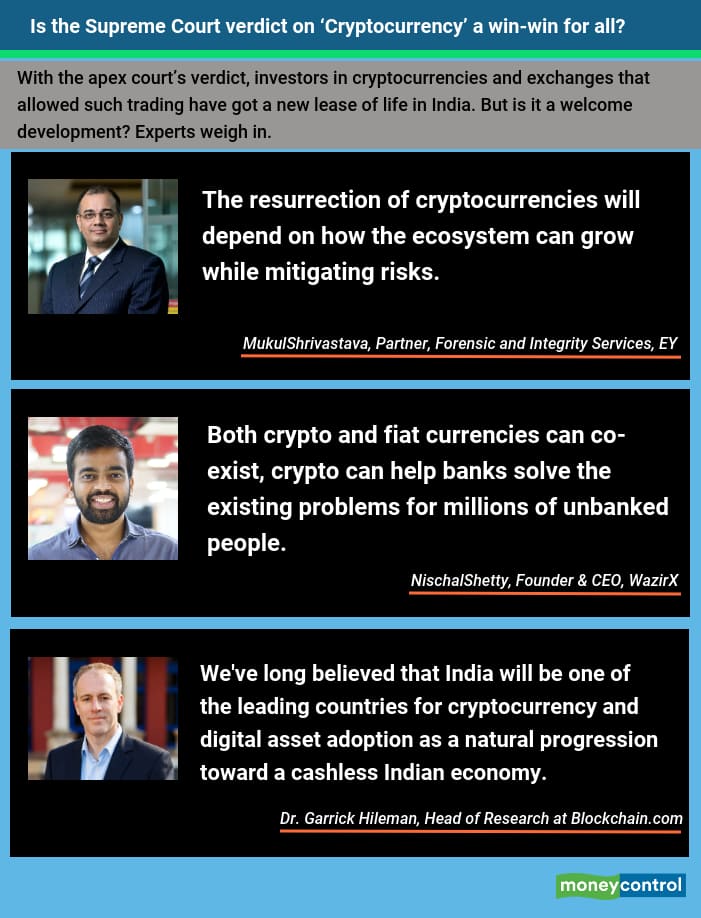

On March 4, the Supreme Court lifted the Reserve Bank of India’s (RBI) ban on cryptocurrency transactions. The RBI had imposed this ban since April 2018, which curbed a wide range of cryptocurrency based activity in India. Now, with this verdict, investors in cryptocurrencies and exchanges that allow trading in them have got a new life. Will this work in favour for both? Moneycontrol spoke to three crypto currency experts to get their views.

Mukul Shrivastava, Partner, Forensic and Integrity Services, EYIt is a mixed-bag of risk and rewards. Savvy investors track technological advances to reap benefits. However, it is equally important to be educated and aware – as an economy, a crypto-exchange, a trader or a consumer – to build a broader ecosystem where innovation thrives, and threats are mitigated. Cryptocurrencies gained acceptability, but they need to be seen as a double-edged sword in today’s volatile, risk-averse environment. For instance, there is a no central authority to regulate, take ownership or provide security to safeguard crypto assets.

There is ease of use and making transactions on a real-time basis, with no cross-border restrictions. Anonymity is offered, but there is virtually no know-your-customer (KYC) requirement, which makes it a concern from a traceability point of view. One of the major issues is that crypto accounts can be used for illicit purposes that are impossible to track. This makes it worrisome. Creating a crypto wallet requires just an internet-enabled device. With limited information technology literacy, this can expose users to high-risk situations and make them potential targets for cyber criminals. The resurrection of cryptocurrencies will depend on how the ecosystem can grow while mitigating risks.

Nischal Shetty, Founder & CEO, WazirXWe need to initiate dialogue with the Indian policymakers and regulators and work towards creating a crypto regulatory framework in India. Recently, South Korea legalised crypto. Japan and Australia have a positive outlook towards crypto as well. More and more countries are setting up regulation for crypto now. Regulating crypto will be a huge win for India as it will lead to more blockchain-focused startups, more jobs, and more tax revenue for the government.

Crypto is a new-age asset class; we shouldn’t pit it against fiat currencies. Currency is just one of the many possible use-cases of crypto. Moreover, the financial action task force (FATF) guidelines clearly states that crypto is not a threat to the global economy, and can be regulated properly. FATF has, in fact, even submitted a crypto standard regulation report to G20 countries, and India is a G20 member. Both crypto and fiat can co-exist and, in fact, crypto can help banks solve the existing problems for millions of unbanked people.

Due to the note ban, Indians had to use peer-to-peer (P2P) platforms for transactions, but the banking channel will be even more successful as it's more convenient for users. It will make it very easy for Indians to start trading in crypto.

Cryptocurrencies will serve as a foundational layer for a new wave of global financial services that empowers end-users to effectively be their own banks.

We've long believed that India will be one of the leading countries for cryptocurrency and digital asset adoption as a natural progression toward a cashless Indian economy. The Supreme Court's decision to support innovation by legalising bitcoin and cryptocurrency trading is a major step in the right direction for both India's consumers and crypto businesses that want to serve them.

Not only will this decision expand the daily use of cryptocurrencies in India, it will also attract new talent and innovation that will support the country’s own blockchain and distributed ledger technology initiatives. Cryptocurrency is a digital currency that runs on blockchain technology.

Countries that embrace public cryptocurrencies will attract talent and generate domestic technology advantages that will help them win the blockchain technology race. A recent example of this occurred in China, which partially relaxed regulations around cryptocurrency mining following President Xi’s speech announcing blockchain technology as a national priority.

India has developed a strong position in developing next-generation blockchain and distributed ledger technologies, and this infusion of talent and enhanced regulatory clarity will only help Indian firms develop regional and global leadership positions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.