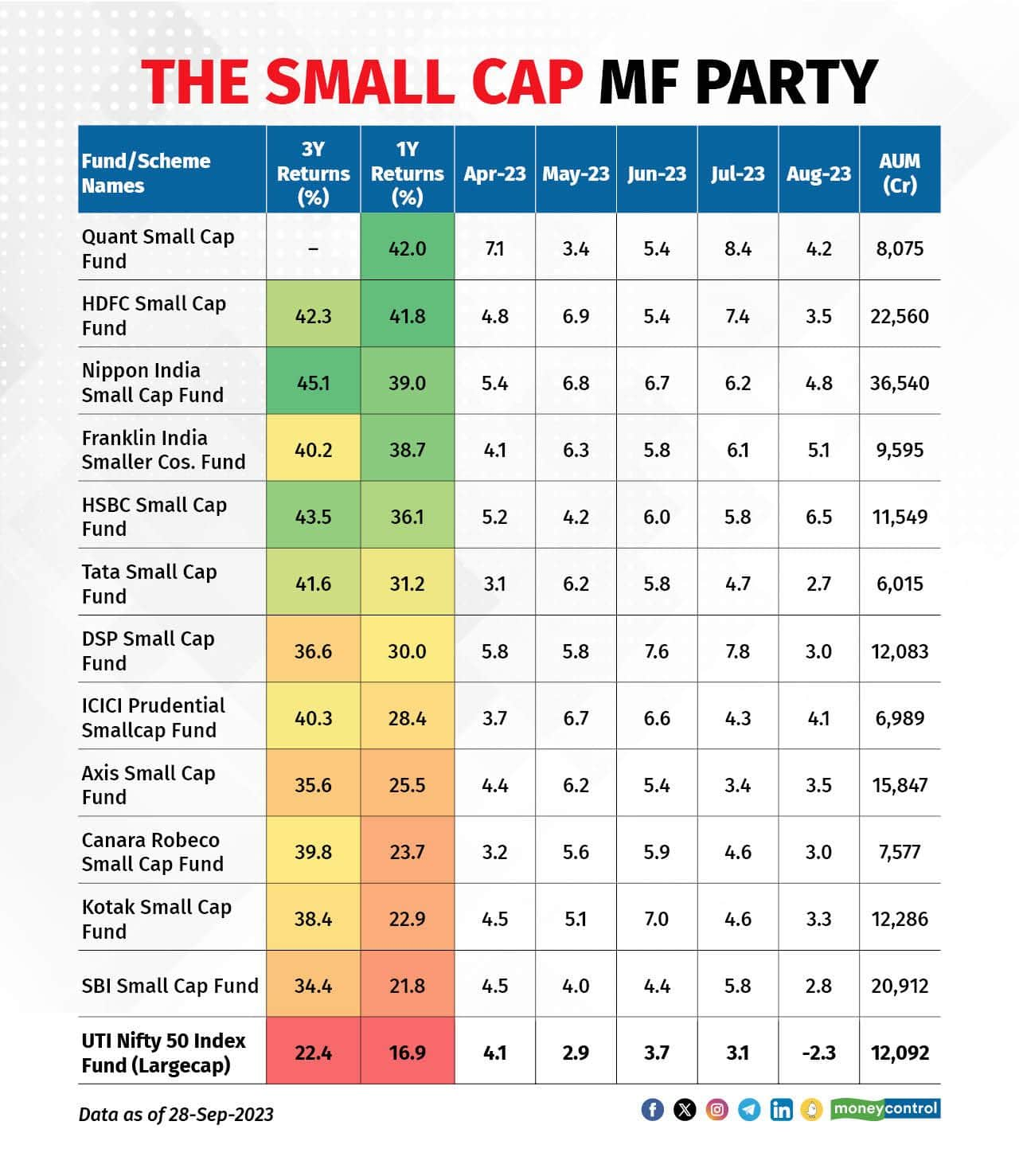

The accompanying table lists the return profile of smallcap funds (AUM > Rs 5,000 crore and at least 2 years old) and also that of a largecap Nifty-50 based index fund for comparison.

