Expanding its sectoral offerings, Quant Mutual Fund, which has assets under management (AUM) of around Rs 18,500 crore, has launched a healthcare fund focusing on life sciences, insurance and wellness companies.

Quant Healthcare Fund (QHF) opened for subscription on June 27 and will close on July 11. This is the second sectoral fund by the fund house within a week, after the Quant BFSI Fund that was launched on June 20.

According to Sandeep Tandon, founder and chief investment officer of Quant MF, earlier this year they had decided to launch multiple funds based on their in-house business cycle analytics.

Also Read: 85% of health insurance reimbursement claims are for less than Rs 1 lakh: SecureNow study

“This is the best time to launch sectoral or themed products funds. The markets may correct any time, and post correction the first sector that is expected to emerge is BFSI. After that healthcare will emerge, and then technology and manufacturing will emerge. By August-September, we plan to launch four-five sectoral themes,” Tandon said.

About the fund

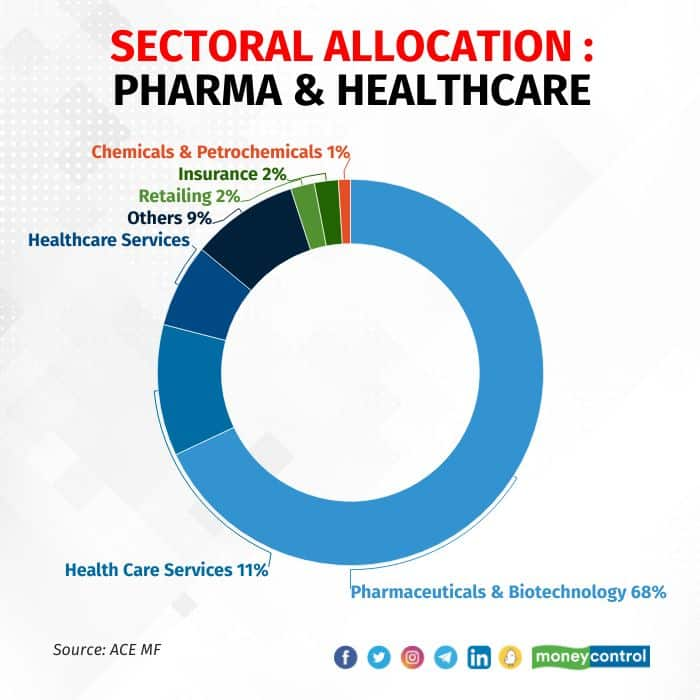

The scheme will invest at least 80 percent in healthcare, life sciences, insurance and wellness companies. These include pharmaceuticals, biotech, hospitals, medical devices, diagnostic services, clinical trials, outsourcing, telemedicine, medical tourism, health insurance, medical equipment, medtech etc.

The benchmark to the scheme would be S&P BSE Healthcare TRI and would be investing across market capitalisations to optimise risk-return payoffs.

Also read: Filing income tax return (ITR) for the first time? Here is how to get started

As per the fund house, it would be using VLRT (valuation, liquidity, risk appetite and time), their risk-mitigating investment framework, and predictive analytics tools to dynamically manage the known risks and identify opportunities across the portfolio.

Fund managers to the scheme would be Tandon, Ankit Pande, Sanjeev Sharma and Vasav Sahgal.

Apart from the new fund, Pande, Sharma and Sahgal have been managing 14-15 schemes at the fund house.

What works?

Pharma is one of the most promising sectors in India, as the medical tourism market was valued at $2.89 billion in 2020 and is expected to reach $13.42 billion by 2026.

As per broking house Sharekhan, Indian pharmaceutical companies are better placed to harness opportunities as they are competitive globally and hold a sizeable market share in most markets.

Also read: Multibagger country: These top smallcap funds grew up to 12 times in 10 years

“Cost pressures besides increased USFDA (Food and Drug Administration) regulatory risk which can slow down new product launches and likely increased remedial costs could act as headwinds to sales and profits growth in the short-medium term. Hence, we are neutral on the sector over the short to medium term. However, collectively, we believe this points towards a strong growth potential over the long term for Indian pharma companies,” it said.

