In recent years, the term financial freedom has become very popular among India’s youth. It’s all over social media and fintech apps. Many young professionals now dream of reaching a stage where they don’t need to work just to pay bills; instead, they want to save and invest wisely so that their money can take care of them in the future.

One of the most talked-about tools to achieve this dream is the Systematic Investment Plan (SIP). It’s easy to start, requires very little effort, and can be done with as little as Rs 500 a month. But the big question is: Are young Indians using SIPs the right way to reach financial freedom?

What is financial freedom?

Financial freedom doesn’t mean becoming super rich or owning expensive cars and houses. It simply means reaching a point where your investments generate enough money to cover your basic living expenses like food, rent, healthcare, and travel, without depending on a job.

This gives you the freedom to retire early, change careers, start a business, or simply work at your own pace without stress.

How SIPs can help you get there

A SIP is a method of investing a fixed amount of money in a mutual fund every month. The amount is automatically deducted from your bank account on a fixed date. Over time, this money grows due to returns from the stock market and the power of compounding.

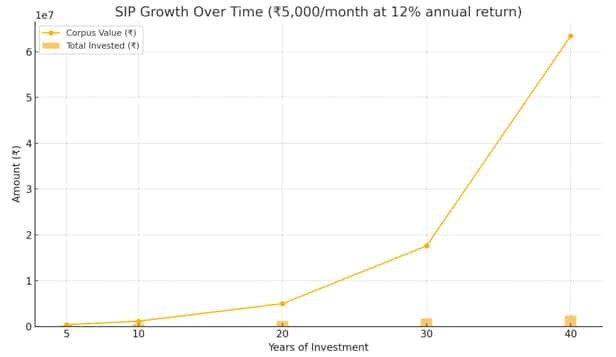

Let’s take a very simple example:

● If you start investing Rs 5,000 per month through a SIP at the age of 25, and continue doing this for the next 30 years, by the time you turn 55, your investment can grow to Rs 1.5 crore to Rs 2 crore, assuming a return of 12–15 percent per year.

● If you increase your SIP to Rs 10,000 per month, the value can be over Rs 3 crore to Rs 4 crore by the time you retire.

● Starting even earlier, say at age 20, can make a huge difference. That extra five years can grow your wealth by 2 to 3 times more, even with the same monthly investment.

This shows how starting small and staying consistent over a long time can give big results.

So, are Indian youth actually doing this?

There is good and bad news.

The good news

Young Indians are more financially aware than ever before. Millions of new investment accounts, called demat accounts) have been opened in recent years. SIP investments in mutual funds have also hit record levels. This means many young people are starting to invest early, and that’s a great start.

Also read | 6 smart ways to lower health insurance premium without losing coverage

The not-so-good news

While the number of investors is growing, a large number of them are still focusing on short-term trading, such as stocks, crypto, and futures/options. These methods are high-risk and meant for experienced investors. Many are trying to make quick money, which often leads to losses.

Also, many people stop their SIPs too early, within just 2 or 3 years, either because they don’t see fast returns or they panic when the market falls. But SIPs are not meant for short-term gains. They work best when continued for 10, 20, or even 30 years.

From government jobs to personal responsibility

Earlier, most middle-class Indians worked in government jobs. These jobs came with job security, pensions, and clear retirement benefits. But today, most young people work in private companies. These jobs offer good salaries but no guaranteed pension after retirement.

This means, it’s now our responsibility to plan for our future. And tools like SIPs are the simplest and safest way to build wealth without taking big risks.

Also read | No ITR filing exemption for small taxpayers in new Income Tax Bill, say CAs

The right way forward

If you’re a young professional in your 20s or early 30s, now is the perfect time to start a SIP. Even a small monthly amount like Rs 2,000 or Rs 3,000 can grow into lakhs or even crores over time.

Here’s what you should keep in mind:

● Start early. The earlier you begin, the more your money grows.

● Be consistent, don’t stop your SIP just because the market falls.

● Be patient, don’t expect results in 2 or 3 years. Think long term.

● Increase your SIP slowly as your income grows.

To sum it up

Financial freedom is not something that happens overnight. It requires small steps taken consistently over a long time. SIPs give young people a chance to build wealth without needing large sums of money. You don’t need to be a financial expert; you just need to be disciplined and committed.

So yes, Indian youth are headed in the right direction, but they need to stay focused, avoid shortcuts, and trust the process. With the right approach, financial freedom is not just a dream. It’s absolutely possible.

The writer is Managing Partner, Scripbox.

Disclaimer: The views expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.