The Reserve Bank of India (RBI) cut its policy rate by 50 basis points (bps) on June 6, its third reduction since February 7, 2025, paving the way for lower home loan interest rates.

Following the monetary policy committee (MPC) decision, the repo rate now stands at 5.50 percent, from 6 percent earlier. The RBI MPC also changed the stance from "accommodative" to "neutral" while announcing the rate cut.

All new retail floating-rate loans sanctioned after October 1, 2019, are linked to an external benchmark, which is the repo rate for most banks.

The RBI's repo rate cut will directly benefit home loan borrowers, especially existing ones, by reducing their interest burden.

How will the repo rate cut benefit borrowers?The repo rate now stands at 5.50 percent, having been cut by a cumulative 100bps since February 2025. “The lowest rates in the market are already at 7.85 percent, largely available to prime borrowers with credit scores above 750, and often in refinance or balance transfer cases. A further rate cut could see sub-8 percent rates becoming more widespread—something we haven’t seen since early 2022,” says Adhil Shetty, CEO of BankBazaar.com. However, the transmission of rate cuts remains uneven, he adds.

Borrowers with repo-linked home loans will see the fastest and fullest pass-through. “But loans taken pre-2019, especially with public sector banks, continue to be linked to older benchmarks like the MCLR or even the Base Rate. These borrowers will not benefit automatically from today’s cut,” says Shetty.

If you’re paying 50 basis points or more above the lowest available rates, and especially if you're in the early years of your tenure, it’s worth exploring a refinance to a repo-linked loan. This can help bring down your interest cost significantly over the life of the loan.

