By Harshad Patwardhan

The Nifty 50 index has lately been showing signs of weakness after its recent peak in the last week of September 2024. The 6 percent decline last October was its worst monthly performance since the pandemic, as per data available with Bloomberg. But even thereafter, the weakness has persisted. What's going on?

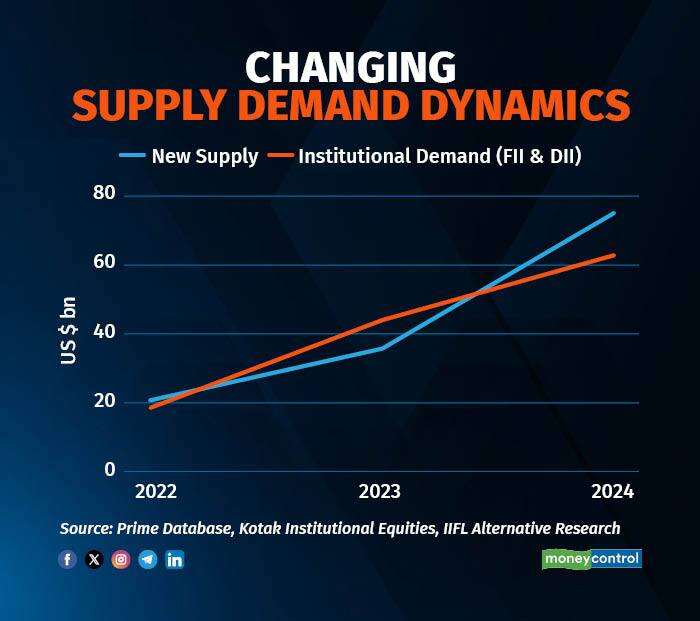

To diagnose the root cause, we need to focus on the supply and demand dynamics. The recent market movement suggests an unhealthy imbalance in these variables.

Strong demand created a burst of supply

Like in the previous cycles, new equity supply has been increasing in response to the rising markets. While some of this has been genuinely to raise capital for deleveraging or growth, a lot of the new supply has been opportunistic.

Selling by promoters (especially noteworthy in this cycle are the MNCs reducing their stakes in Indian subsidiaries) and other long-term stakeholders is becoming a large part of the overall new supply. One cannot fault them for supplying more equity, as individual Indian investors seem to be in a generous mood — ever willing to buy.

Also read | ITR filing: Did you miss the extended January 15 deadline? You can still file 'Updated' returns

Worryingly, as often happens in this phase of the markets, the quality of new listings is progressively declining, in our opinion.

And now, demand is waning even as supply continues unabated.

The supply glut wouldn't be a problem if the market could swallow what was on offer. However, FPI demand has been impaired since last October as GEM (global emerging market) investors started worrying about a billion-dollar question: "What if China starts to perform?"

Additionally, since last November, the FPI demand outlook has become even more uncertain. If the incoming US administration were to vigorously act on its key election promises, it would risk fuelling inflation, thereby sabotaging the prospect of a long-hoped-for steep fall in US interest rates. If things were to progress in this direction, there would be increased concern about equity inflows into GEMs, including India.

The recent deceleration of growth in the Indian economy is an additional headwind.

How long will domestic investors save the day?

Given these worrying developments, the continued appetite of domestic investors has been the only saving grace. However, how long that sustains in the face of lacklustre returns of late is unpredictable.

Can the situation be managed in an orderly manner?

If we are lucky, there may be a robust revival in FPI demand despite all the economic and geopolitical uncertainties. In that case, the market's appetite will recover in time to absorb the higher anticipated new supply. But that is just wishful thinking.

Also read | Why individuals must invest long-term, avoid day trading & derivatives

The best way to address the situation is by reducing the equity supply in an orderly manner to align with the current level of market appetite.

While this looks simple, it is not easy to pull off. It requires self-control and discipline, with individual players sacrificing their cravings to satisfy their immediate self-interest. Unfortunately, history suggests that it is unlikely to happen. In which case healing might simply require market-administered bitter medicine and the passage of time.

Also read | Why setting up a family trust scores over making a will in estate planning

Harshad Patwardhan is Chief Investment Officer of Union Mutual Fund

Disclaimer: The views expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!