The Reserve Bank of India (RBI) has cumulatively reduced its policy repo rate by 100 basis points (bps) this year, which has provided borrowers, particularly those with home loans, with some respite in the form of shorter loan tenures or reduced EMIs.

However, it has also created a dilemma for some—is it wise to prepay home loans and reduce the interest burden or invest any surplus in equities?

Repo rate cut: Impact on home loan borrowers

All new retail floating-rate loans sanctioned after October 1, 2019, are linked to an external benchmark, which is the repo rate in the case of most banks.

The RBI's repo rate cuts thus have a direct impact on home loan interest rates, causing them to drop, which in turn benefits borrowers by reducing EMIs or shortening loan tenures.

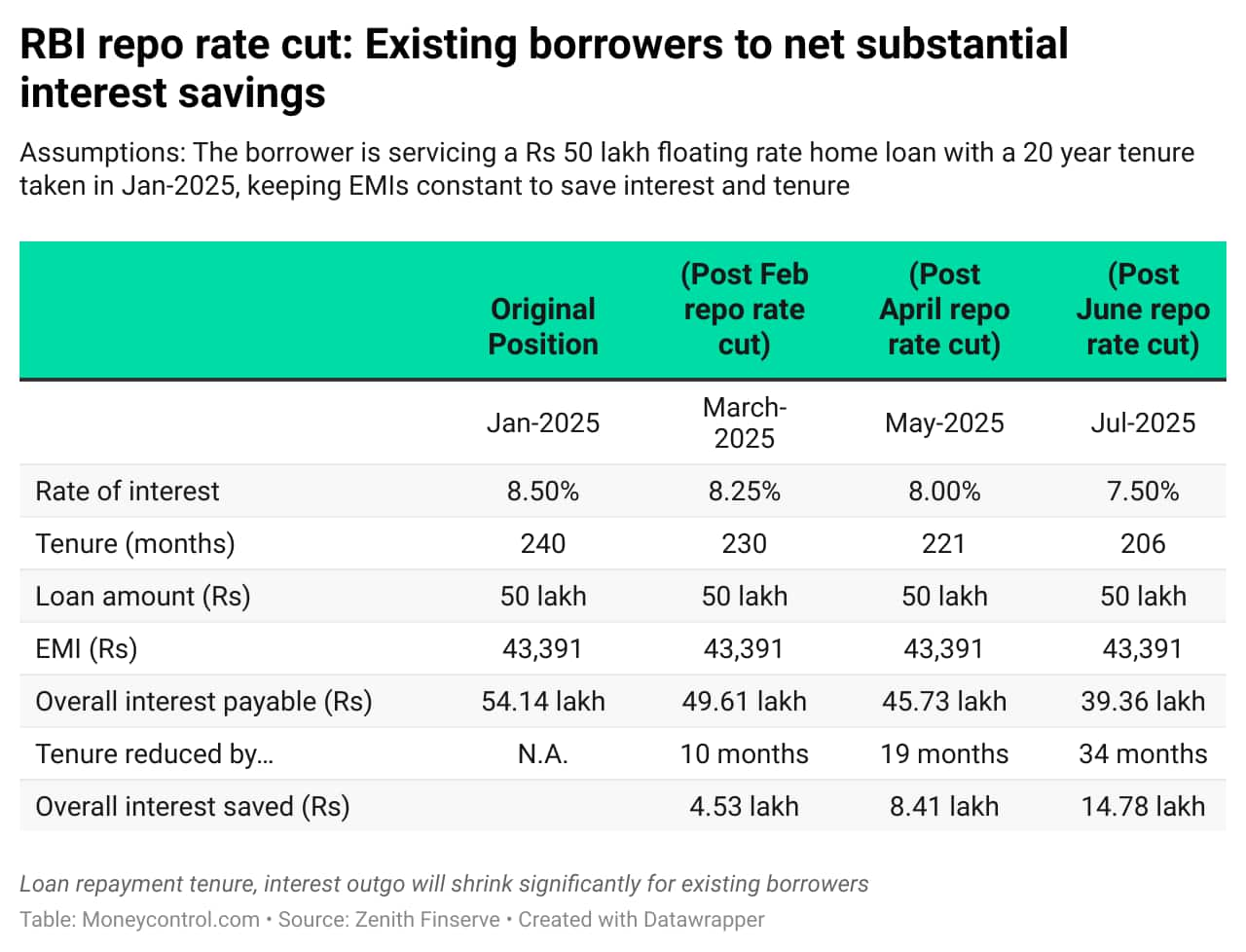

For example, if you have a Rs 50 lakh, 20-year home loan at 8.5 percent interest disbursed in January 2025, a 100 bps rate cut would benefit you when your bank resets the rate after the June policy action. This would reduce your loan tenure to 206 months and save you approximately Rs 14.78 lakh in interest payments.