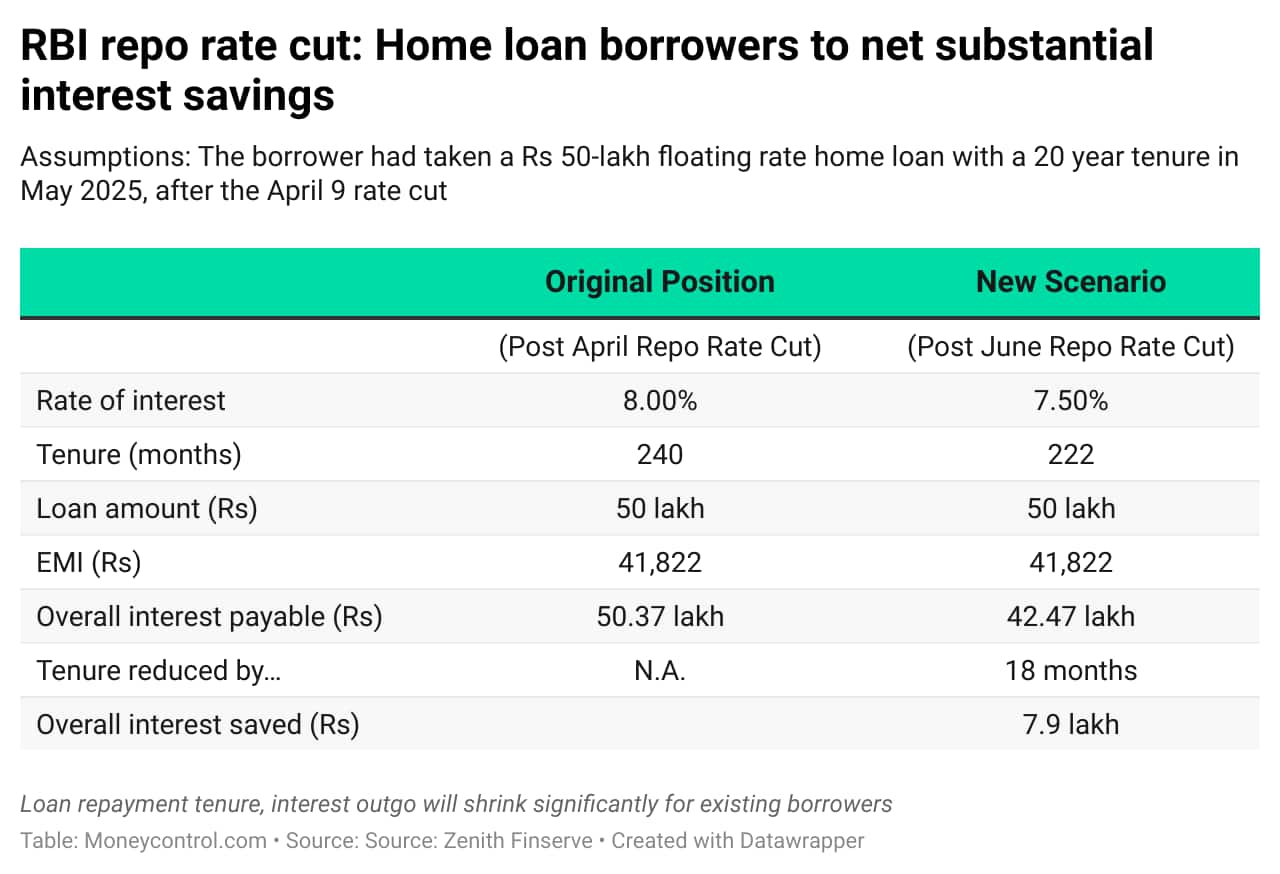

According to the external benchmark lending rules, existing borrowers will get the entire benefit of the 50-bps repo rate cut. For example, on a Rs 50-lakh, 20-year home loan at 8 percent interest, the rate cut would reduce total interest payout from Rs 50.37 lakh to Rs 42.47 lakh, saving Rs 7.9 lakh, and shorten the loan tenure by 18 months, assuming that you retain your EMI of Rs 41,822, as Zenith Finserve data shows.

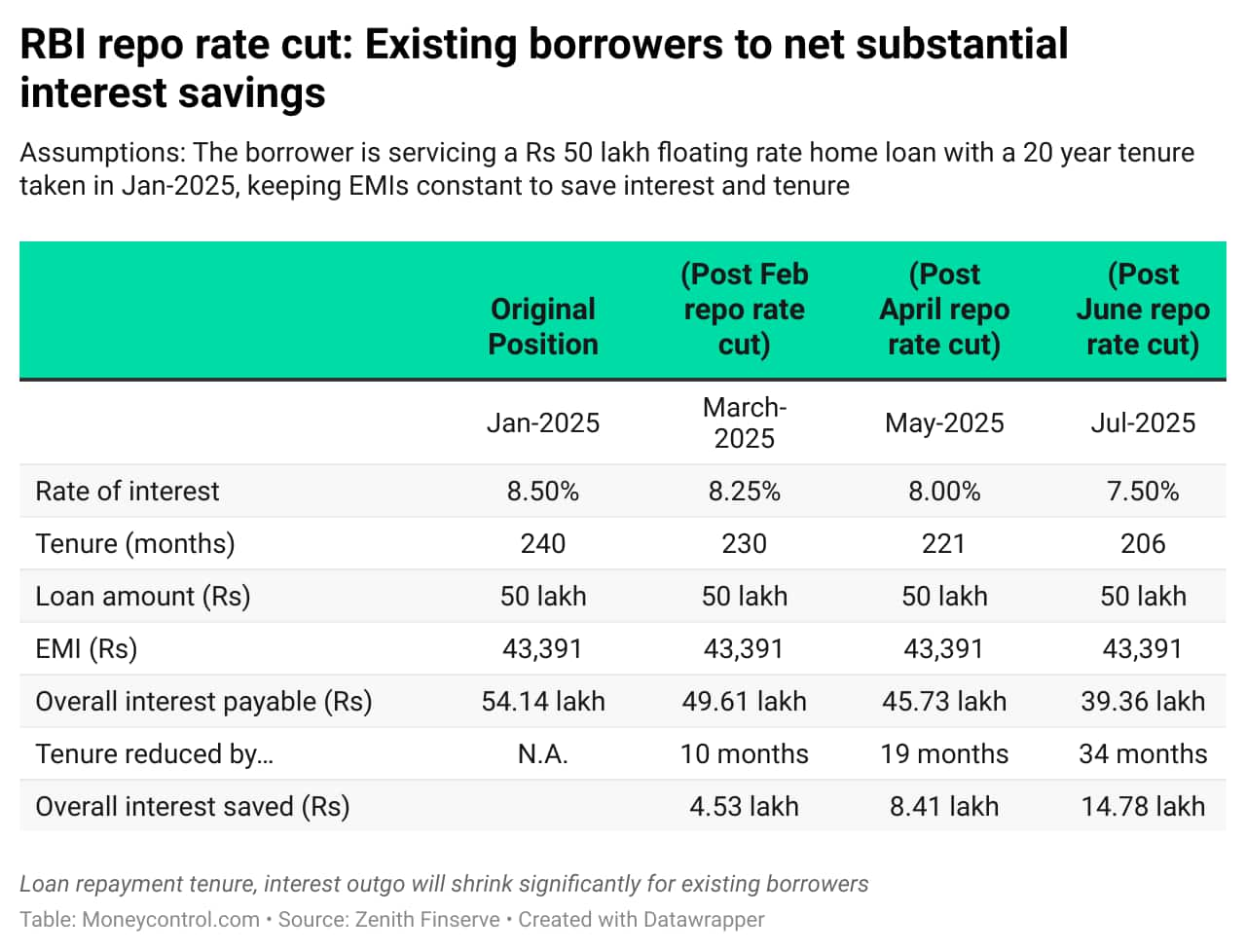

If your Rs 50-lakh, 20-year home loan at 8.5 percent interest was disbursed in January, you'll benefit from a 100-bps rate reduction once your bank resets the interest rate after the June policy action. This would shorten your loan tenure to 206 months and save around Rs 14.78 lakh in interest payments.

