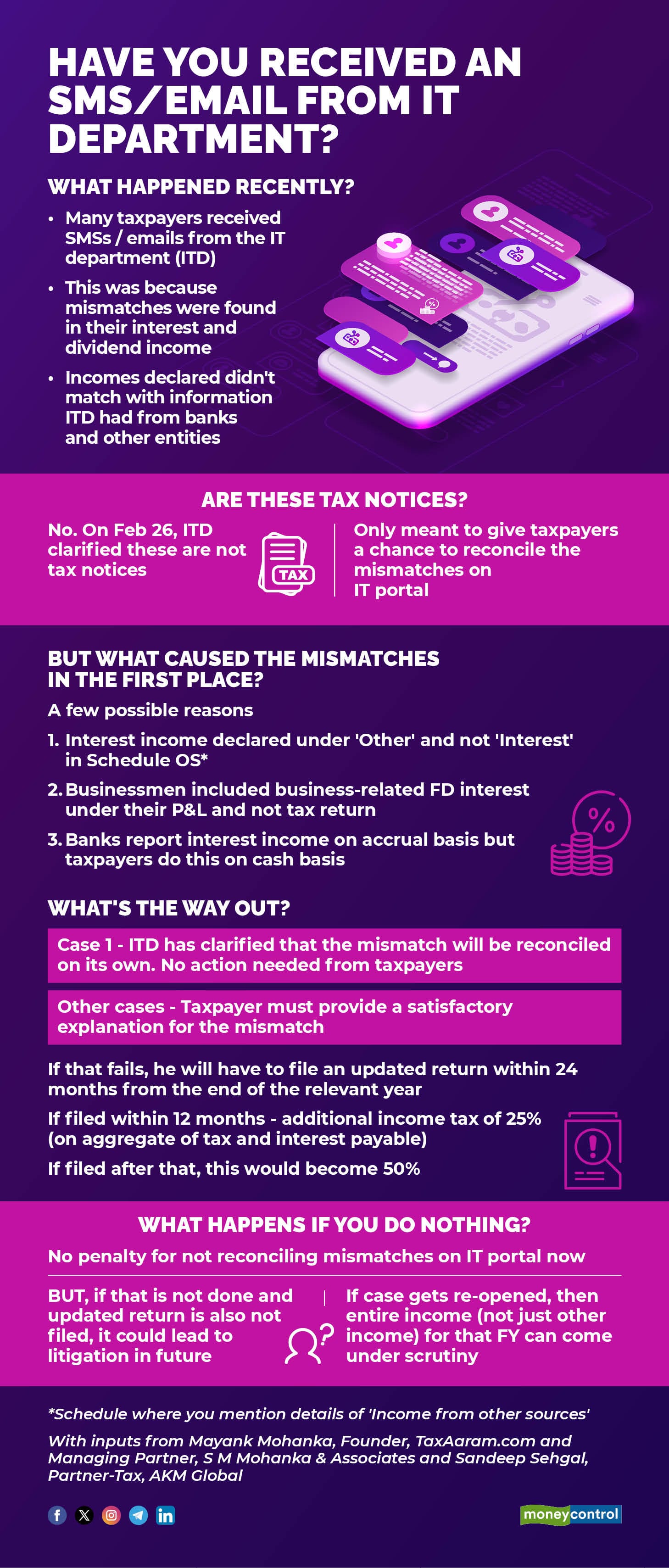

Many taxpayers received SMSs and emails from the income tax (I-T) department in the weekend gone by, intimating them about discrepancies in their interest and dividend incomes.

That is, the I-T department has found that either what many taxpayers have declared as interest and dividend incomes in their I-T returns for financial years 2021-22 and 2022-23 does not match with the information received from banks and other entities, or no return has been filed despite receiving such income.

On February 26, the I-T department clarified that these intimations under the e-Verification Scheme, 2021 do not constitute tax notice but are only meant to provide an opportunity to the taxpayers to reconcile mismatches, if any, on the I-T portal. Taxpayers will not have to submit any documents while doing this. Note that, while failure to provide a response on the I-T portal will attract no penalty now, ignoring this matter can result in future litigation.

