Time to rebalance your portfolio? Check out these aggressive hybrid funds that provide stability and high growth

With the equity markets are trading at their peak, investors who have achieved their financial targets and also investors with medium risk profile can consider shifting their investments from high-risk investments such as mid- and small-cap funds to relatively less risky funds such as hybrid funds

1/11

Indian equity markets have been on an upward trajectory over the past three years, regardless of a bout of volatility. Equity mutual funds especially mid-cap and small-cap funds have delivered handsome returns to the unitholders and most of them are sitting with huge gains.

Investors who have achieved their financial targets with this current rally and also investors with less penchant for risk can consider shifting their investments from high-risk investments such as mid- and small-cap funds to relatively less risky funds such as hybrid funds.

Within the hybrid funds categories, Aggressive hybrid funds are investing 65-80 percent in equity and the rest in debt assets. These funds are good picks for many portfolios as they allow you to participate on the upside, while cushioning your downside as compared to pure equity funds.

Investors who have achieved their financial targets with this current rally and also investors with less penchant for risk can consider shifting their investments from high-risk investments such as mid- and small-cap funds to relatively less risky funds such as hybrid funds.

Within the hybrid funds categories, Aggressive hybrid funds are investing 65-80 percent in equity and the rest in debt assets. These funds are good picks for many portfolios as they allow you to participate on the upside, while cushioning your downside as compared to pure equity funds.

2/11

Top performing schemes from the aggressive hybrid funds have managed to deliver better returns and matched with the returns to that of the largecap funds category.

Here, we list out the top performing schemes from the aggressive hybrid funds category. Only schemes with 10-years track record were considered. Schemes were shortlisted based on the 5-year rolling return calculated from the last ten-year data.

This Moneycontrol analysis has taken care to cull out schemes that come with a good track record, but this is not a recommendation. You can consider the two aggressive hybrid funds that are part of MC30 for investing. MC30 is a curated basket of 30 investment worthy mutual fund schemes which were shortlisted after going through a rigorous risk and return testing process. Canara Robeco Equity Hybrid Fund and DSP Equity & Bond Fund are part of MC30.

Here, we list out the top performing schemes from the aggressive hybrid funds category. Only schemes with 10-years track record were considered. Schemes were shortlisted based on the 5-year rolling return calculated from the last ten-year data.

This Moneycontrol analysis has taken care to cull out schemes that come with a good track record, but this is not a recommendation. You can consider the two aggressive hybrid funds that are part of MC30 for investing. MC30 is a curated basket of 30 investment worthy mutual fund schemes which were shortlisted after going through a rigorous risk and return testing process. Canara Robeco Equity Hybrid Fund and DSP Equity & Bond Fund are part of MC30.

3/11

Quant Absolute Fund

5-year rolling return (CAGR) (calculated from the last 10-year data): 14.6%

Fund managers: Ankit A Pande, Vasav Sahgal and Sanjeev Sharma

Also see: Markets are at peak: Can these low volatile stocks cushion your portfolio volatility?

5-year rolling return (CAGR) (calculated from the last 10-year data): 14.6%

Fund managers: Ankit A Pande, Vasav Sahgal and Sanjeev Sharma

Also see: Markets are at peak: Can these low volatile stocks cushion your portfolio volatility?

4/11

ICICI Prudential Equity & Debt Fund

5-year rolling return (CAGR) (calculated from the last 10-year data): 12.5%

Fund managers: Mittul Kalawadia and Sankaran Naren, Manish Banthia, Nikhil Kabra and Sri Sharma

5-year rolling return (CAGR) (calculated from the last 10-year data): 12.5%

Fund managers: Mittul Kalawadia and Sankaran Naren, Manish Banthia, Nikhil Kabra and Sri Sharma

5/11

Canara Robeco Equity Hybrid Fund

5-year rolling return (CAGR) (calculated from the last 10-year data): 12%

Fund managers: Ennette Fernandes, Shridatta Bhandwaldar and Avnish Jain

Also see: PMS managers sold these midcap stocks lately: Check your portfolio

5-year rolling return (CAGR) (calculated from the last 10-year data): 12%

Fund managers: Ennette Fernandes, Shridatta Bhandwaldar and Avnish Jain

Also see: PMS managers sold these midcap stocks lately: Check your portfolio

6/11

SBI Equity Hybrid Fund

5-year rolling return (CAGR) (calculated from the last 10-year data): 11.4%

Fund managers: R. Srinivasan and Dinesh Ahuja

5-year rolling return (CAGR) (calculated from the last 10-year data): 11.4%

Fund managers: R. Srinivasan and Dinesh Ahuja

7/11

DSP Equity & Bond Fund

5-year rolling return (CAGR) (calculated from the last 10-year data): 11.3%

Fund managers: Atul Bhole, Dhaval Gada and Kedar Karnik

Also see: How have India’s oldest MF schemes rewarded investors?