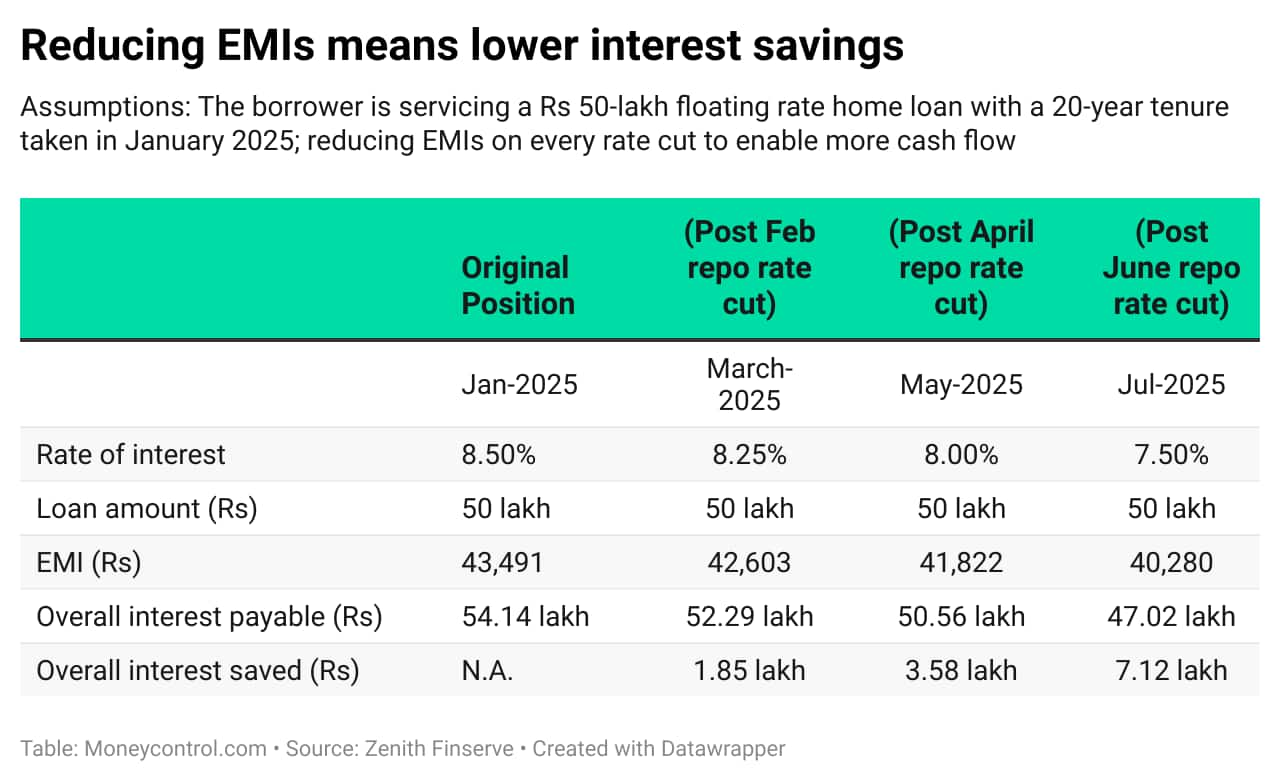

If you opt to decrease your EMI amount instead, your interest savings will be lower, with savings of around Rs 7.12 lakh versus the Rs 14.78 lakh at constant EMIs.

According to Anuj Kesarwani, founder of Zenith Finserve, borrowers who aim to save on interest and pay off their loan quickly should maintain the same EMI amount after a rate cut. However, those who prefer to have more disposable income or invest the surplus can opt to reduce their EMIs, still benefiting from interest savings.

