As the number of Indian families with furry members is growing in India, so is the market for products aimed at ensuring their well-being.

After pet food and veterinary medicine, now an increasing number of general insurance companies are entering the pet insurance space. Bajaj Allianz General Insurance, Digit Insurance and Future Generali Insurance have introduced – and are heavily promoting - pet insurance plans. The products aim to cover several risks that pet owners may have to deal with - incidents of ill-health, surgeries and even theft of their furry kids.

Pet insurance: need of the hour?

As per Statista, a global data analytics major, the population of pet dogs in India has grown from 12.6 million in 2014 to 21.4 million in 2019 and is expected to be over 31 million by 2023. Not surprisingly, India is regarded as one of the fastest growing pet care markets in the world.

However, even though the number of pets is growing exponentially, the financial preparedness around their treatment expenses remains a less-explored concept. “Most people are not aware of the availability of such a product,” says TA Ramalingam, Chief Technical Officer, Bajaj Allianz.

Now, pet insurance is not exactly a novel concept in India, with public sector insurers like New India Assurance, National Insurance and Oriental Insurance offering versions of this product for years. However, private sector insurers’ products come with additional features.

Also Read | Pets in housing societies: What’s allowed and what’s not

How does it work?

A pet insurance policy offers to financially secure the overall health and well-being of your pets by taking care of treatment costs. Like health insurance for human beings, these products pay for the treatment expenses of pets if they were to sustain injuries or suffer from ailments.

This helps pet owners eliminate the risk of high expenditure for medical treatment of the pet and protect its life by providing the best treatment, say insurers. In addition, these products also cover pet thefts and insure the policyholder against damage claimed by third parties – that is, people who may be affected due to your pet’s actions.

What is covered?

A pet insurance policy insures your pets against all hospitalisation expenses, surgeries, and critical illnesses. It also covers your pet’s death due to an accident or a disease, besides facilitating OPD (Outpatient Department) coverage. “Another very important cover that such products include is third-party liability,” says Dr Renjtih PM, Senior Manager - Health Underwriting and Pet Insurance, Digit Insurance.

Third-party liability protects you against the financial loss incurred if your pet bites someone or causes damage to their vehicles or properties.

The policy also covers the expenses incurred if your dog/cat is stolen or lost. These expenses include the cost incurred on filing police complaints, offering rewards, etc.

The cost of insuring your pets

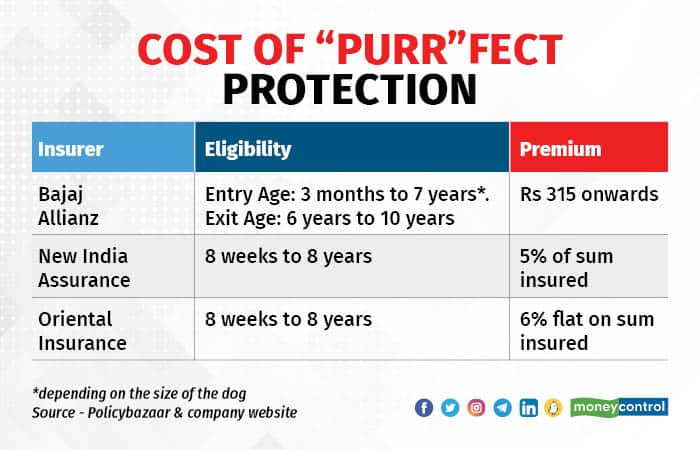

The cost of pet insurance varies depending on the insurer you choose and the age, size and breed of your pet. Not just these, but your pet's health and the sum insured you want to opt for will also determine your plan's cost. The premiums start from Rs 300.

For instance, if you buy a long-term cover with a fixed cover of Rs 25,000 with Bajaj Allianz, it will come at an annual premium of Rs 1,284 for a large-category dog aged under seven. The plan will include cover for epilepsy, pancreatitis, Cushing’s syndrome, diabetes, thyroid dysfunction, ascites, glaucoma, and inflammatory bowel disease. By paying an additional premium of 0.5-1 percent, pet parents can also get covers against poisoning and breeding risks.

Exclusions and limitations major dampeners

Insurers typically have a waiting period of 15-30 days before the cover starts, and the age limit for the pet is eight weeks to eight years, other than Bajaj Allianz, whose entry and exit ages vary from 3 months to 10 years.

There is also a co-pay or deductible imposed by all insurers: 10 percent for surgery and hospitalisation in the case of Bajaj Allianz; 20 percent of the dog’s market value or sum insured under products offered by Oriental and New India Assurance.

Pre-existing diseases are also not covered by insurers, as are specific illnesses like distemper and rabies, which result in the death of the pet. “Most pet insurance covers also exclude ailments such as kidney failure,” says Kapil Mehta, Founder, SecureNow Insurance Brokers.

Most pet insurance policies have 20 to 30 exclusions, which takes away the benefit of even having the policy in the first place, he adds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.