While changes in the taxation of different asset classes during Budget 2024 took many by surprise, the economy is seeing structural growth and the country’s balance sheet remains strong.

Taking a hypothetical example, suppose there's a person called Sam, who's quiet, loves to read, and very organised. We might conclude that he's more likely to be a librarian than a salesperson. But we all know that there are more salespeople in this world than librarians. This is known as ‘base rate neglect’ in the field of behavioural finance — a cognitive fallacy where we favour anecdotal information over statistical data. This leads to flawed reasoning and incorrect conclusions.

Also read | Donald Trump win: Bitcoin outlook turns bullish, but Indian investors need to be cautious

In ‘Thinking Fast & Slow,’ psychologist Daniel Kahneman describes two modes of thinking:

i. System 1: fast, automatic, and without much effort.

ii. System 2: slow, deliberate, requires mental effort.

Base rate neglect happens when we rely on System 1, using anecdotal information or individual cases, and avoid the effort of using System 2, which considers base rate (overall) information. This cognitive error can sometimes have serious consequences.

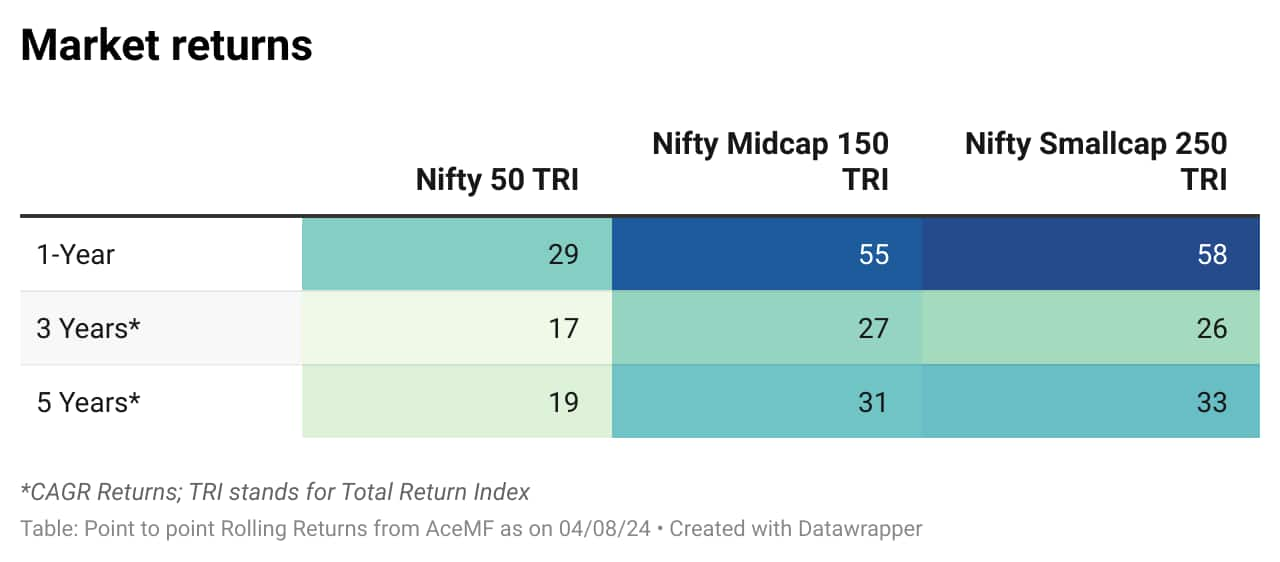

Without becoming too boring and academic, let’s understand this in the context of markets — the Indian stock markets have seen significant growth in recent years:

But these returns haven’t been only because of healthy earnings growth; much of the stock price increase is due to higher valuation. Valuations of SMID (small and midcap) companies, especially, have reached unprecedented levels. Of the top 1,000 companies by market cap, 217 trade at more than 75X of their TTM (trailing 12-month) P/E, and 392 at more than 50X of their TTM P/E (source: Screener).

Also read | RBI rate cut: After the US Fed action, it’s a matter of when and not if

Some investors justify these high valuations given the expected future earnings growth driven by economic growth, industry tailwinds, and government policies. However, this optimism neglects the base rate of companies sustaining high growth from an already high base.

Historically, very few companies have achieved sustained high growth. For instance, over the last decade, only three companies that had profits > ₹250 crore in 2014 managed an EPS CAGR > 26 percent over the next decade. Thus, investing in high P/E companies today is risky due to the low base rate of achieving sustained high earnings growth, even if those companies perform well.

Investors often ignore the base rate and focus on exciting narratives, leading to excessively high valuations. Just as we shouldn't assume Sam is a librarian without considering the base rate, we shouldn't pay excessive prices for businesses based on strong narratives without considering the statistical realities.

Investors should prioritise earnings and asset allocation over the noise that often influences market behaviour. Robert Shiller, in his seminal work Narrative Economics, delves into how stories drive major economic events. For instance, a recession can be fuelled by pervasive narratives about economic downturns, causing people to spend less and invest cautiously.

Similarly, Bitcoin's surge was driven by the narrative that it was the currency of the future, despite its lack of intrinsic value. Covid is also an example of how narratives impact markets. The spread of the virus and the accompanying fear led to a significant market downturn. However, as the narrative shifted from panic to recovery and assurance from governments, markets rebounded.

Investors should be aware of these narratives but not be swayed by them. Understanding market behaviour is essential, but decisions should be based on solid data regarding economies, markets, and companies. By focussing on earnings and maintaining a disciplined approach to asset allocation, investors can navigate the noise and potentially achieve long-term success.

The author is AVP – Investments at Epsilon Money.Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.