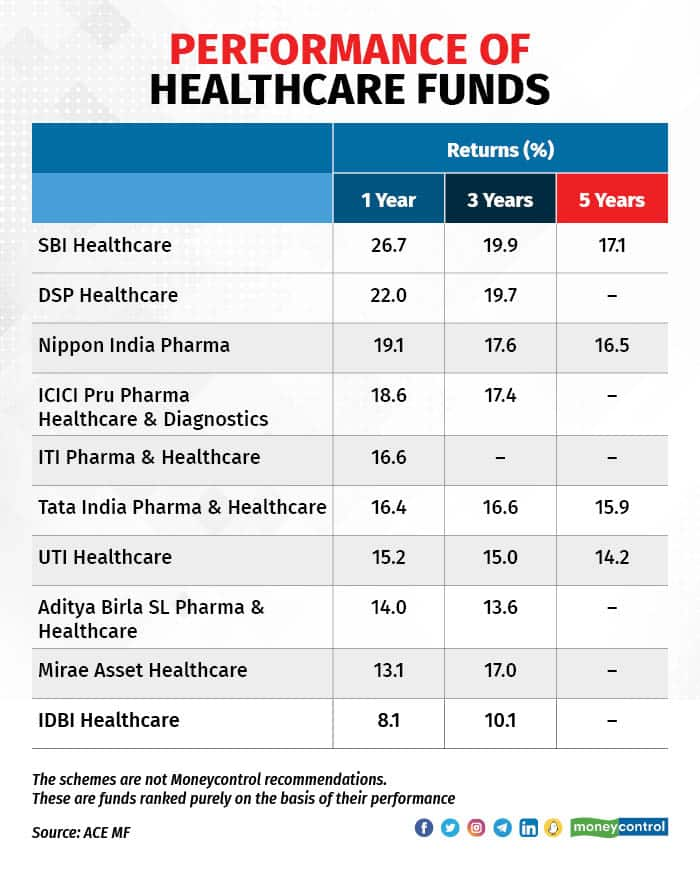

On a long-term basis, pharma funds on average have delivered 16.30 percent (three-year) and 15.95 percent (five-year) returns, which are lower than other sectoral funds such as technology and banking, as per data available with Value Research.

Also read: Is Google a good financial advisor?

However, on a short-term basis, pharma has been among the best performing categories across the board with returns of 7.04 percent (one-month) and 15.44 percent (three-month) returns.

What doesn’t work?

Healthcare has been one of the highly volatile sectors in recent times. After heavy underperformance in 2019, pharma bounced back in 2020 because of the Covid-induced push. However, calendar years 2021 and 2022 were again poor for the sector.

As per Sharekhan, adverse regulatory changes, delays in plant inspections and currency volatility could overweigh the financial performance of companies in the sector in the near term.

The pharma sector is cyclical, which makes timing your entry and exit very crucial.

“The healthcare sector is a large and diverse sector, with companies that operate in a variety of sub-sectors. The fund's investment strategy will determine which sub-sectors it invests in,” said Viral Bhatt, founder, Money Mantra.

Takeaway for investors

Whether or not investors should go for the Quant Healthcare Fund depends on their individual investment goals and risk tolerance. The healthcare sector has historically been a good long-term investment, but it has also been volatile in the short term.

Keep in mind that the fund's performance in the past year is not necessarily indicative of its future performance.

“Investors who are looking for a long-term investment in the healthcare sector may want to consider the Quant Healthcare Fund. However, they should be aware of the risks involved and should do their own research before investing,” said Bhatt.

From an overall perspective, a large-cap or a flexi-cap fund is sufficient in terms of portfolio diversification for most retail investors. In terms of pharma funds, it is better to consider existing schemes with a proven track record and known portfolio construction.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.