5-year rolling return (CAGR) (calculated from the last 10-year data): 11.3%

Fund managers: Atul Bhole, Dhaval Gada and Kedar Karnik

Also see: How have India’s oldest MF schemes rewarded investors?

8/11

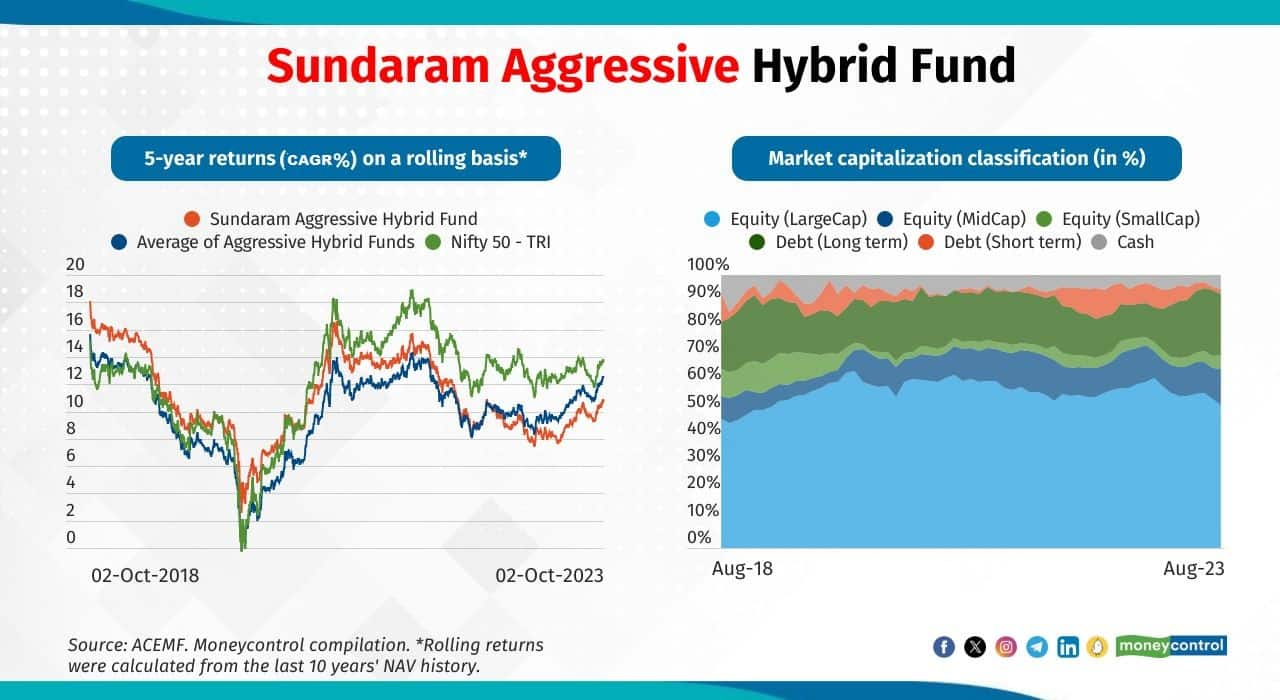

Sundaram Aggressive Hybrid Fund

5-year rolling return (CAGR) (calculated from the last 10-year data): 11%

Fund managers: Ravi Gopalakrishnan, S Bharath, Dwijendra Srivastava and Sandeep Agarwal

5-year rolling return (CAGR) (calculated from the last 10-year data): 11%

Fund managers: Ravi Gopalakrishnan, S Bharath, Dwijendra Srivastava and Sandeep Agarwal

9/11

Kotak Equity Hybrid Fund

5-year rolling return (CAGR) (calculated from the last 10-year data): 10.3%

Fund managers: Abhishek Bisen and Pankaj Tibrewal

Also see: Microcaps that are fund house favourites but yet to unlock their potential

5-year rolling return (CAGR) (calculated from the last 10-year data): 10.3%

Fund managers: Abhishek Bisen and Pankaj Tibrewal

Also see: Microcaps that are fund house favourites but yet to unlock their potential

10/11

Edelweiss Aggressive Hybrid Fund

5-year rolling return (CAGR) (calculated from the last 10-year data): 10.2%

Fund managers: Bharat Lahoti, Bhavesh Jain and Dhawal Dalal

5-year rolling return (CAGR) (calculated from the last 10-year data): 10.2%

Fund managers: Bharat Lahoti, Bhavesh Jain and Dhawal Dalal

11/11

Franklin India Equity Hybrid Fund

5-year rolling return (CAGR) (calculated from the last 10-year data): 10%

Fund managers: Varun Sharma, Anand Radhakrishnan, Rajasa Kakulavarapu, Sachin Padwal-Desai and Umesh Sharma

5-year rolling return (CAGR) (calculated from the last 10-year data): 10%

Fund managers: Varun Sharma, Anand Radhakrishnan, Rajasa Kakulavarapu, Sachin Padwal-Desai and Umesh Sharma

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!