The I-T department has released an updated ‘User Guide for Submitting Response to Notices and Letters Received under e-Verification Scheme, 2021’ to aid taxpayers with this process.

First steps to takeTo start with, one needs to login to the IT portal (https://www.incometax.gov.in/iec/foportal/) with their PAN and password, then go to the ‘Pending actions’ tab and then click on ‘Compliance Portal’. From there, go to the ‘e-Verification’ tab to see year-wise details of any notices or letters sent by the IT department. You can provide your responses to each of these by clicking on them.

If you are not registered on the I-T portal, you must first register by clicking on the ‘Register’ button on the e-filing website and providing the relevant details.

To play it safe, Mayank Mohanka, Founder, TaxAaram.com and Managing Partner, S M Mohanka & Associates, suggests that even those who have not received any messages / emails must log into the I-T portal and check if they have any income mismatches.

If you are wondering why interest and dividend income (other income) related mismatches have popped up in your name, there could be multiple reasons for it.

Mohanka says one major reason could be that taxpayers have shown their interest income under ‘Others’ and not ‘Interest’ in schedule OS where details of all ‘incomes from other sources’ such as interest, dividend etc. have to be mentioned. As a result, the I-T AI (artificial intelligence) and ML (machine learning) tools may not have captured these details in the person’s IT return, hence resulting in a mismatch.

Another possibility, he says is of businessmen creating fixed deposits intrinsically meant for business purposes and declaring the corresponding interest income as part of their business income (available for setoff against business expenses) and not under the head income from other sources, in their IT returns. “While there are some case laws on this matter, the I-T department has held the position that interest income from such FDs must be declared under the head ‘income from other sources’ in the taxpayer’s IT return and not under the head ‘business income’” says Mohanka.

Thirdly, banks report interest income to the I-T department on an accrual basis (when interest becomes due) whereas taxpayers (other than corporates) may declare this in their returns on a cash basis (that is when they actually receive the interest). This too, can result in mismatches.

Also read: Received notices or alerts from Income Tax Department? Here’s how you can respond to themWhat must taxpayers doIn the first situation, the taxpayer does not have to worry as the mismatch will be automatically rectified as clarified by the I-T department too.

“In case the interest income is shown under the line item ‘Others’ instead of ‘Interest’, it would still be considered under the head ‘Income from other sources (IFOS)’ and hence be taxed accordingly. So, if there is a mismatch simply due to reporting of interest income under a different line item under the head IFOS, this would get resolved on its own,” says Sandeep Sehgal, Partner-Tax, AKM Global, a tax and consulting firm.

However, Mohanka says that in the other two cases, the solution may not be that straightforward, as the explanation of the taxpayer may not get due consideration in this e-verification window. “In such cases, it may not be easy to rectify the mismatch. Unlike in case of a regular tax scrutiny where a taxpayer has an opportunity to explain himself, here the taxpayer may not be able to do so,” adds Mohanka.

An updated return must be filed within two years from the end of the relevant year by paying additional taxes and interest. “If an updated return is filed within 12 months from the end of the relevant assessment year, additional income tax would be 25 percent of the aggregate of tax and interest payable therein. However, this could increase to 50 percent if an updated return is filed after 12 months,” elaborates Sehgal.

Also read: Has the new income-tax regime killed tax-saving mutual funds? Not yet, but…If taxpayer does nothingIn any case, tax experts warn against ignoring these intimations from the IT department as this could lead to litigation in future.

“The tax department may open/reopen any income tax assessments wherever there are high value transactions that have not been reported by the taxpayers or reported incorrectly and any corrective steps have not been taken,” says Sehgal.

Mohanka, in fact, says that if a taxpayer fails to provide either a satisfactory explanation for the mismatch of income or in its absence, fails to file an updated return, this could result in their case being re-opened in future whereby their entire income (and not just income from other sources) for that financial year may become subject to I-T review.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.