Also read | Planning to move to the UAE? Know the tax implications for your investments in India

Prepaying home loan vs investing

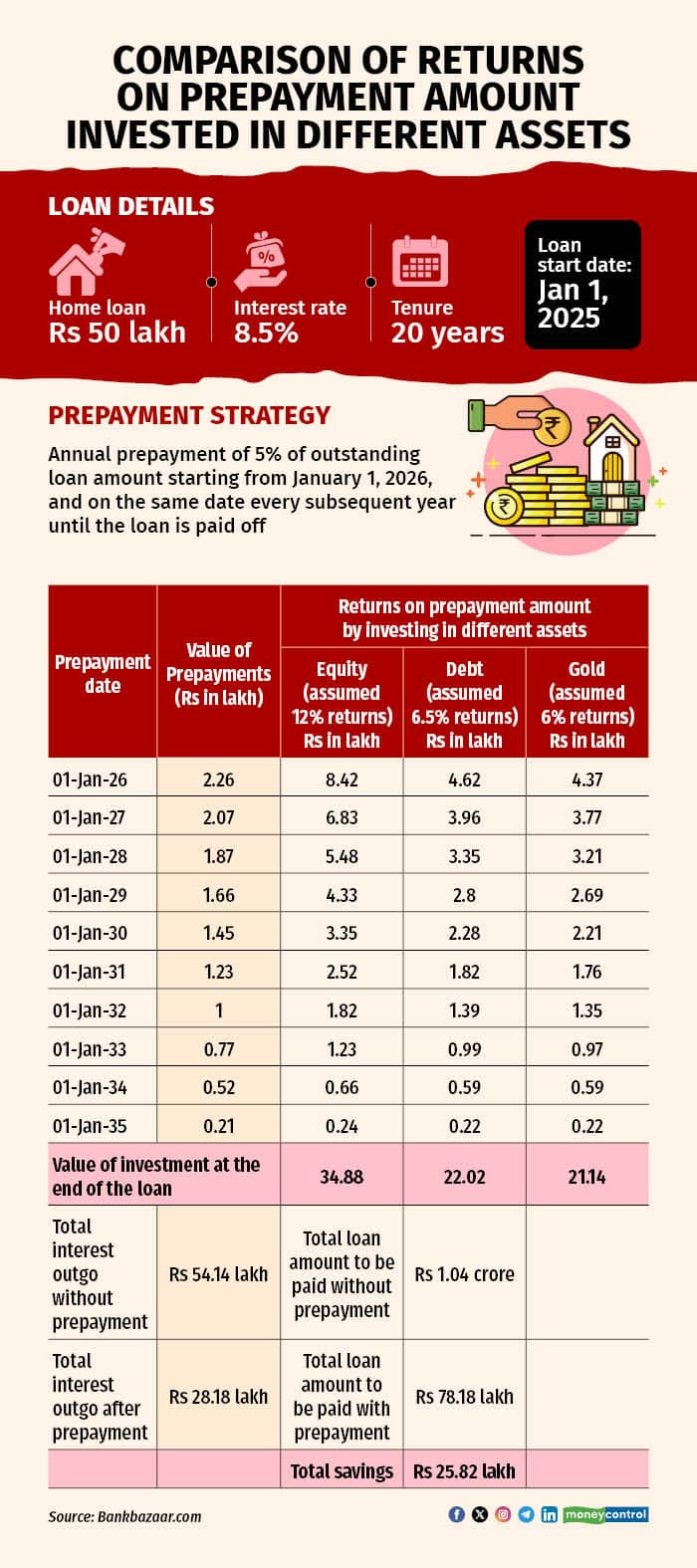

Prepaying a home loan can save significant interest, but it's essential to strike a balance between loan prepayment and other financial priorities. The decision to prepay or invest depends on individual perspectives, and investment returns can vary depending on the asset class, potentially exceeding or falling short of loan interest savings.

According to Adhil Shetty, CEO of BankBazaar.com, prepaying 5 percent of the outstanding loan amount annually can cut the interest burden by 48 percent. However, putting the same amount in investments could generate substantial returns, potentially surpassing interest savings, depending on the investment option, with equities likely offering higher returns than debt investments.

Equities may deliver 10-12 percent average returns in the long term, outpacing home loan rates, but this is a potential outcome, not a guarantee. Consistent returns year after year cannot be guaranteed, despite long-term averages. If investments perform well, not prepaying the loan might seem like a good decision, but a market decline could lead to unfavourable results in the short term. Historical data suggests that equity mutual funds tend to outperform home loan interest rates over the long term, favouring investment over aggressive prepayment from a mathematical standpoint.

Also read | Moved to a new city for work? Here is what it means for your taxes

The decision between prepayment and investment depends on individual financial goals and priorities. If closing the loan early is the priority, prepayment is the better option. However, if other financial goals are a priority, investing in low-risk debt instruments or other options may be more suitable. Ultimately, the decision depends on personal goals, risk appetite and financial situation.

One's life stage is crucial in deciding between loan prepayment and investing. For younger individuals with decades to invest, investing may be more attractive. However, for those nearing retirement with significant outstanding loans, prepaying might be a wiser choice, especially in volatile market conditions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!