How should you calculate long-term capital gains on the sale of an old property with or without indexation? Today's Ask Wallet Wise query decodes how to decide between the 20 percent and 12.5 percent tax options.

Moneycontrol's Ask Wallet Wise initiative offers expert advice on matters of personal finance and money. You can email your queries to askwalletwise@nw18.com, and we will try and get a top financial expert to address your queries.

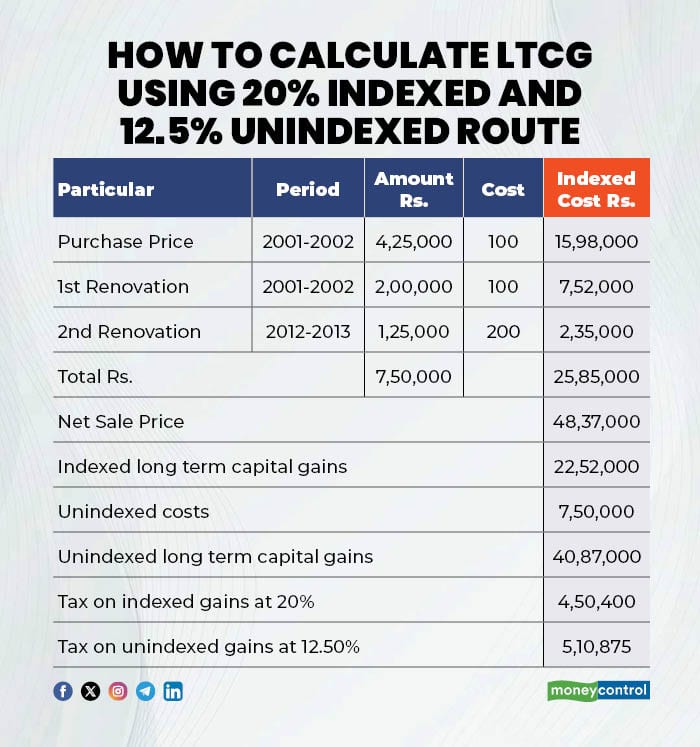

House was purchased in October 2001 for Rs 4,25,000. The expected sale value is Rs 49 lakh. Brokerage payable for the sale transaction is Rs 50,000, and the society transfer charges are about Rs 13,000. The bills for renovation in 2001–2002 for Rs 2,00,000 and in 2012–2013 for Rs 1,25,000 are not available. Kindly help with the best possible tax calculation. Which type of calculation will be best suited for me, the old 20% method or the new 12.5% method?

Expert Advice: Even if you are not able to produce copies of the renovation bills, a certificate from an engineer about the cost of renovation would be sufficient. It is assumed that the renovation expenses were capital in nature and therefore allowable as cost of improvement while computing the capital gains.

You can deduct the brokerage and transfer fee payable to the society from the sale value. After deducting these two costs, the net sale consideration is Rs 48.37 lakh.

The comparative working of tax liability on indexed and unindexed profits is given below, taking the cost inflation index for the current year as 376:

So you should opt for indexation to minimise your tax liability on sale of this property. Please note that the benefit of indexation is available only for computing the final tax liability and not for other purposes like amount to be invested for claiming exemption or amount of loss to be carried forward for set off against income of subsequent years.

Ask Wallet-Wise

Ask Wallet-Wise Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.