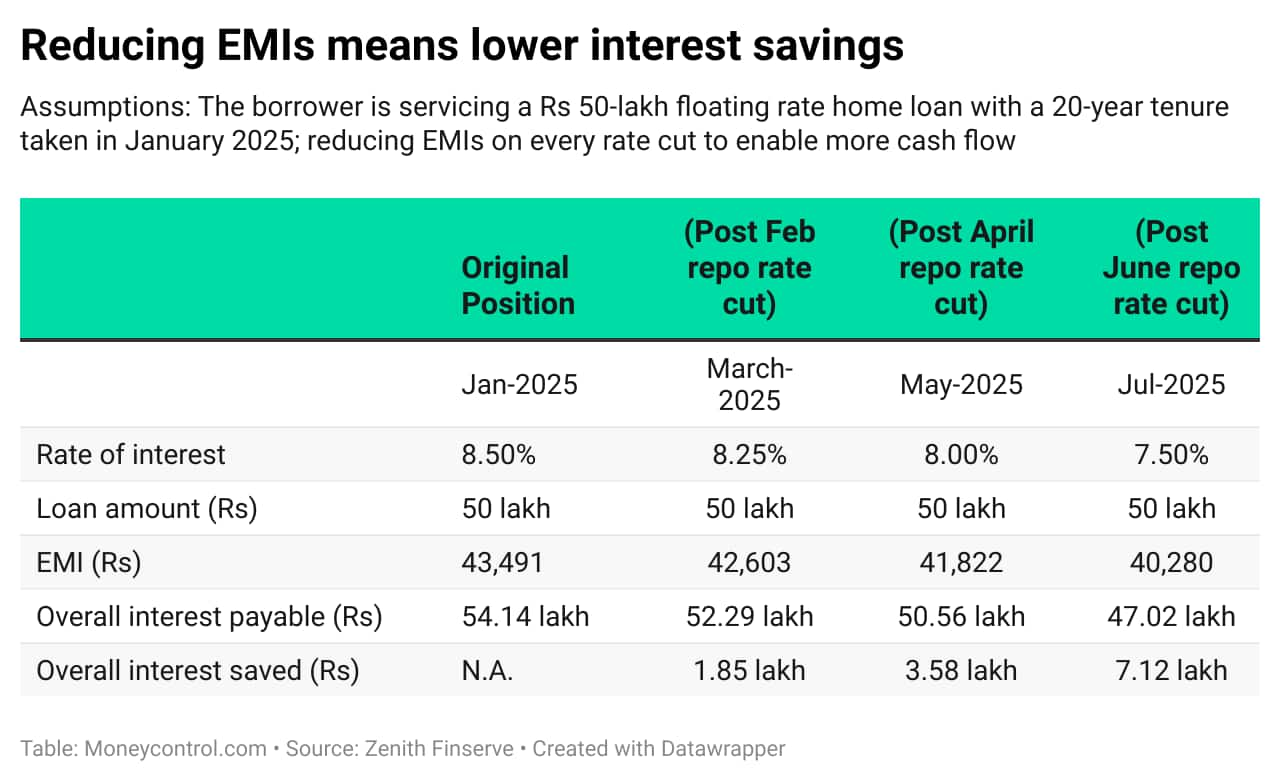

If you choose to reduce your EMI amount instead, your interest savings will be relatively lower. You will save around Rs 7.12 lakh instead of Rs 14.78 lakh by keeping EMIs constant.

According to Anuj Kesarwani, founder of Zenith Finserve, borrowers should maintain the same EMIs after a rate cut if they prioritise saving interest and paying off the loan sooner. However, if they prefer having more disposable income while still saving on interest, reducing EMIs can be an option.

Also read | School fees are on the rise. Can a bridge loan be a help or a hazard?Gains for new borrowersA BankBazaar comparison of home loan rates as on January 31 and May 30 shows that most public sector banks have reduced interest rates for fresh home loans by 50 bps, in line with the RBI policy action on April 9. However, some private sector banks have not transmitted the entire benefit to new borrowers, choosing to adjust the spread over the repo rate instead. With the June 6 cut, those looking to take fresh loans, too, could enjoy significantly lower rates.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.