While smallcaps have had a solid run over the last 5-6 months, they have also propped up the 1-and-3-year return profile of these funds. And it’s nothing less than dazzling. Good smallcap funds have given a 3-year CAGR of 30-40 percent whereas the bellwether Nifty50 gave 16.9 percent. The story is similar if you look at 1-year returns.

But while it is tempting to believe that the smallcap party will last forever, let’s zoom out a bit. If you remember that trees don't grow to the sky and that the pendulum always oscillates, and are willing to look a little further back in history, you will see that the smallcap returns swing wildly. In good years these are life-changing no doubt, but in bad years they test the patience and can be devastating.

ALSO READ: Time to rebalance your portfolio? Check out these aggressive hybrid fundsNote - For reference, smallcap stocks (which are part of smallcap funds), are the stocks of companies ranked 251 onwards by marketcap as per SEBI categorisation definitions. How much to allocate to smallcaps?Different people have different opinions on how to build a portfolio and how much to allocate to different market segments.

I know a few people who want to have absolutely no exposure to largecaps. They run purely mid-smallcap-based portfolios. While everyone has a right to do whatever they want to, I personally don’t think that such a strategy is suitable for the vast majority. It is a highly risky strategy which is best avoided.

And I know that many investors will get tempted by the recent outperformance and choose to invest heavily in smallcap funds. But that is not the right approach.

One should only invest in smallcap funds if the risks are properly understood and one has the patience to stay invested for at least 5-7 years. And if you are coming to invest here after a really good period, then be willing to wait for even longer than 7+ years.

So, what should you do?Here are a few pointers:

· If you are a conservative investor with small exposure to equities, then ignore smallcap funds. This is not your place.

ALSO READ: Mirae Asset Mutual Fund raises SIP limits for Mirae Asset Emerging Bluechip Fund· For balanced to moderately aggressive investors, I would suggest capping the exposure to smallcaps to a maximum of 20-25 percent of the overall equity exposure. Nothing more unless you are really greedy and/or are willingly open to guaranteed higher risks for potentially non-guaranteed better returns.

· If you already have an allocation to smallcap funds for long, and it has increased (due to a run up in smallcap space), then it is advisable to review and rebalance back your smallcap allocation to lower levels. As mentioned in the previous point, having up to 20-25 percent of equity exposure to smallcaps should be the upper limit.

· If you were planning to deploy fresh lumpsum (money) in smallcaps as you (believe and) want to attend the party for long then be very, very cautious. In the smallcap space, the music can stop suddenly and it’s not easy to exit in a hurry.

· If you have SIPs running in smallcap funds and you are accumulating for the long term (10+ years) then you can let them continue. But remember to rebalance the existing portfolio’s allocation to smallcaps.

It may sound a little odd, but most common investors don’t even need smallcap funds. This can be put in the bucket of products best avoided.

And if you have to invest in smallcap funds, remember a few things.

ALSO READ: Old real-estate ripe for redevelopment: Should you invest in them?Different market segments offer different alpha potentials. And while it’s fine to take the passive route for largecaps, it is better (as of now) to take the active route for smallcap funds. Also, the fund size matters here. Generally, smaller AUM funds are expected to do better but it is not always the case (as is seen in recent past as well). And different fund managers have contrasting investment styles which may/may not work at different times. So, pick smallcap funds carefully if you decide to invest in them.

Disclaimer - The views expressed above should not be considered professional investment advice or advertisement or otherwise. No specific product/service recommendations have been made and the article itself is for general educational purposes only. The readers are requested to take into consideration all the risk factors including their financial condition, suitability to risk-return profile and the likes and take professional investment advice before investing.

To know more about the investment ascent in India with the nation’s leading financial pioneers, tune in to the Moneycontrol Mutual Fund Summit, 11th October 2023 in Mumbai, 3.50 pm onwards. Log on here for further details.Powered by Axis Mutual Fund, Strategic Partner Reliance Industries Limited, Associate Partners HSBC Mutual Fund, Motilal Oswal MF, 360 ONE Mutual Fund, IBM and Baroda BNP Paribas.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.